FinTech news in Fintech category

Stripping out all that marketing jargon, Mosaic provides dashboards, modeling and data visualization tools geared toward financial planning use cases, allowing users to quickly share insights with stakeholders.

Gradient Ventures and Fin Capital co-led Vault’s US$3.7 million seed raise, which closed last year and included participation from The Fintech Fund, Exponent Capital and Thirdbase Capital. Vault says it partners with regulated financial institutions and that its customers can see which financial institution is holding their funds via their accounts page.

NY Mag piece detailed a lawsuit brought on by three former employees as well as alleged fabrications and inappropriate behavior on the part of Curtis. The startup also planned to build out a LGBTQ+ business marketplace and a platform that offered discounts and rewards when members shop at merchants whose actions support the queer community.

But Chu points to firms like Apollo Global Management (full disclosure: the owner of journalist’s parent company), Ares Management and Blackstone, all of which have developed large private credit operations, as supporting evidence that private credit has its merits.

Obie, a real estate-focused insurance technology company, has raised $25.5 million in a funding round led by Battery Ventures. Since the company last raise – a $10.4 million Series A – nearly two years ago, the startup says it has gone from securing insurance for over $3 billion worth of property to $20 billion worth.

The Mint will be a three-month accelerator, based out of San Francisco, that cuts $500,000 checks in exchange for 10% equity in between six to ten startups.

A majority of consumers approved for Petal credit cards since its 2018 launch had either thin or no credit history when they were first approved, according to Rosen. Prism Data essentially takes the cash flow underwriting technology the company initially developed for use at Petal, and makes it available to any lender, fintech or financial institution.

Down the line, the goal is to build an age-based, risk-tolerance-based deaccumulation ETF, Nazemi said, as well as a product called a home pension, where Charlie can enable users to use a portion of their home equity to supplement their social security check.

Peter Ackerson has departed from his role as general partner at fintech-focused venture firm Fin Capital and started a new firm, Audere Capital.

On May 2, as first reported by Barron, U.S. Senator Sherrod Brown, chairman of the Senate Banking, Housing, and Urban Affairs Committee, wrote a letter to FDIC Chairman Martin Gruenberg expressing concerns about Tellus’s claims

So far, it processed more than $300 million in payments through a closed beta with several consumer brands in the region ($20 million of that was processed in the first two quarters of 2022), and now says it’s ready to open access to cross border and local merchants across Latin America.

Essentially, Green-Got guarantees that your savings and the money that is sitting in your bank account aren’t going to finance fossil fuel projects and other polluting industries

As journalist’s Connie Loizos reported at the time, Finix told employees that soon after issuing its check, Sequoia concluded that Finix competes too directly with Stripe, the payments company that represented one of Sequoia’s biggest private holdings and that in turn counted Sequoia as one of its biggest outside investors. Serna believes that Finix’s latest move only drives the two closer toward each other despite the disparity in size (Finix has 130 or so employees and Stripe had just under 7,000 as of last November) and funding (Finix has raised about $133 million in funding and Stripe has raised nearly $9 billion). Block (formally known as Square) is often viewed as a payment processor, is actually built on top of other payments technology and itself works with a number of payment processors to provide direct connection into networks, Serna noted. Serna believes that Finix’s tech stands out because it was built from the ground up, and not built through a number of acquisitions as in the case of some legacy providers.

Founded last year by former Adyen product manager Sophia Goldberg and ex-Affirm software engineer JT Cho, San Francisco-based Ansa is building what it describes as a white-labeled digital wallet infrastructure to help businesses process small payments and offset high credit card fees for smaller transactions.

three former managing directors of Amex Ventures in early 2022 branched out to form their own fintech-focused venture firm, Vesey Ventures.

The company, co-founded by Manuel Alemán, Rodolfo Lazo and Paul Cattólica in 2022, is developing a vertical SaaS product for institutions, like banks and credit unions, that want to launch and operate their own credit products.

Hyve is building a multiplayer fintech infrastructure for saving and investing where users can create their network of supporters, and those people can automatically round up their purchases to match the user’s personal cash contributions. The more people added to the “hyve,” the more money the user saves to reach their goals.

Zamp offers a treasury management platform that enables businesses worldwide to invest surplus cash in U.S. Treasury bills and notes, partnering with BNY Mellon Pershing, which manages over $2 trillion. The platform serves businesses of all sizes, it said.

The acquisition is notable for a couple of reasons. For one, if the companies have managed to keep their valuations level (valuations have seen a lot of pressure in the last six months) it would be one of the bigger M&A deals between two fintech startups, coming at a time when startups have found it very challenging to raise further funding — either from private investors, or from the public markets by way of an IPO.

Checkout.com is building a full-stack payments company — it acts as a gateway, an acquirer, a risk engine and a payment processor

Oscilar is entirely self-funded, backed by $20 million that Narkhede and the company’s other co-founder, Sachin Kulkami, themselves contributed. Narkhede says that they opted not to take outside funding so that they could “quickly build and scale the company” as it launches publicly.

During one of the most rapid raises of interest rates we’ve really seen in U.S. history and with the cost of capital gone up, companies realized they need to make the most of every dollar,” he said

One Austin-based startup is out to help people build — or get — credit without taking on debt. And that startup, StellarFi, has just closed on a $15 million Series A round of funding to help it advance on that goal.

Eagle believes Beam differs in that Briq is more focused on building tools for large enterprises to automate their billing process. common refrain in the construction industry is that most contractors are forced to complete projects before getting paid, often having to pay for material and labor out of pocket.

The round was led by Japanese bank Mizuho Bank, a subsidiary of Mizuho Financial Group that contributed $125 million. It included participation from returning investors like Square Peg Capital, Jungle Ventures, Naver Financial Corporation, GMO Venture Partners and Openspace Ventures.

Besides seeking to snag market share from incumbents such as Concur, Brex is also taking on startups such as Navan (formerly called TripActions) — which actually started its business focused on travel expense management before broadening its offering and also Ramp, which itself expanded into travel last year.

The company came to an agreement with investors, according to eToro, that the investment would be converted two years after the signing of the agreement based on the following conditions: that it had not pursued the SPAC transaction or raised any additional capital.

Broom, an Indonesia-based auto-financing startup that wants to help used car dealers work more efficiently by applying the asset-backed lending model to their businesses .

As part of the latest funding announcement Synctera said is also announcing that it is partnering with the National Bank of Canada to help companies launch fintech apps and embedded banking products in the country.

Growfin, a Singapore- and San Francisco–based fintech startup that provides SaaS for finance departments to track and collect payments and to help manage the accounts receivable process, has raised a $7.5 million Series A.

Earlier this year, journalist reported that Thrive Capital was said to have committed $1 billion in fresh capital to Stripe as part of a new investment in the works that would have valued the fintech company at between $55 billion and $60 billion

Revenue can be broken down in three big pillars: cards, subscriptions, and foreign exchange

Even former Amazon employees with vested equity can use the service, according to Better.com, and there are many, following Amazon companywide layoffs.

Founded out of Spain in 2019, StudentFinance partners with educational institutions such as Ironhack and Le Wagon to help finance those looking to upskill into disciplines like software development, cybersecurity, and artificial intelligence, serving as an alternative to traditional bank or student loans.

Our action products bring together a company’s data and provide APIs to give developers and business stakeholders in a company the ability to build more sophistication in their payment stack to address issues such as churn, risk, and cost

We wanted to make sure that consumers would be able to use Klarna everywhere. So we created a browser that allows you to go to any website like Amazon, and you have this Klarna button at the bottom

The goal is that by allowing people to co-buy a home and build equity that way, they can eventually sell their shares and purchase their own home at a later time.

Rex Salisbury and Lee Hower and others on hiring in FinTech industry

Merlos and Estrada say the company’s homegrown credit scoring system allows it to offer credit cards in tiers so that its lending is responsible.

Jake Gibson, founding partner of Better Tomorrow Ventures and co-founder of NerdWallet, said that as his firm evaluated the opportunity to invest in Portão 3, it found that enterprise companies in Brazil have access to corporate cards but, as Pereira mentioned, they rarely utilize the products due to concerns around fraud, reconciliation and decentralization of data.

Founded in 2018 to provide working capital loans for small to medium-sized businesses, Aspire began offering more services, including bank accounts for cross-border businesses, corporate cards, payable and receivable management and automated invoice processing connected to financial management software.

Highbeam, a startup that provides banking features, credit and cash flow insights to e-commerce customers, today announced that it raised $10 million in debt from TriplePoint as it looks to expand the reach of its digital product portfolio.

Its API covers over 170 markets for card payments, and 85 markets for local payments collection, which means its customers can accept payments in different countries without having to set up local entities.

Affirm today also posted its second quarter results for the 2023 fiscal year. GMV (gross merchandise volume) of $5.7 billion set a new record but still fell short of an outlook that Affirm itself had provided in November.

The company plans to use its new capital to continue building out its new integrated partner marketplace (similar to what Synctera is doing) and multi-bank network — which is currently made up of 16 banks — as well as develop new products and services, including lending options. Treasury Prime co-founder and CEO Chris Dean believes that the best outcomes for consumers will result from traditional banks and fintechs working together. Over time, it has expanded its offering and today says it gives businesses of all sizes a way to integrate with banks so they can offer new services, lower the cost of deposits and ultimately generate more revenue. San Francisco-based Treasury Prime, which has raised about $73 million since its 2017 inception, started out by building software tooling that helps banks automate and accelerate routine tasks.

Egyptian fintech MNT-Halan lands $120M from Apis Partners, DisrupTech and others It’s been demonstrated that lending is MNT-Halan’s primary business and main revenue generator; however, what’s interesting about the company is how it has layered a digital ecosystem of products, including e-commerce, FMCG delivery and mobile POS payments that feed its lending operations. CEO Mounir Nakhla, who founded the company with Ahmed Mohsen, said MNT-Halan continued where it left off and is presently Egypt’s largest lender to the unbanked: Total loans disbursed now exceed $2 billion per the company’s website (MNT-Halan issued loans north of $65 million last month). In 2021, Halan, operating a digital wallet that offered bill payments, e-commerce and ride-hailing as well as micro, nano and consumer loans, entered into a swap agreement with MNT Investments (a microlending platform operating in Egypt with roots dating back to 2010) to provide financing solutions to the underbanked and unbanked. Egyptian fintech and e-commerce ecosystem MNT-Halan has raised up to $400 million in equity and debt financing from local and global investors as it continues to serve underbanked and unbanked customers in the North African country.

Founded by Irish brothers John and his brother Patrick Collison (the CEO), Stripe has raised more than $2.2 billion in funding since its 2010 inception from investors such as Allianz (via its Allianz X fund), Axa, Baillie Gifford, Fidelity Management & Research Company, Sequoia Capital, General Catalyst, Base Partners, GV and an investor from the founders’ home country, Ireland’s National Treasury Management Agency (NTMA). Thrive Capital has reportedly committed $1 billion in fresh capital to payments giant Stripe as part of a new investment in the works that would value the fintech company at between $55 billion and $60 billion. journalist reported last week that Stripe was seeking to raise $2 billion but the number could actually be closer to $2.5 billion to $3 billion, according to reports from the New York Times and The Information. Also, journalist recently reported on how new fintech startup Mayfair is paying Stripe a fee as part of its mission to offer businesses a higher yield on their cash.

Ultimately, Hakimian said, TrueBiz claims it gives financial services providers a way to onboard their business customers faster, and eliminate the churn that can result from verification delays. Its target customers are mid-size financial service providers, such as banks opening new business bank accounts, or payments providers onboarding merchants. Founded by Danny Hakimian and Max Morlocke, the company recently raised $2.4 million in a seed round led by Flourish Ventures in an effort to reinvent how financial services verify businesses during account opening. Specifically, TrueBiz aims to add color to a business’ background with over 50 data points – such as industry and revenue – from around the web, and then summarize key risk indicators, noted Satya Patel, partner of Homebrew.

Power’s first product is a credit card issuance program, which is designed for companies, brands and banks to offer embeddable fintech experiences, such as customized credit card programs, targeted promotions and personalized rewards, into existing mobile and web applications. Historically, Marqeta was focused on debit and prepaid cards, but in February 2021, it formally expanded into the consumer credit card space to help other brands launch credit card programs. Once the deal closes, Power Finance CEO Randy Fernando will lead the product management of Marqeta’s credit card platform. Marqeta has agreed to acquire two-year-old fintech infrastructure startup Power Finance for $223 million in cash, marking the first acquisition in the publicly-traded company 13-year history.

PhonePe, which is valued at $12 billion, has projected a revenue of $325 million in the calendar year 2022 and $504 million in 2023, according to a valuation report prepared by the auditing firm KPMG and filed by PhonePe. A concern for PhonePe’s growth was Indian regulators enforcing a market cap check on each player, but the deadline for the new guidelines was extended last month and now won’t come into effect until 2025, giving PhonePe another two years of fast-growth. The nine-month financials marks a jump from the $201.6 million revenue that the Bengaluru-headquartered generated in the 12-month period ending in financial year March last year. The startup, backed by Walmart, doesn’t expect to turn EBIDTA positive, a key profitability metric, until the calendar year 2025, KMPG wrote in its valuation report.

Fintech startup Stripe has set a 12-month deadline for itself to go public, either through a direct listing, or pursue a transaction on the private market, such as a fundraising event and a tender offer, according to sources familiar with the matter.

Tapping into identity verification data from credit bureaus (e.g. Equifax) and wireless carriers (e.g. T-Mobile) and combining it with real-time data from financial institutions’ core banking systems, Method can collate a person’s liabilities across more than 60,000 institutions in the U.S. and kick off tasks such as balance transfers, payoffs, bill pay and more. While the startup competes with big names like Plaid, MX, Spinwheel and Dwolla, Shah sees Method holding its own, particularly as the platform rolls out new features in the next few months including real-time credit card transactions, instant balance transfers and enhanced live data points for liabilities. Method, a startup that aims to make it easier for fintech developers to embed repayment, balance transfers and bill pay automation into their apps, today announced that it closed a $16 million Series A funding round led by Andreessen Horowitz with participation from Y Combinator (Method a Y Combinator graduate), Abstract Ventures, SV Angel and others. Shah points out that there’s no standard, technically easy way to access all of a person’s financial liabilities — their student loans, credit cards, mortgages and so on — and push money to those liabilities.

Whenever you want to spend money in your Plum account, you can either withdraw money to your bank account or pay with a Plum debit card — but you have to pay a subscription fee to get a card. It can be particularly useful for people who earn enough money to save money every month, but also tend to spend everything they have on their main bank account. The app can connect to your bank account and round up all your transactions in the past week and transfer everything over to a Plum-managed pocket of money. Originally from the U.K., Plum is a money management app that helps you automatically set some money aside.

After years watching deals falls through due to a lack of payment flexibility, they left Motive to build Vartana, aiming to equip companies with a managed platform that helps sales reps close deals. Vartana also secured a $50 million line of credit from i80 Group, which Kella says will ensure financed deals can be managed through Vartana’s new capital marketplace. Vartana helps to manage tasks like contract tracking, payment terms and signature capture, accepting a range of different payment options (e.g., pay in full, deferred payment) and installment plans. But he doesn’t see them as direct competitors, pointing out that Vartana’s model hinges on delivering financing to buyers and targeting late-stage tech companies.

With the funds from the recently-closed Series A, Shoykhet says that Link will launch account verification, which will verify bank accounts and ownership information to bring merchants in compliance with Nacha’s new account validation rule. Link customers pay by bank transfer, sending funds directly from their bank to a merchant’s business account. Recently, Discover dove into the accounts-to-accounts space, partnering with payments fintech Buy It Mobility so that its partner merchants can accept card-free payments, Link claims to be one of the first companies in the U.S. to enable customers to make online payments using their bank accounts.

Existing backer Bain Capital led the extension, with participation from previous investors such as Access Ventures, CLSA Capital Partners Lending Ark Asia, D3 Jubilee Partners, 500 Global, Kakao Investment, TBT Partners and IBX Partners. PeopleFund plans to use its new capital to continue to advance its AI-powered risk management and credit scoring system for its users, which includes borrowers and lenders. In 2021, PeopleFund raised $63.4 million (75.9 billion won) in equity for Series C, also led by Bain Capital, to further develop its credit-scoring system. Korea’s P2P lending startup PeopleFund gets $63.4M Series C led by Bain Capital

Multiple due diligence mashups, hot M&A and more FinTech news in the first two weeks of 2023. Major banks are on the acquisition roll.

Beyond providing access to higher interest rates, Mayfair says its software gives businesses a way to choose how much they need for operations and earn yield on the rest via automated cash management. Stripe in turn pays Mayfair and Mayfair pays its customers, keeping what Chopra described as a small cut. The pair teamed up with serial entrepreneurs Kent Mori and Kevin Chan in February 2021 to start a company, exploring different business models before settling on Mayfair current offering. Mayfair itself is not a bank, but rather a fintech company that offers FDIC-insured products through an Arkansas-based bank called Evolve Bank & Trust.

Investment giant BlackRock announced Friday it is taking a minority stake in, and leading a financing round for, venture-backed fintech startup Human Interest. Terms of the deal were not disclosed. Human Interest’s digital retirement benefits platform allows users “to launch a retirement plan in minutes and put it on autopilot,” according to the company. It \[…\]

Remote payroll startup Deel has acquired fintech Capbase for an undisclosed amount in a cash and stock deal, the companies have told journalist exclusively. With its acquisition of Capbase, Deel plans to pair those services with a new product dedicated to equity management and issuance. It was drawn to the fact that Capbase works to help companies with incorporation and fundraising in their early days as well as with compliance filings and granting equity as they mature, according to Bouaziz. Services it offers include helping companies send offer letters, grant equity to new employees, manage their cap tables and get a 409A valuation report, among other things.

The Qonto and Penta teams are going to merge with Penta’s co-founder Lukas Zörner acting as the new VP of Germany for Qonto. As for existing customers, Qonto now expects to move all Penta customers to Qonto banking platform by the end of 2023. While Penta is no longer accepting new customers, new German companies looking for a bank account can sign up to Qonto directly. At the time of the acquisition, Penta was serving 50,000 companies in Germany while Qonto had 300,000 customers in France, Spain, Italy and Germany.

While German startup Trade Republic is better known as a mobile app that helps you buy and sell stock, the company is adding interest on uninvested cash. With this new feature, Trade Republic will likely attract new customers who are looking for higher interest rates as inflation impacts the savings of European consumers. Users who hold cash in their Trade Republic account will receive 2% in annual interest. More precisely, Trade Republic says that interests will be calculated on a daily basis and the startup credits user accounts once per month.

Pakistan markets regulator issued new guidelines for digital lending in the country, cracking down on several sketchy practices that it said have become prevalent in the South Asian market. The non-banking finance firms will be required to share these key facts with consumers through audio or video and emails and text messages in both English and Urdu languages. Neighboring nation India also introduced strict rules surrounding digital lending in a move that has toppled the local fintech industry. (You can read the full-guidelines here {PDF}.)

Indian fintech Money View said on Monday it has raised $75 million in a new funding round, its second this year, despite the market slump as it looks to scale its core credit business and build more products in the South Asian market. The eight-year-old startup offers personalized credit products and financial management solutions to customers who otherwise don’t have a credit score and so can’t avail credit from banks and other financial institutions. Apis Partners led Money View Series E funding round, valuing the Bengaluru-headquartered startup at $900 million, up from $615 million in a $75 million Series D funding round in March. Money View plans to deploy the fresh funds to grow its credit business, broaden its product portfolio with services such as digital bank accounts, insurance, wealth management and hire more talent, it said.

The new capital will help also Toss accelerate growth for the challenger bank Toss Bank— launched last year by Via Republica — and a Robinhood-like retail investment app, Toss Securities, which both look to turn a profit next year, according to Seo. Viva Republica, an operator of South Korean finance super app Toss, has finalized a $405 million Series G funding and it says it is now valued at 9.1 trillion won ( $7 billion), up from 8.5 trillion won in June 2021, when it raised $410 million in pre-Series F funding at a $7.4 billion (8.5 trillion won) valuation. Viva Republica with Toss Securities, Toss Payments and Toss Insurance is expected to post about 1 trillion won ($ 767 million) in revenue next year, according to the company. In fact, Viva Republica claims it has the largest market share with its fintech super app in the country in terms of monthly active users (MAUs), with 24 million registered users for Toss and 14 MAUs as of August this year.

Into this fray has stepped Bling, a startup founded by a 20-year-old, that offers a finance platform aimed specifically at families, which is designed so that parents can do financial planning for their children, from pocket money to first investments. It now raised a €3.5M Seed round of financing from Peak (based out of Amsterdam); La Famiglia ; angels such as Lea-Sophie Cramer, Verena Pausder, Felix Haas (co-founder IDnow), Jakob Schreyer (Co-Founder Orderbird), former ING-Diba CEO Ben Tellings, football world cup winner Andre Schürrle, family ‘influencer’ Carmen Kroll, Angel Invest and Prediction Capital . Prior to Bling, Feigenwinter founded three other companies in the youth segment, including Switzerland’s largest student magazine, family merchandise and licensing house, as well as a consultancy agency specialized in young adult topics, leading him to be described as the ‘fintech wunderkind’ by German media. After that, family members and the community join Bling via links, thus contributing to savings pots and investment plans, managing household spending and prepping for critical financial events.

I asked Guillaume Pousaz if Checkout.com’s new valuation was similar to a 409A valuation update. It has implications when it comes to taxes as employees usually pay taxes on the difference between the price of their options and the new share value as defined by the new 409A valuation. Fintech startup Checkout.com was in the news this morning because the Financial Times reported that the payment company had slashed its internal valuation to $11 billion. Unlike Klarna’s down round, the new valuation wasn’t determined by a VC firm willing to invest in the company.

Akros Technologies wants to disrupt the current asset management industry via its AI-driven asset management software platform that mines market data for stocks. The outfit aims to maximize the finance management performance of data-driven ETFs and offer a portfolio management solution via the PMaaS for Akros’s users to help them compete with global ETF institutions like Vanguard or JPMorgan. To build a slew of investment strategies that lower the cost of portfolio modeling and generate scores of investment portfolios, Akros applies a generative AI model based on a decision transformer, which predicts future actions through the sequencing model, Chung said, adding the company also employs GPT-3 natural language processing (NLP) to analyze unstructured language data. The latest funding, which brings Akros’s total amount raised to $6.1 million since its 2021 inception, will help Akros to scale its software platform and asset management products and ramp up its users, including local and global financial institutions and fintech companies.

Nagpal isn’t worried about the seasonality of the 401(k) product because of the upcoming product roadmap, which includes the education product, investment flows into the retirement product like being able to invest in startups and ETFs, and even HSAs, often described as a 401(k) for healthcare. It would be a few years of self-employment, and building a venture firm later, before Nagpal returned to the moment as one of the early catalysts for his newest startup, Ocho. Perhaps the unique connection between Nagpal’s first company, to his firm, to his newest startup, could hint at what his approach to personal finance may be: diversify across multiple vehicles, redefine what a supercharged investment could look like, and keep on learning. To power that ambitious product spree, Ocho has raised $2.5 million from Nagpal’s own venture firm, Vibe Capital.

Earlier this year, Stripe announced a new product called Financial Connections, which gives Stripe’s customers a way to connect directly to their customer’s bank accounts, to access financial data to speed up or run certain kinds of transactions. More recently, Plaid announced that it had named Meta veteran John Anderson to serve as its new head of payments as it began personally facilitating payments through its Transfer offering, in addition to facilitating its partners’ payments. In a practice that is becoming increasingly common, the company is also accelerating equity grants for employees who worked at the company for more than one year to the February 15, 2023 vesting date. Fintech decacorn Plaid is laying off 260 employees, or about 20% of its workforce, the company announced today.

Other African startups on the list include: OVEX, a South African digital asset exchange and OTC trading desk ($5 million from FTX at a $122 million valuation); Kenya-based payment automation and settlement company AZA Finance ($25 million promissory note/loan); African mobile money unicorn Wave ($10 million in equity); South African crypto exchange platform VALR ($4 million equity); Nigerian crypto exchange startup Bitnob ($500,000 from FTX at a $20 million valuation); Nestcoin, a Nigerian web3 platform whose assets got stuck on SBF’s bankrupt crypto exchange platform ($250,000 equity from FTX at a $30 million valuation), and Congolese-based web3 startup Jambo ($500,000 in tokens). According to FT, the four-year-old fintech was one of over 450 investments Sam Bankman-Fried wanted to offer as collateral in an attempt to raise money for the FTX group, which includes 10 holding companies such as Alameda Research, FTX Ventures, FTX Trading, Maclaurin Investments and Clifton Bay Investments (the arm used to invest in Chipper Cash.) FTX processed billions monthly in Africa before going bust It’s not clear if Chipper Cash will maintain this valuation in its next priced round seeing as its lead investor FTX is currently bankrupt. Sam Bankman-Fried’s now-defunct cryptocurrency exchange platform FTX led the round and Chipper Cash’s valuation skyrocketed to $2 billion, becoming one of Africa’s five unicorns last year.

To get the product up and running as soon as possible, Robinhood is inviting anyone with an existing Robinhood account or who is eligible to create a Robinhood account — meaning they are 18 and over and meet other standard criteria — to join the waitlist. (Waitlisting users is a move that Robinhood has used numerous times, including with its crypto product, to both build buzz and ensure a smoother experience for users as they are moved past the figurative velvet rope.) To head off similar criticism with this new product, the company is taking early steps to provide what Tenev described as in-app guidance, education and guardrails for users. Once onboarded, users will have the choice of investing in stocks and ETFs through either a traditional IRA or a Roth IRA, says Robinhood.

Some venture investors have also shown appetite to invest in banks in recent months – Accel and Quona recently backed Shivalik Small Finance Bank, for instance – but a growing number of other banks including RBL and Federal Bank have employed a similar strategy as SBM and courted many startups in the past two years. The Indian arm of SBM Bank, one of the banks that has aggressively worked with fintech startups in the South Asian market, is engaging with investors to raise capital and pitching the vision of becoming one of the top banking-as-a-service providers in the country, according to a source familiar with the matter. The firm sees its deep partnerships with fintech startups such as Bengaluru-headquartered fintechs Razorpay and Slice as a key growth pillar, according to an investor presentation seen by journalist. The bank has actively courted fintech startups as customers, offering them co-branded cards and powering their neobanks, as it sought to differentiate itself from the large competitors that for years avoided engaging with the younger firms.

Providing a complement to the longer process of applying to banks directly for loans, to facilitate lending on its platform, KreditBee works both with non-banking financial companies (NBFCs) and banks registered with the Reserve Bank of India, including Krazybee Services, IIFL Finance, Incred Financial Services, Vivriti Capital, Northern Arc Capital, PayU Finance, Poonawalla Fincorp, Piramal Capital and Housing Finance and Cholamandalam Investment and Finance. The startup said it is planning to use the fresh funds to invest in its product development, specifically to expand from unsecured personal loans to secured loans, home loans and credit lines, and to start work on adjacent services such as insurance, credit score reports and merchant-side offers. The digital loans business in India has been the subject of a lot of controversy, not least for over-predatory and un-transparent practices, yet that existed alongside the rise of a handful of startups that hoping to apply tech to build products that are clearly understood and fill a need in the market for quick, short-term access to capital. KreditBee today offers instant personal loans of up to $3,700 (3 lakhs Indian rupees) as well as loans for salaried individuals and purchases via e-commerce platforms.

It also is not only not a down or a flat round, the cash infusion boosts X1’s valuation by 50%, according to Deepak Rao, co-founder & CEO of X1. X1, a consumer fintech startup which recently launched an income-based credit card to the public, has raised an additional $15 million in funding. Also, notably, X1 latest financing comes just six months after the San Francisco-based company raised $25 million in a July Series B round. The startup’s long list of previous backers include FPV, Craft Ventures, Spark Capital, Harrison Metal, SV Angel, Abstract Ventures, the Chainsmokers, Global Founders Capital, actor Jared Leto, Box co-founder and CEO Aaron Levie, Jeremy Stoppelman, Affirm and PayPal co-founder Max Levchin and Y Combinator Partner Ali Rowghani.

The startup, which offers users the ability to manage and pay their credit card and scores of other bills on time as well as access to D2C brands and loans, backed peer-to-peer lender Liquiloans two months ago, invested in lender CredAvenue earlier this year and expense management platform HapPay in December. CRED is acquiring CreditVidya, a SaaS startup that helps firms underwrite first-time borrowers, in the latest of a series of investments from the Bengaluru-headquartered fintech as it broadens its infrastructure and offerings. The two firms will continue to operate independently and CRED will extend its employee stock program and other benefits to CreditVidya workforce, CRED said in a statement. The 10-year-old CreditVidya — headquartered in Hyderabad and backed by Navroz Udwadia, Kalaari Capital and Matrix Partners — had raised $10 million in previous financing rounds and was last valued at about $30 million post-money.

The startup declined to name its crypto mining-related customers, but notably, Pipe had a public partnership with Compass Mining, a now beleaguered crypto mining company that is reportedly facing its own fair share of struggles. Meanwhile, a Form-D signed by Pipe Senior Counsel Peter Chiaro with the U.S. Securities and Exchange Commission in late September reveals that the company recently secured $7.12 million in debt financing, which could be construed as a positive alternative to the kind of highly structured inside round that many startups are closing currently. Besides Fin Capital, other VCs to lead investments in Pipe on the part of their investment firms include Marlon Nichols, a managing director at MaC Venture Capital, and Ashton Newhall, a longtime investor with Greenspring Associates and now a partner with StepStone Group, which acquired Greenspring in September of last year. Other backers in the company include Morgan Stanley’s Counterpoint Global, CreditEase FinTech Investment Fund, 3L, Japan’s SBI Investment, Marc Benioff, Alexis Ohanian’s Seven Seven Six, Republic and Craft Ventures, which led the company’s $6 million seed funding in February 2020.

Narayanan and O’Dowd were used to card alternative payments after living in Singapore, and saw an opportunity to use the U.K. open banking payments stack to build a Visa and Mastercard alternative, Narayanan told us. Atoa co-founder Sid Narayanan told journalist that he and co-founder Cian O’Dowd developed the idea for Atoa after selling their previous startup, expense management platform KlearCard, to Singapore fintech Validus in 2021. Mastercard and Visa payment rails can cost small merchants and their customers net margins of 51%, with card machine fees of about 1.75%, Narayanan said. To incentivize more customers to use Atoa, the startup also plans to add rewards and loyalty benefits, like digital scratch cards that can let them get cash rewards into their existing U.K. bank accounts.

Crowdz, which secured $10 million in capital co-led by Citi and Dutch growth equity firm Global Cleantech Capital, said this year it expanded from providing invoice-based financing to SaaS-focused SMEs to also providing them with recurring revenue access to upfront capital they need without having to dilute their equity. With that buy — its first — Pipe created a new media and entertainment division called Pipe Entertainment with the aim of giving independent distributors the opportunity to trade their revenue streams in the same way a SaaS company could. The three co-founders of alternative financing startup Pipe are stepping down from their roles as executives of the company in one of the most dramatic management shake-ups seen in the fintech startup world in some time. Since its founding, the startup says that 22,000 companies have signed up for Pipe and $7 billion of ARR (annual recurring revenue) has been connected to the platform.

Users can also leverage Taktile to experiment with off-the-shelf data integrations and monitor the performance of predictive models in their decision flows, Wehmeyer said, performing A/B tests to evaluate those flows. To allay the fears of privacy advocates, customers and regulators, Wehmeyer says that Taktile built technology that enables its clients to host decision flows in their country of choice and process data locally — a requirement for many regulatory agencies. As a piece in The New York Times recently detailed, some lenders are increasingly drawing on outside-the-box data sources to evaluate creditworthiness, presenting opportunities to consumers historically barred from certain financial products but at the same time amplifying the risk of perpetuating biases or making inaccurate predictions. Taktile puts the onus on its fintech customers to communicate the types of data and models they’re hosting and deploying via the platform.

In an interview with journalist, Anderson explained that while Plaid will be personally facilitating payments through its Transfer offering, it will also continue working with its dozens of payments partners, which include the likes of Square, Stripe, Marqeta, Gusto and Silicon Valley Bank. In its own way, Anderson pointed out, Plaid has been involved in digital payments for years, by enabling nearly a billion ACH transactions for things like account funding and account-to-account transfers. In working with its payment partners over the years, Anderson said that Plaid saw a consistent challenge — that it usually took several days for an ACH transfer to complete. Specifically, Stripe’s Financial Connections was designed to give that company’s customers a way to connect directly to their customers’ bank accounts, to access financial data to speed up or run certain kinds of transactions — exactly what Plaid has done historically.

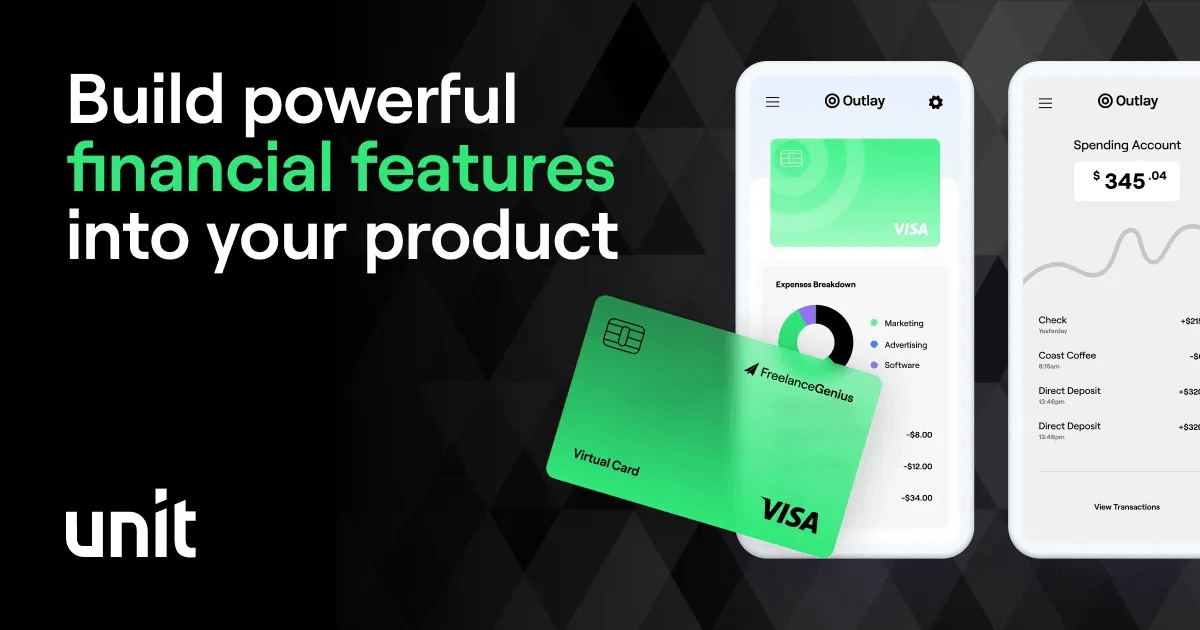

Customers can offer their customers a charge card, credit card, revolving loan or any other credit products that Unit’s bank partners offer. Charge cards, which are more popular than credit cards for small businesses, give Unit a way to enable customers to build and offer lending products, even though the startup is not a lender itself. Unit claims that a card swipe transaction will yield 0.5% more interchange revenue when done with a credit card compared to a debit card. The company gives companies a way to embed financial services into their product — and after already launching debit cards, Unit is officially breaking into the charge card game.

Because it is using its retail customers’ savings deposits to fund these loans at a 3.85% to 4.5% yield, Tellus makes its money on the spread of what it’s paying out in interest versus what it’s charging its borrowers. The six-year-old fintech startup claims it can offer people yields of 3.85% to 4.5% on their savings balances by using the money to fund certain U.S. single-family-home loans. Tellus says it promotes financial literacy by quizzing users on financial terms, for example, and then rewarding them with higher interest rates. With mortgage interest rates having more than doubled since a year ago, one might think that this is not the best time to be a digital mortgage lender.

So the pair spent nights and weekends building a prototype for Loop, a startup that sits at the intersection of logistics and payments, before leaving Uber in May of 2021 to focus full time on the business. And, McKinney claims, it can bring payments down Loop makes money by taking a percentage of total payments volume. Matt McKinney was a data science manager at Uber, helping launch Uber Freight, along with software engineer Shaosu Liu. One of the tailwinds that helped Loop, believes McKinney, is the COVID pandemic-driven secular shift of paper to electronic methods of payments.

In the memo, Britt said that he and co-founder Ryan King are re-calibrating marketing spend, decreasing the number of contractors, adjusting workspace needs and renegotiating vendor contractors. The company memo, along with the fact that Chime has paused its public debut plans, suggests that growth trends may have changed. Chime was notoriously one of the first neobanks to hit EBITDA profitability, a milestone it shared when it hit $14.5 billion two years ago. Digital bank Chime confirmed today that it is laying off 12% of its workforce, or about 160 people.

Decentro has partnered with scores of industry players including Axis Bank, ICICI Bank, Kotak Mahindra Bank, Yes Bank, Visa, RuPay, Quickwork, Equifax, Aadhaar and National Securities Depository Limited (NSDL) to offer solutions for prepaid payment instruments, no-code workflows, conversational banking via WhatsApp and enable document verification and KYC process. Indian angel investors including CRED founder Kunal Shah, Groww co-founder and CEO Lalit Keshre, Gupshup co-founder and CEO Beerud Sheth and former CBO of BharatPe Pratekk Agarwaal also participated in the funding round. India Decentro, the Y Combinator-backed startup that helps companies enter the fintech market by deploying its APIs, has raised $4.7 million in a Series A round. The Bengaluru-based startup offers banking and payments APIs that allow development of fintech products such as banking, payment cards, neobanking and collections and payout services in a short period of time.

The daughter of divorced parents herself, Jacklyn Rome founded Onward in 2020 with the aim of helping divorced and separated parents more easily manage their shared expenses. Since that time, Onward has launched a number of new features, including the ability to pay your co-parent back through the platform, partial payments, and the ability to track other expenses not related to children, such as shared mortgages or telephone bills. Rome, who previously led new product launches at Uber and Blue Apron, said she built the app with the intent of not only alleviating headaches for the parents but also helping reduce family tension overall. By partnering with influencers who are co-parents, Rome said, the startup has boosted awareness of its offering.

As N26 and Bitpanda have likely agreed to share revenue coming from N26 Crypto, the new feature should contribute to the company’s bottom line. Similarly, when you cash out with N26 Crypto, you will get EUR in your main N26 account — no need to transfer money back to your bank account. Challenger bank N26 is launching a new trading feature in its app — N26 Crypto. N26 is going to slowly roll out N26 Crypto across Europe.

Banyan, a platform for product purchase data that allows customers such as banks, fintechs, hotels and merchants to automate expense management and more, today announced that it raised $43 million in a Series A funding round — $28 million in equity and $15 million in debt — led by Fin Capital with participation from M13, FIS Impact Ventures and TTV Capital.

Visa’s network is now connected to Thunes’ B2B platform, which means Visa Direct can reach more than 1.5 billion new endpoints (for a total of 7 billion) and that the 78 digital wallet providers already integrated with Thunes get a new send-to-wallet capability.

To continue growth due to the rising demand for food and groceries and fuel its expansion across the MENAP region, MaxAB has raised more money, this time a pre-Series A to the tune of $40 million.

To help fuel continued growth, the startup is announcing it has raised $67 million in a Series B funding round that included participation from Battery Ventures, Don Griffith, NFL player Drew Brees, Ferst Capital Partners, FinTLV, Next Play Capital, Operator Stack, Redpoint Ventures, Tencent, Tom Williams and Wedbush Capital.

Ayoconnect’s new funding will be used for leadership hiring, and on its Ayoconnect’s product and technology, including new solutions for payments, data and banking and new APIs for account opening and card issuing.

U.K. fintech GoHenry is announcing $55 million in funding to double down on the opportunity. This also played out, interestingly, among young people, GoHenry said, with the company seeing a surge of new users during the pandemic and an increased rate of activity among existing customers.

Ntropy, a company offering an API that enriches transaction data for financial services businesses, today announced that it raised $11 million in a Series A round led by Lakestar with participation from QED Investors and January Investors.

After the layoffs, Brex has just over 1,150 employees. Unsurprisingly, Brex cited the challenging macro environment in its decision.

Red River West led Jiko’s Series B financing, which also included participation from Trousdale Ventures, Owen Van Natta, Temaris & Associates, La Maison Partners, BPI France, Airbus Ventures, Anthem Ventures, Upfront Ventures and Radicle Impact.

To help meet SMEs’ financial needs in the country, Seoul-based fintech startup Korea Credit Data (KCD) said Thursday that it has raised $24.7 million in Series D extension financing. KCD claims that it has more than 1.7 million registered merchants in South Korea and its app has grown into a super app among small and mid-sized business owners.

Embedded banking — used by companies that do not build financial products like credit, payments or deposits from the ground up but want to offer those services to their customers to grow revenues — has been on a big growth tear in the last several years, and today one of the bigger players building finance as a service tools like these and others is announcing a round of funding to continue its growth.

South Africa’s Talk360 raises $4M to build single payment platform for Africa Talk360 told us in a past interview, that its decision to be a payment aggregator was informed by the challenges it encountered in implementing digital payment options, which affected the bottom line of its internet calling business.

On September 28, LinkedIn released its Top Startups list, which is its self-described annual ranking of 50 emerging U.S. companies “gaining attention and recruiting top talent.” The professional networking site takes into consideration a variety of criteria based on its own data when coming up with the list: employment growth, engagement with the company and its employees, job interest and ability to attract talent from companies.

Series A investment was led by AlbionVC and includes Aldea Ventures, as well as previous investors Seaya Ventures, Speedinvest, SIX FinTech Ventures and angel investors, including Leandro Sigman, board member at Endeavor Spain.

At one point, John began having more visibility into the company’s records and found there were inconsistencies in how Better was managing loan documents, post-closings and HR documents. To get a better understanding of what’s happening on a human level, we talked to several former employees of the embattled startup who have been laid off in recent months, as well as current ones impacted by the new leave policy. In the meantime, workers who stayed at the company despite all the goings-on of the past year — only to be laid off with far less in severance pay than those who were laid off before them — feel betrayed.

A number of high-profile angel investors also put money in the round including 12-time NBA All-Star Chris Paul, Super Bowl Champion Vernon Davis, early-stage investors Tim Fong, VSC’s Jay Kapoor and athletes Jimmer Fredette and Kyle Hines.

While French retailers, online shops and businesses can use Stancer starting today, Iliad has already been using Stancer for many of its activities already, including as the payments processing platform to bill Free mobile and internet subscribers. When it comes to online payments, Stancer clients can accept card payments as well as SEPA direct debits. There are many ways to accept Stancer payments — an API, a pop-in or iframe, a Stancer-hosted payment page and CMS plugins. Stancer is already teasing more products down the road, such as split payments and Stancer-designed online shops.

Ultimately, Cohen-Shohet’s goal is to build a holistic, all-encompassing business management platform for small business owners in the beauty and wellness space. GlossGenius has over 40,000 customers in the beauty and wellness space today and sees about $2 billion in annualized transaction volume on its platform, CEO and founder Cohen-Shohet told journalist in an interview. The company plans to use the new funding to grow its employee base of 150 with a focus on engineering, product and design as well as marketing, Cohen-Shohet said. Helping small businesses run big operations is core to the company’s mission, Cohen-Shohet said.

Given that building a new accounting platform is extremely complex if you want to comply with all accounting rules, Regate partners with software companies that have been working on accounting software for many years. For accounting firms, they can add Regate to their accounting stack and communicate with their clients directly from Regate. There are two types of clients for Regate — companies that have their own accounting department, or accounting firms working with small and medium companies. Regate is currently working with 10,000 clients — many accounting firms as well as many companies directly, such as Le Slip Français, Jimmy Fairly, Cityscoot and Skello.

Giesecke message was sent to around 500 Klarna employees, including in IT and and recruiting, though Klarna tells us in a separate statement that the job cuts will impact fewer than 100 employees globally. In May, the company shrunk its global workforce by an estimated 10%; it also raised funds at a $6.7 billion valuation in an $800 million round, down from the somewhat aspirational $45.6 billion valuation that Klarna was assigned by SoftBank when the Japanese conglomerate led a $640 million round in the company in June of last year. Our organization is built on 700 fast-moving teams that are constantly changing, and Klarna employees move between teams and departments every week. When layoffs follow layoffs, as is happening at a growing number of companies (TC’s Natasha Mascarenhas has observed this trend at Robinhood, On Deck, Gemini and others, for example), morale can sink further still.

Mark Mullen, co-founder of Bonfire Ventures, the firm that invested in Brightflow’s seed stage, said the company’s initial customers were e-commerce, which made it easier to understand the pain points. However, Brightflow founder and CEO Robbie Bhathal told journalist that the company differentiates itself by focusing on the automation of financial services and disseminating that information in a way that a business owner can understand. The San Francisco–based company cash flow calculator grabs financial data from platforms like Shopify, Amazon, QuickBooks, Facebook and Google Ads, and then provides a real-time look at cash flow. Brightflow AI is injecting technology into this problem with its forecast and analysis tools so that small businesses can assess their cash flow and make data-driven decisions in real time.

Pie Insurance, which provides workers’ compensation insurance to small businesses, has closed on a $315 million Series D round of funding. Notably, workers’ compensation insurance is the only commercial insurance mandated for nearly every company in the United States, points out Lauren Kolodny, founding partner at Acrew Capital.

Noble today emerged from stealth and announced the close of a $15 million Series A round led by Insight Partners with participation from Cross River Digital Ventures, Plug & Play Ventures, Y Combinator, Flexport Fund, TLV Partners, Operator Partners, Verissimo Ventures, Interplay Ventures and the George Kaiser Family Foundation.

Nilos also helps you manage your crypto transactions as you can orchestrate crypto-to-crypto payments as well as crypto-to-fiat payments. The startup currently takes a fees on crypto-to-fiat transactions, but the company plans to move to a more traditional software-as-a-service subscription model as it’s more transparent for the end users. Meet Nilos, a startup that wants to bridge the gap between crypto wallets and traditional business bank accounts. The company provides a dashboard that displays all your transactions — whether those are fiat transactions or crypto payments.

An investment is typically part of a broader strategic play by the banking industry juggernauts, and Monese’s latest tie-up is no different — HSBC is looking to leverage Monese’s banking-as-a-service platform, which it unveiled last year to help other financial institutions easily develop online money management and related digital services.

Baldwin describes Boundless Rider as a standalone motorcycle, e-bike and power sports product that can be purchased directly from the company or eventually, bundled with another carrier’s homeowner or car insurance product or purchased through a manufacturer at the time of purchase. CoverTree CEO Adarsh Rachmale – who left his product management role at LinkedIn to focus on building the insurtech with Rishie Modi and Divyansh Sharma – says the goal of the company is to only focus on pre-fab or manufactured home residents. As of 2019, about 10% of new single-family homes (including manufactured homes) were categorized as manufactured homes. Boundless Rider is a new insurance company founded specifically to serve riders of motorcycles, e-bikes and power sport vehicles.

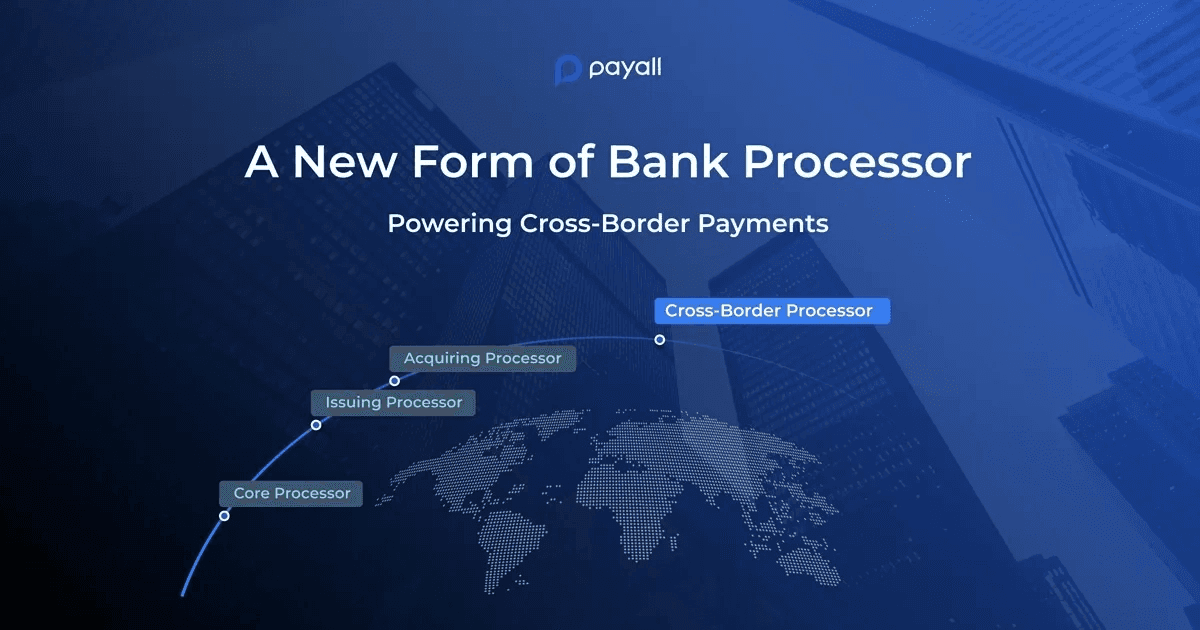

Payall differentiates itself from other startups in the cross-border payments space in that rather than competing with banks, it works with them by white labeling its software. Indeed, with the COVID-19 pandemic fueling more remote work globally, the need to provide cross-border payments for business and individual clients has never been as pressing for banks. He founded Payall, a cross-border processor for regulated banks, in 2018.

He notes that by using Kojo, supervisors spend about 38% less time on materials management, back-office staff save approximately 75% of time processing purchase orders and customers save around 3 to 5% on materials. Earlier this year, the startup rebranded to Kojo and expanded from serving just one construction trade — electrical — to eight, including mechanical, concrete, drywall, roofing, flooring, site preparation and self-perform general contractors. In other words, it provides software to help contractors get the best price for the materials they use in construction projects so they save a lot more money, move faster and have less waste. Kojo claims it can help contractors save as much as hundreds of thousands of dollars in materials annually due to far less waste, while also cutting down their order process time by 50%.

When DolarApp founders Zach Garman, Álvaro Correa and Fernando Terrés were living in the United States and Europe, they would spend time in Latin America, where they saw problems that friends were having when it came to finances and access to banking in dollars.

Power’s first product is the credit card issuance program, which is designed for companies, brands and banks to offer embeddable fintech experiences, like customized credit card programs, targeted promotions and personalized rewards, into existing mobile and web applications. Power, a fintech infrastructure startup, is now kicking off its full-stack credit card issuance platform after a year in stealth mode and with $16.1 million in seed funding and $300 million in a credit facility.

Formerly known as Fazz Financial Group, Fazz goal is to close the $300 billion funding gap for MSMEs, which has been exacerbated by the pandemic, and give them the same tools as larger businesses. The equity investment came from returning investors Tiger Global, DST Investment, B Capital, Insignia Ventures Partners and ACE & Company, with participation from Ilham Ltd, EDBI, InterVest, Y Combinator managing director Michael Seibel and GGV Capital managing partner Hans Tung.

Essentially, Kafene’s model is based on the premise that at the point-of-sale, the prime consumer will probably go with BNPL, while the subprime consumer doesn’t have the credit score to do so and would typically do lease-to-own as their alternative financing mechanism.

Pakistan embedded finance platform Neem has raised $2.5 million in a seed funding round as it works to support underbanked communities in the country.

This week in FinTech, banks vs FinTechs and billion dollar acquisitions

Last batch, YC’s India founders appeared concentrated mostly within the financial services sector, around 30% when you consider that out of 36 Indian startups, 11 were in the fintech world. Out of the 21 startups YC backed in India this cohort, about 40%, or 8 startups, are in the fintech category. Despite a bit of a slowdown in fintech funding for private companies this year compared to the ultra-hot 2021 market, the sector remains much hotter than it was in years past, accounting for nearly 21% of total venture deals as of Q2 2022. YC’s startups are no exception – only time will tell if their approach of focusing in on international companies operating in niche markets will pay off or if consolidation in the sector has already gone too far for new upstarts to see breakout success.

Founded in Israel and now with headquarters in New York, Mesh Payments is one of a growing group of startups focused on helping companies manage their spend through automation. Put simply, Mesh aims to help its clients automate, and get real-time insights about, their spend. For its part, Mesh says it saw its revenue run rate triple in the first half of 2022, since its November 2021 raise.

They also see what factors go into their credit score, including their payment history, credit utilization, the balance versus their secured versus unsecured credit accounts, the age of each of their credit accounts, ID monitoring to see if a financial institution is doing a hard check on their data, the total number of credit accounts they have, both active and inactive, and outstanding balances.

Lightspeed Venture Partners and Avenir Growth co-led Alloy’s latest financing, which included participation from existing backers Canapi Ventures, Bessemer Venture Partners, Avid Ventures and Felicis Ventures.

Listen to an interview with the co-founder of Momo.credit, Sean Grossman. Learn about the inception of his consumer FinTech startup and how he, together with his co-founder, scaled it from 0 to 1. Subscribe to FinTech First podcast to hear more founding stories from FinTech founders.

CEO Yishai Cohen and CTO Amit Assaraf started Landa in 2020 in an effort to make real estate ownership more inclusive. Users can start investing with just $5, and buy and sell shares as well as see real-time updates on their properties from the Landa app.

The gap that Kenya’s embedded finance fintech Pezesha seeks to bridge as it expands into Nigeria, Rwanda and Francophone Africa following a $11 million pre-Series A equity-debt round led by Women’s World Banking Capital Partners II with participation from Verdant Frontiers Fintech Fund, cFund and Cardano blockchain builder Input Output Global (IOG).

This year, Argyle announced a $55 million Series B funding round and the launch of a self-service tool so that consumers can access their employment records with ease. Argyle, which wants to help companies and institutions get access to employment records, has laid off a number of employees across all departments, journalist has learned from sources. CEO and co-founder Shmulik Fishman said he wanted to disrupt the process in which institutions buy records from third parties and instead bring user consent into the mix. A spokesperson for the company confirmed the workforce reduction to journalist, saying that it let go of 6.5% of the team, or 20 people.

Digital mortgage lender Better.com has conducted its fourth round of layoffs since December 1, 2021.

Dubai-based Zywa, a neobank for Gen Z, plans to fuel its growth in the United Arabs Emirates (U.A.E), and to kick-start its expansion to Saudi Arabia and Egypt after raising $3 million seed funding at over $30 million (110 million AED) valuation. The fintech is also adding community-based value-add services like a platform it is building within the app to enable users to apply for internships at Zywa and partner startups, as a strategy for encouraging users to start earning early. They created Zywa as a social banking app and prepaid card to make it possible for the Gen Z (between the age of 11-25 years) to receive money, manage it, and make payments. Zywa also plans to introduce a social element to its app by enabling its users to share photos or videos of their purchases, and to react to their friends’ purchases on different feeds.

The corporate spend startup launched its bill pay feature in October of 2021, building upon its corporate card business and accounting software product. If the business pays back the money within 30 days and did not use their card, Ramp won’t actually make any money off it using the bill pay feature.

Enter Deposits, a Dallas-based finance startup offering a cloud-based, plug-and-play feature to simplify the implementation of digital banking tools for companies like credit unions, community banks, insurers, retailers and brands.

Showing that the regtech industry remains robust to economic headwinds, private equity firms Centerbridge Partners and Bridgeport Partners today announced plans to acquire the publicly-traded Computer Services, Inc. (CSI), a provider of payments processing and regulatory compliance services, for $1.6 billion in an all-cash deal. Centerbridge and Bridgeport note that the deal, if approved by shareholders and regulators as they expect in Q4 2022, will net CSI shareholders a 53% premium over CSI’s closing stock price as of August 19. CSI’s board unanimously approved the plan to take the company private; post-acquisition, its stock will no longer be listed on the public market. Throughout the 1980s, CSI built a network of data centers, began selling its first PC software, and developed what it claims was one of the first online ATM systems.

LatAm FinTechs prevail in the new rounds, while larger FinTech companies go after M&A via SPACs, according to NASDAQ

Stripe has laid off some of the employees that support TaxJar, a tax compliance startup that it acquired last year. In July, Stripe went through a 409A valuation process that saw its internal valuation cut by 28%. Stripe’s new and lower internal valuation, explained Fintech hasn’t been immune from the downturn – for evidence, you need to look no further than the stock prices of Block (formerly Square) PayPal, Robinhood and Affirm.

We sat down with General Partners Angela Strange and Anish Acharya to learn more about why the pair believes that the fact that more people are working globally spells huge opportunity for fintech companies. The interview has been edited for clarity and brevity.

Uni, which is backed by General Catalyst, Elevation Capital and Lightspeed Venture Partners, confirmed in a statement to us that it is suspending card services on its products (Uni Pay 1/3rd Card and the Uni Pay 1/2 Card) and expects to roll out the change to entire customer base by Monday.

Launchpad Capital led Rocketplace seed round, which also included participation from TTV, Accomplice, Menlo Ventures and Soma Capital. But Beryl maintains that the startup’s biggest differentiator lies in the fund distribution model. Meanwhile, points out CEO Louis Beryl, customers will need appropriate disclosures and compliance, especially as regulation increases in the industry. Beryl was also a partner at both a16z and Y Combinator, and also founded Solid Energy Systems, which went public via a SPAC merger on the NYSE earlier this year.

eToro has signed a definitive agreement to acquire Gatsby — a fintech startup which also aimed to go head to head against Robinhood — for $50 million in a cash and common stock deal.

Pomelo, Frenkiel’s new startup launching out of stealth today, wants to make it easier to send remittance payments and conduct international money transfer, with a credit twist.

Left Lane led Arc’s Series A financing, which also included participation from NFX, Y Combinator, Bain Capital Ventures, Clocktower Technology Ventures, Torch Capital and Atalaya, as well as founders from Wayflyer, Plaid, Column, Chargebee, Vouch and Jeeves.

The two moves put Finix squarely on Stripe’s turf, though its CEO and co-founder Richie Serna told us that Finix differs from Stripe in its focus on creating an open ecosystem. Read more.

Weekly news about Paystand, Alloy, Payday, QED Investors, Metromile, Lemonade, Wiseasy, Attentive, Robinhood, Opendoor, Savana, Lami, Bluecopa, Geopagos, Mudafy, Parafin, FinanZero, PayIt, NG.CASH, Legalpad, Weltio and others.

Kontempo, a startup offering buy now, pay later (BNPL) and interest-free installment plans to business-to-business (B2B) customers, today announced that it raised a $30 million seed round in a mix of equity ($6.5 million) and debt ($25 million).

Prior to helping co-found Geopagos, Núñez Castro spent over 14 years as VP and general manager of Amex´s GNS, LatAm division, where he managed the card business operation in Latin America, including penetration into new markets.

Users aren’t under a legal obligation to repay ZayZoon and ZayZoon won’t take action to collect payments, but nonpaying users will be limited from accessing the service in the future. ZayZoon’s platform allows small- and medium-sized businesses to implement what’s known as an earned wage access (EWA) program.

It’s been a volatile year for retail investment behemoth Robinhood. The fintech company is laying off 23% of its workforce, as first reported by the Wall Street Journal and confirmed by TechCrunch. The layoff comes just three months after Robinhood cut 9% of full time staff. At the time of its last layoffs in late April, \[…\]

Rakuten Capital said that it saw a huge market potential for Indian-based rewards business opportunities, and Twid was well positioned to take advantage of this opportunity to build and scale its business model. In parallel with Rakuten, Google’s addition is expected to help Twid expand its model of enabling customers to make purchases using their multiple reward points.

Sanchez argues that Savana has an advantage in its experience building digital systems for banks and financial institutions. One fintech that competes almost directly with Savana is London-based 10x Future Technologies, which helps larger, established banks build both next-generation services and tools to help their older services work more efficiently.

Publicly traded Lemonade has laid off about 60 employees of Metromile, the auto insurtech company it recently acquired – adding to the volatility the technology sector has seen over the past 18 months.

After assessing the current market conditions and uncertainty we’re seeing across the e-commerce sector, this was the most prudent action to take and was necessary to.

Kompliant’s platform allows customers — mostly acquirer processors, banks and sales organizations — to build credit risk programs by leveraging services such as auditing, application processing and verification, and business monitoring.

Umba, a US-based digital bank with a focus on emerging markets, has acquired a majority shareholding of Daraja, a Kenyan deposit-taking microfinance bank, for an undisclosed amount.

His community building had accidentally led him into the world of venture, as Salisbury ultimately became a founding member of a16z’s fintech practice alongside general partners Anish Acharya and Angela Strong before becoming a partner in 2019.

Right now, the company gets largely paid through affiliate fees and exchange of data. opts in for a suggested insurance plan Clicks into a location-based offer Answers market research or campaign measurement questions Or scans Pogo card for a discount when buying a prescription In the next iteration, Wong says, Pogo will suggest users to turn to fee-free banking alternatives, and then Pogo can make money through affiliate fees.

After living and working in the United States for almost 25 years, he moved back to Bangladesh in 2018 to digitize micro-credit, with the goal of creating a digital credit platform for micro-merchants that did not require a smartphone or digital literacy.

When Kristy Kim started TomoCredit in early 2019, she was on a mission to help international students more easily obtain credit.

While Glyman did not reveal hard revenue figures, he did point out that the company had crossed $100 million in annualized revenue before its third birthday in March.

Bloom’s seed round is the largest in Sudan, a country whose tech ecosystem can be termed passive and only recently welcomed foreign investment when Fawry backed fintech and e-commerce player Alsoug after 30 years of international sanctions on the country.

X1 Card is taking a different tack by underwriting customers based on their income rather than their credit scores, which the company says enables it to set credit limits up to 5x higher than traditional card providers.

On a high level, it’s no surprise that funding flowing into fintech startups was down both globally and in the U.S. in the second quarter of 2022. And it wasn’t only funding. Everything was down. New unicorn births, M&As, IPOs.

BAI Capital, GIC and GGV Capital co-led the equity portion of the deal, which also included participation from other existing and new investors.

Unlike Stripe, Klarna’s valuation was cut by its investors – which include Sequoia, Silver Lake, Commonwealth Bank of Australia, the UAE’s sovereign fund Mubadala Investment Company and Canada Pension Plan Investment Board (CPP Investments). The Journal reports that the valuation cut comes from a 409a price change, which means that Stripe hasn’t decreased the value of preferred shares sold in the last round.

To power the expansion, which will see Lightyear land in 19 new markets including the Baltics and much of Western Europe, London-based Lightyear has also raised $25 million in a series A round of funding led by U.S. venture capital firm Lightspeed, with participation from other notable backers including Virgin Group,

Plaid, the company building data transfer technologies to power fintech and digital finance products like smartphone-based wallets, today announced that it adding support for thousands of crypto exchanges to its data network.

The Japanese fintech startup said today it has raised a $20 million (2 billion JPY) Series A funding round led by Globis Capital Partners with participation from Z Venture Capital, Mitsui Sumitomo Insurance Venture Capital, and DBJ Capital.

To help users search these various money transfer options in their region and compare rates and fees, Zazuu initially launched as a chatbot in 2020, informing users of the daily remittance rates of various platforms via Facebook and Telegram groups.

On the employee side, Kadmos serves up a mobile app replete with e-wallet that holds workers’ salaries in U.S. dollars or euros, while also allowing them to send money home instantly, with predictable set fees.

Elivalat Fintech Ltd., Hupesi Solutions, Cruz Ride Auto Ltd and its director Simon Karanja Ngige, Boxtrip Travels and Tours, Bagtrip Travels Ltd. accounts, and Adguru are the entities said to have received the funds from Flutterwave, and whose accounts were also frozen.

Co-founder and CTO Henry Bradlow had previously written algorithms to power rocket ships at SpaceX, so the trio —Calvano, Francisco Enriquez and Bradlow — was determined to find a way for artificial intelligence to streamline the construction back office.

Apparently when ABG became a Bolt customer in October 2020, reported Insider, Bolt entered a deal to award the group stock warrants, which give the holder the right to buy shares at a specified price before a specified date — under certain conditions.

In product terms, Peakflo is a collection of services, per Chauhan, including accounts receivable (money in), accounts payable (money out), a payment layer and an integration layer, linking the service to accounting software and some enterprise resource planning.

In April 2022, American Express and Pymnts.com published a survey that found that about two-thirds of firms that have automated accounts receivable processes report benefiting from improved days sales outstanding (a measure of the average number of days that it takes for a company to collect payment after a sale has been made), while about half said that they achieved lower delinquency rates.

Cash App last week launched Round Ups, allowing customers to invest their spare change into a stock of their choice or bitcoin every time they use their Cash Card. Even that new figure represented both a dramatic decline from Klarna’s mid-2021 valuation of more than $45 billion and the $30 billion figure it was reported to be targeting earlier this year, as our own Alex Wilhelm noted here.

Swedish buy now, pay later giant Klarna is reportedly close to inking a new round of funding that would slash its valuation to $6.5 billion – about 7x of what the company was valued in June of 2021.

CEO Lindsay McLean started the Santa Monica, California-based company in 2015 with attorney and real estate broker Jennifer Stein, after her own home-selling experience. Enter HomeLister, a digital brokerage and real estate site that gives homeowners a way to list and sell their properties online, with support.

While Stake competes against the aforementioned Bilt, which last year raised $60 million for its loyalty program for property renters, Hobbs claims that Stake is growing at a robust pace.

April users connect their payroll, bank statements, mortgage, prior year tax return and other finance apps to the platform and then tell April about significant tax events over the past year (e.g., moving to another state).

Apti said that providing large-scale access to mid- to low-income communities in a cost-efficient way compared to their traditional channels means Mapan is able to offer better prices.

With $18 million in seed funding led by San Francisco-based Human Capital and London Giant Ventures, Tenet says its EV loan offering cuts monthly payments by $200 on average.

Today, Conversion Capital is announcing that it has raised $122 million for its third fund — more than six times the size of its previous fund — to back early-stage fintech and infrastructure startups.

At the time of that last raise, Hughes told journalist that Amount’s clients included financial institutions collectively managing nearly $2 trillion in U.S. assets and servicing more than 50 million U.S. customers.

We found that fintech startups raised $1.5 billion from June 16 to June 23 across 39 deals — compared to $1.4 billion raised across 53 deals the week prior and $1.2 billion across 59 deals 2 weeks prior.