FinTech news in Accel category

Eagle believes Beam differs in that Briq is more focused on building tools for large enterprises to automate their billing process. common refrain in the construction industry is that most contractors are forced to complete projects before getting paid, often having to pay for material and labor out of pocket.

The 12 startups gathered in the presentation hall had been hand-picked from about 3,600 applicants for the latest cohort of Sequoia’s four-year-old early-stage-focused Surge program

Funding Circle co-founder Samir Desai has unveiled a new U.K. fintech startup called Super Payments, a venture he founded back in February but which very little was known about until now. Reports emerged a few months back that Desai had raised around $30 million for this new company, and today this has been confirmed. Super \[…\]

The second PV angel fund is backed by some of the U.K.’s more active angels, including Chris Adelsbach, Will Neale and Michael Pennington, alongside founders from Credit Kudos, FreeAgent, BrandWatch, Wayve, Passfort, ContentCal, Griffin, Bibliu, Rahko and Fixflo. PV makes much of its community-driven culture, with a network of founders, investors and others alongside the PV founders Will Martin and Will Brooks who put the fund together in 2014. Starting Funding Club (SFC) is the funding services provider, and all investors are committed to the fund and Portfolio Ventures are discretionary fund managers deploying from a pot of capital put in by these investors. A good example of that is Portfolio Ventures (PV), which has now closed its second angel fund (which they claim was oversubscribed), where many of the investing angels do so under EIS.

Two firms stuck out in recent days, including Urban Innovation Fund, which closed with commitments of $100 million for its Fund III and $20 million Opportunity Fund, and VMG Catalyst‘s $400 million Fund II.

Lightspeed began investing in India over 10 years ago and has amassed an impressive portfolio of several fast-growing startups including Byju’s, India’s most valuable startup, SaaS firm Innovaccer, e-commerce giant Udaan, social media giant ShareChat and payments giant Razorpay. The firm, which has a team of nine partners in India and Southeast Asia, is nearly doubling the size of its fund because it’s seeing more opportunities in the regions as a young crop of startups attempt to solve deeper and newer problems, said Rahul Taneja, a partner at Lightspeed, in an interview with journalist. The fund, fourth for Lightspeed India, was hard-capped at $500 million, meaning it didn’t want to raise additional capital, said the firm, which unveiled its $275 million third India fund in 2020. The Tuesday announcement confirms journalist April report, which said Lightspeed had kick started fundraising deliberations for the new India and Southeast Asia fund and was aiming to raise about $500 million.

While Dcode Capital can’t be a substantial financial backer to its portfolio companies based on its small check sizes at the stage it invests at, it hopes to have an outsized impact with its knowledge of getting tech into the government, something most VCs can’t offer.

According to Mack, Middesk allows service providers to form a picture of their customers and offer products they might need to establish, operate, and maintain their businesses.

It works with major brands and companies including McDonald’s, Wendy’s, Ford, the CBRE Group and 60% of the Fortune 500, which use Near’s interactive, cloud-based AI platform (branded Allspark) to tap into anonymised, location-based profiles of users based on a trove of information that Near sources and then merges from phones, data partners, carriers and its customers

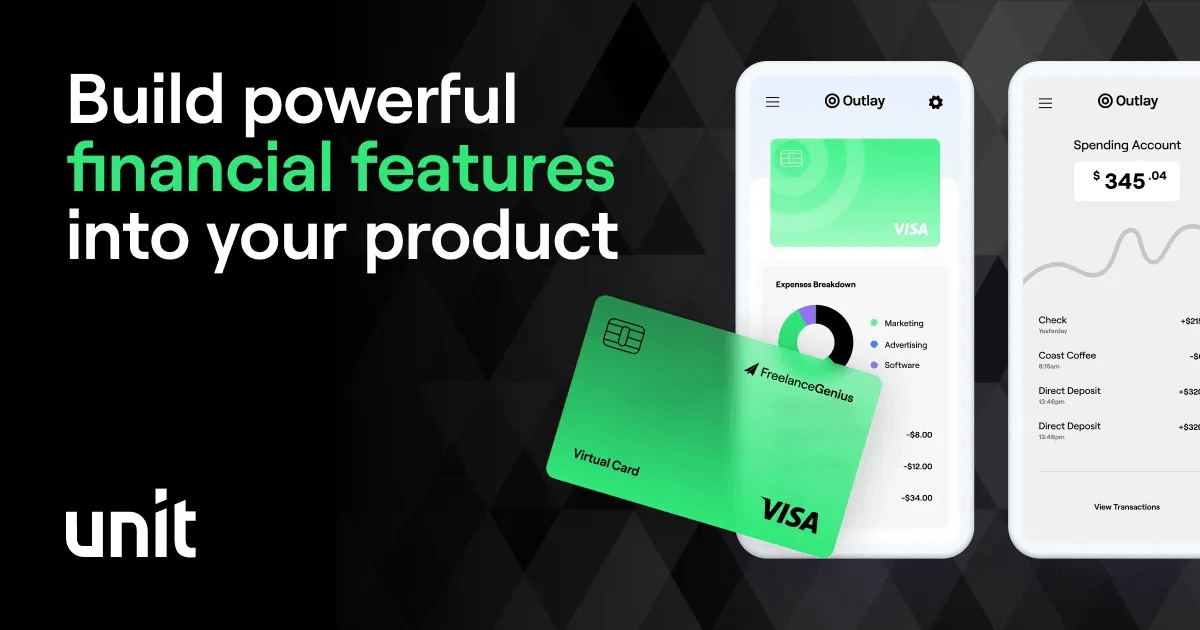

In other words, Unit touts that companies using its technology in a variety of industries — such as freelance or creator economy and personal financial management, for example — can build financial products directly into their software.

The round brings Fashinza’s total raised to $135 million, which Gupta says is being used to refine the company’s supply chain technology and expand into new markets, including raw materials procurement. In an endorsement of Fashinza’s approach to supply chain management, the company today announced that it raised $100 million in Series B funding ($60 million in equity and $40 million in debt).

Today, said Sathyanesan, Winden offers digital entrepreneurs features such as free ACH, wire and check payments and the ability to manage transactions, payments and expenses in one place. In August 2021, Winden was born as a neobank that offers deposit banking, spend management and other financial products for digital entrepreneurs.

Notably, dozens of angel investors also put money in Truora’s latest financing round. Truora, a Colombian user authentication startup, has raised $15 million in Series A funding co-led by two Silicon Valley-based venture firms.

Vietnamese gaming studio Sky Mavis announced that it has raised $150 million in funding led by crypto exchange Binance to help reimburse users who lost funds during a ~$625 million hack of its play-to-earn game Axie Infinity, which was the largest crypto heist to date.

Antler East Africa, the Nairobi office of VC firm and venture builder Antler, has closed a $13.5 million fund to invest in early-stage tech startups in the region. Being a female-led VC team, Antler East Africa is particular about investing more in startups founded and led by women in the region, Kebede said

Niyo co-founder and chief executive Vinay Bagri told journalist in an interview that the startup has amassed over 4 million customers across its banking and wealth management products. India Niyo has raised $100 million in a new financing round as the consumer-facing neobank platform looks to add lending and insurance to its offerings and make deeper inroads in the world’s second largest internet market.

To that end, and like the aforementioned spend management companies, Coast has created a commercial charge card designed for the businesses that operate vehicle fleets, such as trucking companies, plumbers, HVAC businesses or last-mile delivery companies.

Coinbase, one of the world largest crypto exchanges, announced an exclusive partnership earlier this week with crypto tax and portfolio tracking provider CoinTracker, meaning Coinbase users will get access to CoinTracker’s software at a discounted price.

In his view, CaptivateIQ alleviates these pain points by taking the flexibility of spreadsheets and combining it with the scalability and performance of software technology to configure commissions plans with minimal support.