FinTech news in a16z category

While there are a number of web3 security companies out there, Stelo Labs focuses on helping prevent malicious transactions, phishing and social engineering for Ethereum-based users, Dhesi said.

Over a 10-year horizon, the idea for a total market for crypto assets will look very different, Diamond said. The biggest difference between this index product and traditional equity indices is the exposure to crypto assets, Diamond noted. Last month, the startup launched its first product, the Alongside Crypto Market Index ($AMKT), which gives people broad exposure to the entire crypto asset market through a single token. In the future, Alongside will consider launching different products centered around DeFi as a category or layer-2 blockchains as a category, Diamond said.

Because it is using its retail customers’ savings deposits to fund these loans at a 3.85% to 4.5% yield, Tellus makes its money on the spread of what it’s paying out in interest versus what it’s charging its borrowers. The six-year-old fintech startup claims it can offer people yields of 3.85% to 4.5% on their savings balances by using the money to fund certain U.S. single-family-home loans. Tellus says it promotes financial literacy by quizzing users on financial terms, for example, and then rewarding them with higher interest rates. With mortgage interest rates having more than doubled since a year ago, one might think that this is not the best time to be a digital mortgage lender.

Banks and card issuers typically use fraud detection algorithms for crypto that aren’t nearly granular enough, Ranjan said, meaning around half of the customers who attempt to transact using fiat-to-crypto onramps through traditional platforms are declined as fraudulent.

In this, Sequence and its investors believe the startup is an early mover in building building payments software that allows businesses to capture data in real time and to feed that into dynamic pricing and payments flows. The role of no-code and low-code software has often been described in terms of being more efficient, or just to cut through red tape in helping non-technical people get more hands-on with the digital products they are themselves using, but it has more recently taken on a more pragmatic, fiscally-minded purpose: at a time when companies are reevaluating their spend on new product and projects and how they allocate their talent resources, services like billing and payments are also getting revisited. Sequence, which wants to create what it describes as a new kind of FinOps stack for B2B businesses — APIs and other tools to create more responsive pricing, billing and related services, leveraging data and analytics to do so — has raised $19 million, a seed round that it will be using to continue developing its products and hiring more talent. Companies like Stripe, Paddle and Modern Treasury have opened the door to making it easier for digital businesses — which are not necessarily at their core payments and billing companies — to use APIs to incorporate more modern payments, billing, reconciliation and other revenue-related services into their financial stack.

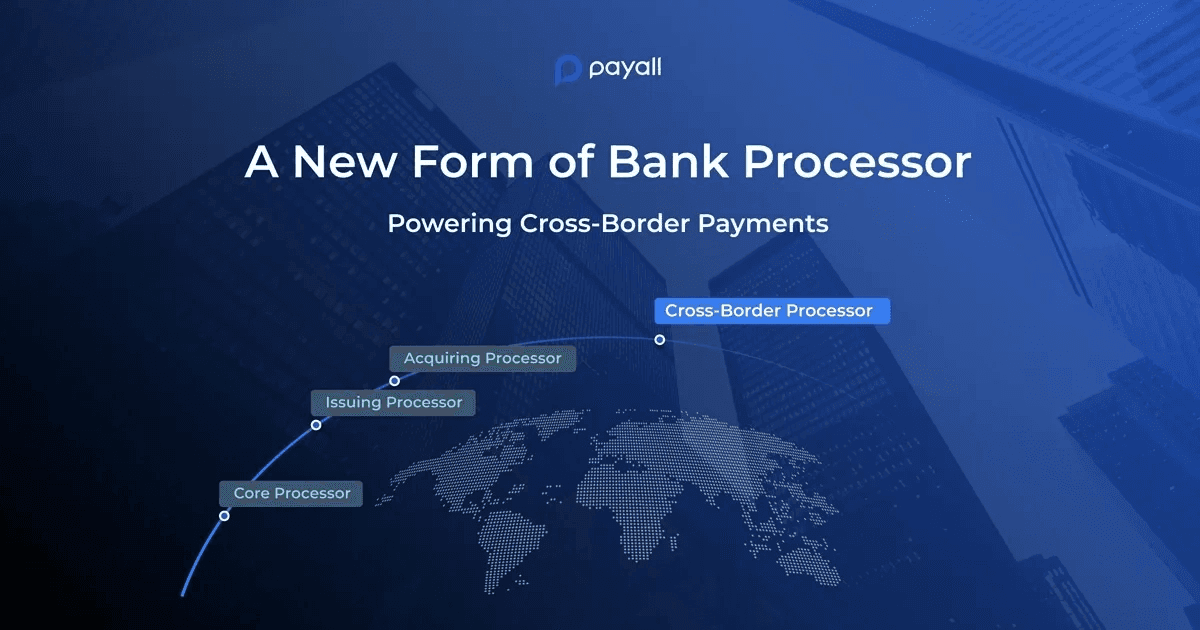

Payall differentiates itself from other startups in the cross-border payments space in that rather than competing with banks, it works with them by white labeling its software. Indeed, with the COVID-19 pandemic fueling more remote work globally, the need to provide cross-border payments for business and individual clients has never been as pressing for banks. He founded Payall, a cross-border processor for regulated banks, in 2018.

LatAm FinTechs prevail in the new rounds, while larger FinTech companies go after M&A via SPACs, according to NASDAQ

We sat down with General Partners Angela Strange and Anish Acharya to learn more about why the pair believes that the fact that more people are working globally spells huge opportunity for fintech companies. The interview has been edited for clarity and brevity.

Though Halliday plans to charge an initial fee to customers using the product to cover the startup’s costs, Malhotra hopes to eliminate the fee over time as his goal is to keep the product as low-cost as possible for gamers.

Andreessen Horowitz recent hire of former Jordan Park Group Chief Investment Officer Michel Del Buono suggests the venture capital firm is getting into startup founder wealth management. Alongside ditching a centralized HQ, a16z announced new offices in Miami Beach, New York and Santa Monica in addition to its existing Menlo Park and San Francisco posts. The outfit, more commonly known as a16z, confirmed Del Buono’s hire as CIO to oversee those types of services for founders, as first reported by Bloomberg. That move was notable in that the storied venture firm was founded in 2009 in Menlo Park and has historically been associated with the Bay Area.

Co-founder and CTO Henry Bradlow had previously written algorithms to power rocket ships at SpaceX, so the trio —Calvano, Francisco Enriquez and Bradlow — was determined to find a way for artificial intelligence to streamline the construction back office.

Of the total funds raised in this round, $32 million came from venture capital firms and $38 million from the sale of Flowcarbon’s Goddess Nature Token (GNT), a crypto token on the Celo blockchain backed by carbon credits, Reuters reported.

But in this case, that may actually be serving as a tailwind for Point and companies like it, although Lim emphasizes that Point is not out to replace refinancings, for example. Point then values the home — often with an in-home appraisal — and updates the final offer.

Wayne Chang, co-founder and CEO of Spruce, told journalist that web2 platforms that offer sign-in capabilities have been able to access this data in the past because they offer trust and verification to users of the network. That’s the question Spruce is trying to answer by building a public utility of sorts for internet users, but doing so requires individual users to build trust with one another by voluntarily sharing data through the network when they can’t rely on a centralized intermediary to make assurances.

Vietnamese gaming studio Sky Mavis announced that it has raised $150 million in funding led by crypto exchange Binance to help reimburse users who lost funds during a ~$625 million hack of its play-to-earn game Axie Infinity, which was the largest crypto heist to date.

Datanomik’s goal is to connect financial institutions across LatAm through its B2B open finance API, which gathers a company’s banking information on one platform, Strauss told journalist. Now, dLocal and AstroPay co-founder Sergio Fogel has teamed up with AstroPay’s former head of product, Gonzalo Strauss, to launch another fintech out of Montevideo, Uruguay, called Datanomik.

Andreessen Horowitz (a16z) and NFX co-led Latitud’s $11.5 million seed funding round, which also included participation from Endeavor, Canary, FJ Labs, Ganas Ventures and unicorn founders.

The company operates with an asset light model, Rubin said, in that it doesn’t need cash to buy homes and rather uses money from when people are rolling in their equity from their homes. He was drawn to Flock’s ability to allow any landlord to roll their properties into the portfolio it has created, while still providing the former landlord with the same income stream with no immediate tax consequences A startup called Flock Homes wants to give landlords a similar ability to own shares of a portfolio that is made up of multiple properties and it just raised a $26 million Series A funding round toward that effort.

Less than seven months after closing on a $57 million Series B, fast-growing fintech Jeeves has raised $180 million in a Series C round that values the company at $2.1 billion. For example, Jeeves says that since its Series B was announced in September, it has seen its revenue climb by 900% and doubled its client base to more than 3,000 companies.

The ability to raise a relatively large seed round so soon after inception speaks to the experience of the company’s founders, which include Juan Pablo Ortega, the co-founder of on-demand delivery unicorn Rappi (which as of last July was valued at $5.25 billion) and Julián Núñez, an early Rappi employee. Yuno wants to bring to Latin American companies an easy online checkout solution that solves the pain point of managing multiple payment methods.

When customers move money to their wallet via credit card, debit card, or ACH transfer, Sardine assigns a risk score to the card or bank account being used through an algorithm and assumes fraud liability for the transaction.

The grant sparked a closely collaborative relationship between Nomic and the Ethereum Foundation that resulted in the latter becoming Nomic’s single funding source before Nomic’s pivot to nonprofit status, Zeoli said.

While this is easier for customers, it has created headaches for many software, or SaaS, businesses that are not equipped with billing systems that can easily charge customers on a usage basis. Woody agrees, adding that Metronome can help companies that have built a new product that they want to get out into the market as quickly as possible.

Today, Yu and Yang’s new company, San Francisco-based Vesta, is announcing it has raised $30 million in Series A financing led by Andreessen Horowitz (a16z) with participation from new investor Zigg Capital.