FinTech news in Andreessen Horowitz category

On May 2, as first reported by Barron, U.S. Senator Sherrod Brown, chairman of the Senate Banking, Housing, and Urban Affairs Committee, wrote a letter to FDIC Chairman Martin Gruenberg expressing concerns about Tellus’s claims

With that more enhanced data, Spade customers, which include card issuers, anti-fraud platforms and neobanks, can do things like implement spending controls and improve fraud prevention models.

Over a 10-year horizon, the idea for a total market for crypto assets will look very different, Diamond said. The biggest difference between this index product and traditional equity indices is the exposure to crypto assets, Diamond noted. Last month, the startup launched its first product, the Alongside Crypto Market Index ($AMKT), which gives people broad exposure to the entire crypto asset market through a single token. In the future, Alongside will consider launching different products centered around DeFi as a category or layer-2 blockchains as a category, Diamond said.

Banks typically use deposits to make loans, which puts them into one of two situations: either they have too many deposits and not enough lending or investment opportunities, or they don’t have enough deposits to meet the loan, explained Paolo Bertolotti, co-founder and CEO of ModernFi.

It seems like a lot of moolah in a volatile market, even coming as it does from two separate a16z funds: the firm’s $600 million debut games vehicle and its $4.5 billion crypto fund, both of which were announced last May. The latter remains privately held, but after scrapping plans to go public through a special purpose acquisition company, it managed to snag $350 million in funding in 2021 from Netmarble, Kabam, and affiliates of funds managed by Fortress Investment Group, which suggests it’s doing just fine. The pair previously co-founded the once-hot social media platform MySpace (which originally sold to MySpace for $580 million in 2005) and the mobile game studio Jam City. (Indeed, Jam City, which claims to have 30 million monthly active users, announced this morning that a third cofounder, Josh Yguado, is now running the show after serving as the company’s COO and president previously.)

In the long term, the network wants to create a system using which people can transact and coordinate with the level of encryption needed for mainstream blockchain adoption, Andrews said. Aztec Network, a privacy layer for web3, has raised $100 million in a Series B round led by Andreessen Horowitz (a16z), the startup co-founders Zac Williamson and Joe Andrews exclusively told journalist. While there are several encrypted blockchains like Zcash and Iron Fish network, Aztec differentiates itself from them because it’s programmable, Williamson said. Encrypted blockchains provide transparency for the protocol but privacy for the users, so people aren’t required to show their identities when transacting, Williamson said.

Andreessen Horowitz (a16z) is one of the most influential players in the web3 ecosystem, funding entrepreneurs in the space amid “crypto winter.” Founded and helmed by general partner Chris Dixon, the venture firm’s crypto arm raised a massive $4.5 billion fund in May for its fourth dedicated sector fund to continue backing early-stage founders just \[…\]

Banks and card issuers typically use fraud detection algorithms for crypto that aren’t nearly granular enough, Ranjan said, meaning around half of the customers who attempt to transact using fiat-to-crypto onramps through traditional platforms are declined as fraudulent.

In this, Sequence and its investors believe the startup is an early mover in building building payments software that allows businesses to capture data in real time and to feed that into dynamic pricing and payments flows. The role of no-code and low-code software has often been described in terms of being more efficient, or just to cut through red tape in helping non-technical people get more hands-on with the digital products they are themselves using, but it has more recently taken on a more pragmatic, fiscally-minded purpose: at a time when companies are reevaluating their spend on new product and projects and how they allocate their talent resources, services like billing and payments are also getting revisited. Sequence, which wants to create what it describes as a new kind of FinOps stack for B2B businesses — APIs and other tools to create more responsive pricing, billing and related services, leveraging data and analytics to do so — has raised $19 million, a seed round that it will be using to continue developing its products and hiring more talent. Companies like Stripe, Paddle and Modern Treasury have opened the door to making it easier for digital businesses — which are not necessarily at their core payments and billing companies — to use APIs to incorporate more modern payments, billing, reconciliation and other revenue-related services into their financial stack.

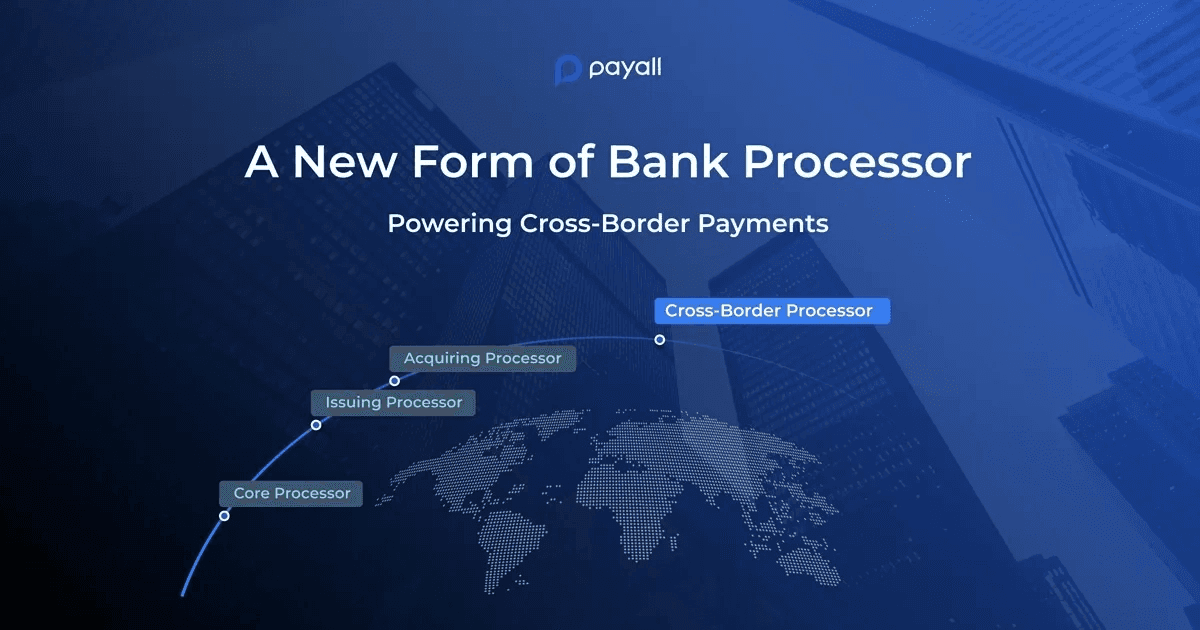

Payall differentiates itself from other startups in the cross-border payments space in that rather than competing with banks, it works with them by white labeling its software. Indeed, with the COVID-19 pandemic fueling more remote work globally, the need to provide cross-border payments for business and individual clients has never been as pressing for banks. He founded Payall, a cross-border processor for regulated banks, in 2018.

The team’s goal is to tap the blockchain to build a music creation suite that bakes in an open source ethos, allowing producers to sample a wide variety of songs and sounds while the platform ensures that credit always flows back to original creators appropriately. Arpeggi Labs, a new crypto startup focused on using blockchains to make music creation more collaborative, has scored $5.1 million in seed funding from Andreessen Horowitz crypto arm alongside a host of artists including names like Steve Aoki, 3LAU and Wyclef Jean. To make this dream happen, Arpeggi is aiming to go beyond developing a protocol and build an entire in-browser digital audio workstation that allows producers to mix blockchain-minted beats while integrating with the wider arena of Web 2.0 and web3 music platforms. While the company hasn’t landed on whether they’re looking to issue a token for the platform down the road, the founders say they are mainly focused on enticing music professionals who haven’t already aligned themselves with the web3 mantra but are excited about the idea of the industry doubling down on open source.

Now, Landing, a startup that is making it possible for its customers to rent a fully furnished apartment on its platform for as short a period as one month, says it, too, has secured fresh funding: $75 million in equity funding and another $50 million in debt. Blueground, a pre-furnished apartment rental startup focused on short-term and long-term rental, meanwhile raised $180 million in equity and debt funding last September. Earlier today, journalist reported that an online rental marketplace, Zumper, just raised $30 million in a Series D1 round of funding led by Kleiner Perkins to help it better serve people looking for short-term rental options. Another flexible-living company is Sentral, whose 3,000-plus properties are owned by Iconiq Capital, the San Francisco-based investment firm whose investors include Mark Zuckerberg and Reid Hoffman; Iconiq is also a major investor in Sentral, the WSJ reported last year.

India financial crime-fighting agency conducted searches at multiple premises of the Bengaluru-headquartered CoinSwitch Kuber on Thursday, alleging the crypto exchange startup violated forex laws, four people familiar with the matter told journalist. The government agency has performed over half a dozen probes into tech firms this year, including Chinese smartphone vendors Vivo, Oppo and Xiaomi and seized more than $1 billion of capital that it said firms had evaded in fraudulent tax computations. The Enforcement Directorate searched the office facilities and residences of some executives and also questioned many, including chief executive Ashish Singhal, two people said, requesting anonymity as the matter is private and sensitive. The agency believes that the Indian startup acquired shares of over $200 million in violation of local forex laws, a person familiar with the matter said.

We sat down with General Partners Angela Strange and Anish Acharya to learn more about why the pair believes that the fact that more people are working globally spells huge opportunity for fintech companies. The interview has been edited for clarity and brevity.

a16z wrote its largest individual check ever, at $350 million, to Flow, Neumann new residential real estate company focused on rentals, the New York Times reported today.

Though Halliday plans to charge an initial fee to customers using the product to cover the startup’s costs, Malhotra hopes to eliminate the fee over time as his goal is to keep the product as low-cost as possible for gamers.

Andreessen Horowitz recent hire of former Jordan Park Group Chief Investment Officer Michel Del Buono suggests the venture capital firm is getting into startup founder wealth management. Alongside ditching a centralized HQ, a16z announced new offices in Miami Beach, New York and Santa Monica in addition to its existing Menlo Park and San Francisco posts. The outfit, more commonly known as a16z, confirmed Del Buono’s hire as CIO to oversee those types of services for founders, as first reported by Bloomberg. That move was notable in that the storied venture firm was founded in 2009 in Menlo Park and has historically been associated with the Bay Area.

The full scope of the Yuga’s monetization plans for their network are still in development and the founders have yet to nail down timing for a wide public launch, but while multi-million dollar avatars and massive NFT land sales may be unique among today’s games, Yuga is positioning itself to compete with today’s big platforms including players like Epic Games, Roblox and Meta.

Co-founder and CTO Henry Bradlow had previously written algorithms to power rocket ships at SpaceX, so the trio —Calvano, Francisco Enriquez and Bradlow — was determined to find a way for artificial intelligence to streamline the construction back office.

With a fresh $42 million in its coffer, the firm plans to invest in the “social ecosystem” of web3, a version of the internet built largely on blockchain that promises to be more decentralized.

GGV’s index leaves exited companies aside and ranks the 50 API-led private companies that have raised the most funding.

Pacific also attributes Entropy’s edge to their own willingness to deviate from the traditional business model for custodians, wherein users pay them a fee to safekeep funds, and to work towards finding a model that can generate revenue not just for the custodian but also for the protocol itself, as well as crypto users.

Iyer, a serial entrepreneur with two successful exits, spent the majority of last year honing in on his interest in web3 as a visiting partner at Pear VC and an instructor teaching a DeFi masterclass to over 2,000 students.

The Justice Department and SDNY U.S. Attorney’s Office have begun getting more active in prosecuting crypto crimes, but the NFT space has largely evaded much action, which made the announcement a bit of a shock to those in the crypto space. OpenSea soon fired Chastain after they determined the allegations were legitimate, though Chastain has continued to be active in the NFT community, especially on Twitter.

Zhang said she has noticed a growing interest of funds coming into the crypto space or new funds launching to invest in crypto after they saw the potentials of blockchain technology and crypto ecosystem.

Of the total funds raised in this round, $32 million came from venture capital firms and $38 million from the sale of Flowcarbon’s Goddess Nature Token (GNT), a crypto token on the Celo blockchain backed by carbon credits, Reuters reported.

The fund, which is backed by Dapper’s venture arm and Dapper investors Andreessen Horowitz, Coatue, Union Square Ventures, Coinfund, Digital Currency Group and Cadenza Ventures, among others, is aiming to incentivize more crypto devs to choose Flow as the blockchain they build their projects on with investments, token grants and development support.

Katie Haun new firm, Haun Ventures, has led its first deal in NFT startup Zora Labs. The NFT ecosystem continues to chug along, but the vast majority of volume is still moving through the centralized halls of NFT marketplace OpenSea, leaving crypto VCs eager to find new channels.

The raise includes strategic investors such as Carta, Circle Ventures, OpenSea and Uniswap Labs’ new venture arm, as well as institutional funds-of-funds, nonprofits and web3 talent networks.

Sequoia crypto partner Shaun Maguire talked about the firm’s commitment to the sector, regulatory challenges and what plenty of crypto investors still don’t understand.

In the world of crypto, where vast amounts of investment are pouring into young and scrappy teams building uncharted technology, it increasingly the VC firms who are investing heavily in research to sweeten their sell to early teams with plenty of offers on the table. On Thursday, venture firm Andreessen Horowitz announced that it was building out a dedicated crypto research team led by faculty from Columbia and Stanford.

Wayne Chang, co-founder and CEO of Spruce, told journalist that web2 platforms that offer sign-in capabilities have been able to access this data in the past because they offer trust and verification to users of the network. That’s the question Spruce is trying to answer by building a public utility of sorts for internet users, but doing so requires individual users to build trust with one another by voluntarily sharing data through the network when they can’t rely on a centralized intermediary to make assurances.

Vietnamese gaming studio Sky Mavis announced that it has raised $150 million in funding led by crypto exchange Binance to help reimburse users who lost funds during a ~$625 million hack of its play-to-earn game Axie Infinity, which was the largest crypto heist to date.

On Friday, Justin Kan’s crypto gaming marketplace Fractal, which hosts Solana-based NFTs, raised $35 million in a round co-led by Paradigm and Multicoin, with participation from Andreessen Horowitz, Animoca, Coinbase and Solana Labs.

Datanomik’s goal is to connect financial institutions across LatAm through its B2B open finance API, which gathers a company’s banking information on one platform, Strauss told journalist. Now, dLocal and AstroPay co-founder Sergio Fogel has teamed up with AstroPay’s former head of product, Gonzalo Strauss, to launch another fintech out of Montevideo, Uruguay, called Datanomik.

The latest round marks the third time that a16z has put money in Cross River Bank, with the first time being in the company’s first institutional round that closed in October of 2016 — a $28 million financing which ended up closing at $30 million as others added to it.

The ether and USDC deposits on Ronin were drained from the bridge contract, but the network is working with stakeholders from Axie Infinity and its parent company Sky Mavis to determine the best move forward so no user funds are permanently lost, it said.

Vinik’s experience in the hedge fund world has informed Equi’s data-driven approach to investment management and risk assessment; the portfolio team leverages Equi’s in-house technology to help them identify and structure deals with fund managers, Reiss said.

Andreessen Horowitz (a16z) and NFX co-led Latitud’s $11.5 million seed funding round, which also included participation from Endeavor, Canary, FJ Labs, Ganas Ventures and unicorn founders.

The company operates with an asset light model, Rubin said, in that it doesn’t need cash to buy homes and rather uses money from when people are rolling in their equity from their homes. He was drawn to Flock’s ability to allow any landlord to roll their properties into the portfolio it has created, while still providing the former landlord with the same income stream with no immediate tax consequences A startup called Flock Homes wants to give landlords a similar ability to own shares of a portfolio that is made up of multiple properties and it just raised a $26 million Series A funding round toward that effort.

The Miami-based NFT firm behind Bored Apes Yacht Club has not previously raised funding, though the startup has long been courting attention from VCs eager to back a major player in the NFT craze. Yuga Labs, maker of the multimillion dollar monkey JPEGs that plenty of NFT skeptics love to hate, just raised a $450 million round from Andreessen Horowitz.

The $1.5 billion in capital puts Haun Ventures in the company of other crypto native funds like Paradigm and Electric Capital, which have debuted large funds in recent months.

This has pushed some founders to build competing blockchains on entirely unique infrastructure, while others in the developer community are focusing their resources on building modular blockchain solutions that sit on top of Ethereum, bundling transactions faster and cheaper while keeping a record of the movements on the central chain.

Delivery Hero worked within what you might think of as the hat trick of the e-commerce world — its three-sided marketplace comprised independent and larger restaurants, delivery people and millions of consumers ordering food; and, as an added layer of difficulty, all of them were making calls into and out of a payment system in real time, 24 hours a day, across dozens of markets, currencies, preferred payment methods and so on. By that, he means that it isn’t necessarily initially positioning itself as a point-of-sale provider or payment facilitator; it’s built a platform that will make it easier to integrate and work with any of these by way of APIs, to work more easily with a wider variety of third-party businesses (paying money in and taking it out), freelancers (payouts) and consumers (paying in), and with a wider variety of payment methods depending on the locale in question.

With these funds focusing solely on crypto and its surrounding ecosystem and investing more in these startups than traditional fintechs at the moment, why is Luno Expeditions choosing a dual focus on crypto and fintech instead of going head-on with crypto?

The product is for early-stage startups only, with Mercury offering between 25% to 50% of a startup’s equity round in debt.

They started off building a universal e-commerce API for reading and writing data so that tech customers can integrate with commerce platforms and access financial data points to offer loans, launch in new marketplaces and streamline inventory syncing for brand management.

The fund is backed by a who’s who of crypto investors, with LPs including a sizable chunk of a16z’s investing team.

The ability to raise a relatively large seed round so soon after inception speaks to the experience of the company’s founders, which include Juan Pablo Ortega, the co-founder of on-demand delivery unicorn Rappi (which as of last July was valued at $5.25 billion) and Julián Núñez, an early Rappi employee. Yuno wants to bring to Latin American companies an easy online checkout solution that solves the pain point of managing multiple payment methods.

Lido aims to solve both of these issues through its decentralized staking platform that allows users to stake their coins with no minimum investment required. Andreessen Horowitz made the investment in Lido partially using ETH, buying up some of Lido’s governance tokens from other holders, Lomashuk said. Assets staked on Lido are worth over $10 billion USD at today’s prices, and are split across 76,000 individual crypto wallets.

This capital raise pushes the Palo Alto-based fund toward the company of larger firms like Andreessen Horowitz, which closed a $2.2 billion crypto fund this past June, and crypto VC Paradigm, which debuted a $2.5 billion fund in November.

When customers move money to their wallet via credit card, debit card, or ACH transfer, Sardine assigns a risk score to the card or bank account being used through an algorithm and assumes fraud liability for the transaction.

The grant sparked a closely collaborative relationship between Nomic and the Ethereum Foundation that resulted in the latter becoming Nomic’s single funding source before Nomic’s pivot to nonprofit status, Zeoli said.

Though compliance presents an ever-evolving suite of challenges, the most persistent landmine for DAO tooling startups has been helping DAOs educate their users on potential threats — something that will only become more important as crypto startups and DAOs look to entice an increasingly mainstream user base.

While this is easier for customers, it has created headaches for many software, or SaaS, businesses that are not equipped with billing systems that can easily charge customers on a usage basis. Woody agrees, adding that Metronome can help companies that have built a new product that they want to get out into the market as quickly as possible.

Phantom, one of the premier wallet apps for the Solana ecosystem, has seen plenty of momentum as the result of investor and developer attention being paid to the Ethereum competitor which has seen its value explode over the past year — though the relative newcomer is also proving to be a more volatile bet with the token taking a particularly rough hit during the most recent crypto crash.

Today, Yu and Yang’s new company, San Francisco-based Vesta, is announcing it has raised $30 million in Series A financing led by Andreessen Horowitz (a16z) with participation from new investor Zigg Capital.

Syndicate’s suite of smart contracts can walk users through the process of formalizing their club with a legal entity and handling things like setting up a bank account and getting tax forms to ensure stuff stays above-board.

Consider that late last summer, Andreessen Horowitz (a16z) invested in an outfit, Yield Guild Games (YGG), that invests in NFTs from blockchain-based games, then loans them out to people who use them and generate revenue as they play. To ensure that their games offer enough liquidity to keep users engaged, game makers have already proven open to working with third-party outfits like YGG and other so-called play-to-earn guilds that similarly buy NFT gaming assets and lease them to players under revenue-sharing arrangements.

Inventa, a Brazil-based company offering a digital marketplace for small and medium-sized companies to discover and purchase new inventory, raised $20 million in Series A funding.

Autograph, an NFT agency co-founded by athlete Tom Brady with a particularly deep bench of star power, has banked new funding from crypto investors who hope the platform can bring a new generation of celebrities and their fans into the fold of crypto collectibles.

The three-year-old company has signed publishing deals for seven games from six studios globally, including Tilting Point, publisher of Nickelodeon’s SpongeBob: Krusty Cook-Off, which Carry1st recently launched in Africa.

The Bay Area startup wants to take a more blended solution to crypto lending with its protocol, building up capital pools and allowing fintech organizations outside the U.S. to make their case to lenders operating on the protocol and get access to funds while showing non-crypto collateral. Goldfinch is a crypto startup building a decentralized lending protocol that allows organizations to receive crypto loans without owning massive amounts of crypto already.