FinTech news in credit card category

With that more enhanced data, Spade customers, which include card issuers, anti-fraud platforms and neobanks, can do things like implement spending controls and improve fraud prevention models.

It also is not only not a down or a flat round, the cash infusion boosts X1’s valuation by 50%, according to Deepak Rao, co-founder & CEO of X1. X1, a consumer fintech startup which recently launched an income-based credit card to the public, has raised an additional $15 million in funding. Also, notably, X1 latest financing comes just six months after the San Francisco-based company raised $25 million in a July Series B round. The startup’s long list of previous backers include FPV, Craft Ventures, Spark Capital, Harrison Metal, SV Angel, Abstract Ventures, the Chainsmokers, Global Founders Capital, actor Jared Leto, Box co-founder and CEO Aaron Levie, Jeremy Stoppelman, Affirm and PayPal co-founder Max Levchin and Y Combinator Partner Ali Rowghani.

Bilt Rewards, which works with some of the country largest multifamily owners and operators to create loyalty programs and a co-branded credit card for property renters, entered unicorn status after securing $150 million in a growth round led by Left Lane Capital. Members can also calculate how an improvement in credit rating will affect the mortgage interest rate they may qualify for, and should they need or want it, enroll in Bilt’s free rent reporting to help boost their credit history with every on-time rent payment. However, there was a lot of inbound interest in the company, and bringing on institutional investors like Left Lane Capital positioned Bilt to think more long-term, including a possible initial public offering or other future opportunities, for example, acquisitions. Today’s investment raises that to $1.5 billion and gives the company about $213 million in total funding since the company launched in June 2021 out of Kairos, the startup studio led by Bilt founder and CEO Ankur Jain.

Qualifying for a credit card is not easy when you have a poor credit score or none at all, but Los Angeles-based fintech company Arro wants to help consumers grow their credit line while also teaching them why that important. Duitch started the company with Luke Pelullo in 2021 to provide a credit card and credit-building platform that has a proprietary underwriting model that instead of relying on the FICO system, relies on income; for example, earning at least $1,000 a month in income. However, from Arro’s perspective, traditional lenders appeal to their bottom line, which doesn’t involve helping its customers stop the cycle of overspending or going into debt, Ryan Duitch, co-founder and CEO at Arro, told journalist. As the customer progresses through the in-app activities, like learning how to use credit responsibly and creating and meeting budget and savings goals, there are additional rewards like increases in credit line.

The Samsung Axis Bank Credit Card, powered by Visa, is our next big India-specific innovation that will change the way our customers buy Samsung products and spend on services through a series of industry-leading features. The South Korean giant said it has partnered with the Mumbai-headquartered Axis Bank and global payments processor Visa to launch the cards, which it is calling the Samsung Axis Bank Credit Card. Samsung has launched two credit cards in India, entering a crowded category that sees more than 50 companies fiercely compete for consumers’ attention in the world second largest internet market. Indian banks have issued over a billion debit cards to customers in the country, but fewer than 25 million unique individuals in the nation have a credit card, according to industry estimates.

Noble today emerged from stealth and announced the close of a $15 million Series A round led by Insight Partners with participation from Cross River Digital Ventures, Plug & Play Ventures, Y Combinator, Flexport Fund, TLV Partners, Operator Partners, Verissimo Ventures, Interplay Ventures and the George Kaiser Family Foundation.

Power’s first product is the credit card issuance program, which is designed for companies, brands and banks to offer embeddable fintech experiences, like customized credit card programs, targeted promotions and personalized rewards, into existing mobile and web applications. Power, a fintech infrastructure startup, is now kicking off its full-stack credit card issuance platform after a year in stealth mode and with $16.1 million in seed funding and $300 million in a credit facility.

X1 Card is taking a different tack by underwriting customers based on their income rather than their credit scores, which the company says enables it to set credit limits up to 5x higher than traditional card providers.

Co-founders Roberto Enrique Kafati Santos and Jose Maria Serrano started the company after a career at McKinsey leading digital payments for Kafati Santos and at delivery company JOKR for Serrano.

While banks use rigorous credit policies and don’t care much about small businesses, particularly those without any local credit history or track record, informal lenders act as loan sharks to the detriment of these businesses.

Eventually, Kasheesh plans to develop its technology so users can use the same card across multiple transactions rather than having to generate a new single-use card each time, Miller said.

all had track records of working in digital businesses where they saw, not just for themselves but their customers, an opportunity to build a bank that took all of that into account (so to speak) and built a financial management service that fit those dynamics.

That where Constrafor comes in: as a SaaS construction procurement platform with embedded financing, it streamlines information and documentation for how general contractors work with subcontractors, while its Early Pay Program assumes the risk for the subcontractor invoice, freeing up cash flow and reliance on traditional and costly lending options.

The company doesn’t just look at top-line sales, which Youngstrom believes differentiates his company from competitors but takes in historical sales data to build a sales forecast.

Parents must opt into the automatic investment feature, and if they don’t want their funds invested in the ETFs Greenlight pre-determines are relatively safe, they can also choose to invest that cash in other ways through Greenlight investment app or opt for the cash to go directly to their bank account, Sheehan said. The Greenlight-branded card, offered through Mastercard, offers up to 3% unlimited cash back on all purchases and gives parents the option to automatically invest those cash rewards in stocks and ETFs to spend on family-related expenses, co-founder and CEO Tim Sheehan told journalist. Sheehan said the company considered designing the card so cash back accrued into a 529 plan, a tax-advantaged educational savings account parents can open on behalf of their children. Plenty of investment platforms, including Bank of America, Fidelity and Charles Schwab, offer credit cards that automatically invest cash rewards into the market, but Greenlight hopes its focus on families and their needs will help it stand out.

In addition to building the card product, Sample intends to use the new funding to acquire its first customers for the loans and card businesses — the majority of its customers are using the grant matching product — and onboarding new employees.

Kard manages the relationships with each business looking to offer rewards to promote their brand, making it easy for a new issuer to mix-and-match from Kard’s offerings and integrate those rewards into the issuer’s own user interface, CEO and founder Ben Mackinnon told journalist in an interview. Kard‘s rewards-as-a-service API streamlines the process for card issuers, allowing them to create a customized rewards program tailored to their particular customer base by choosing from Kard set of merchant partnerships.

The credit card is one of two options — the second via the mobile app — consumers can use to access CredPal’s BNPL services when they visit a partner store to shop for items ranging from electronics, particularly smartphones, to furniture and groceries. To that effect, CredPal, one of the earliest pioneers of buy now, pay later in Nigeria, has closed a bridge round of $15 million in equity and debt — the latter constituting a very large chunk of the financing — to expand its consumer credit offerings across Africa.

After hearing from clients that they want to tap into the capital markets, but find it challenging to rely on banks and credit cards, Rodriguez says the second step of Finally is to unlock a credit opportunity. In 2018, after a career as a network engineer, Rodriguez and his wife, Glennys Rodriguez, began helping small and mid-sized businesses manage their finances, and after joining with Edwin Mejia, founded Finally.

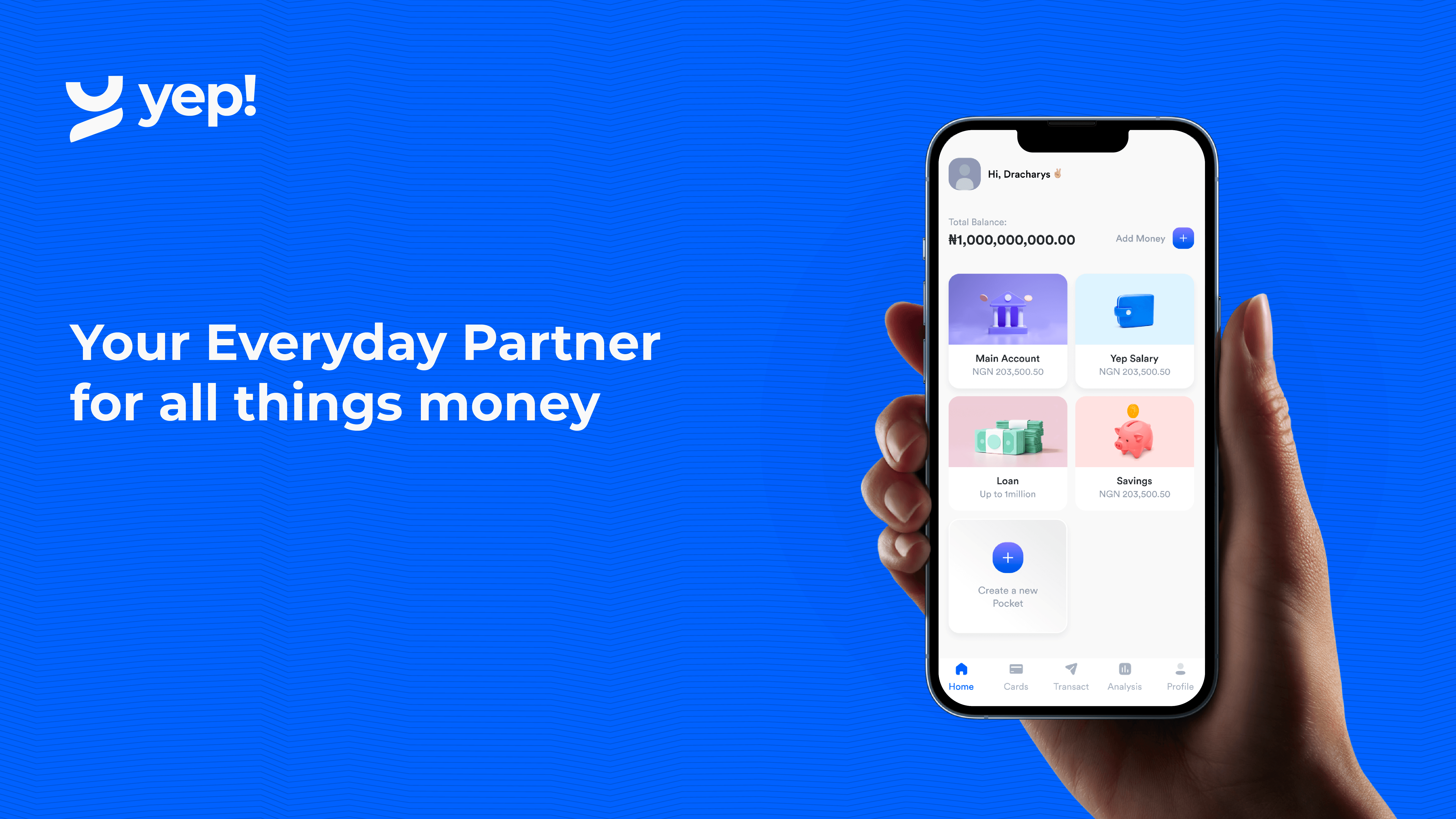

What gives Yep! an edge, according to its founders, is a superior experience in raising debt capital for lending purposes — a practice where agency banking providers supply working capital to their agents who in turn lend to their end consumers.

French startup Sunday, which didn’t even exist in 2020, has raised large sums to allow people to easily pay and share the bill, freeing up wait staff and increasing turnover in restaurants. The payment solution for consumers in restaurants has now raised $17 million in seed financing in a round co-led by Berlin Cherry Ventures and Point Nine Capital of Germany. The benefits for restaurants include a higher potential turnover of tables, more possibility of tips for wait staff and returning customers who enjoy the simple experience. The founding team of Qlub consists of Arun Sharma, Eyad Alkassar, Filiberto Pavan, Gizem Bodur, Jeff Matsuda, Jianggan Li, John Mady, Mahmoud Fouz, Oscar Bedoya and Ramy Omar.

Unlike most developed countries, the West African nation lacks an advanced credit bureau system to detail people’s credit histories, so there’s some scepticism to how Fintech Farm will use credit cards to operate.

Accrue Savings, founded in June 2021 by CEO Michael Hershfield, aims to get people saving again with its merchant-embedded shopping experience that rewards consumers for saving up for the things they want to buy.

A majority of Petal members had thin or no credit history when they first applied for a Petal card, and more than 40% of new members approved for a Petal card in 2021 were first denied credit by a major bank, the company said.