FinTech news in Bank category

Some venture investors have also shown appetite to invest in banks in recent months – Accel and Quona recently backed Shivalik Small Finance Bank, for instance – but a growing number of other banks including RBL and Federal Bank have employed a similar strategy as SBM and courted many startups in the past two years. The Indian arm of SBM Bank, one of the banks that has aggressively worked with fintech startups in the South Asian market, is engaging with investors to raise capital and pitching the vision of becoming one of the top banking-as-a-service providers in the country, according to a source familiar with the matter. The firm sees its deep partnerships with fintech startups such as Bengaluru-headquartered fintechs Razorpay and Slice as a key growth pillar, according to an investor presentation seen by journalist. The bank has actively courted fintech startups as customers, offering them co-branded cards and powering their neobanks, as it sought to differentiate itself from the large competitors that for years avoided engaging with the younger firms.

Its customers are asset managers looking to offer these alternative investment opportunities to their private wealth clients, who tend to be high-net-worth individuals that meet regulatory accreditation requirements applied to many alternative assets, Advani explained. Advani started Allocations in 2019 as a response to challenges he faced in trying to set up his own investment funds and realizing that none of the tools available to him at the time could help him spin up funds quickly enough to stay competitive in the increasingly fast-paced private markets. Less than three years after its founding, the company, which provides APIs to help private fund managers streamline processes, has crossed $1 billion in assets under administration on its platform, its CEO and founder Kingsley Advani told journalist in an interview. Taking a page from KKR’s book, Advani said Allocations is in the early stages of exploring a blockchain offering as he thinks the technology can help meaningfully streamline fund administration.

Earlier this year, Majority announced that users can register for an account without needing a social security number or U.S. documentation, and instead use an international government-issued ID and proof of U.S. residence — a move the startup says could make its services more accessible. The fintech announced today that it has raised a $37.5 million Series B, $30 million of which is in equity financing led by Valar Ventures and other existing investors, and the remaining $7.5 million in debt financing from an undisclosed U.S.-based commercial bank. Nine months after raising a Series A round, Majority has raised tens of millions in both equity and debt financing for its mobile bank for migrants. Creating physical spaces has helped the Majority gain trust with consumers, Larsson explained, showing that the company won’t just show up, handle money and disappear in a few weeks due to the volatility of startups.

Following the company’s seed round, Adrián Yanes joined as chief technology officer and Sarita Bhatt as chief marketing officer to help Boopos scale to Series B and beyond, Garcia Braschi said. Six months after announcing $30 million in equity and debt, Boopos, a Miami-based lending platform for business acquisitions and growth, is back with an even bigger round, a $58 million Series A, again in a mix of equity and debt. Garcia Braschi started the company in 2020 to cater to business owners, mainly company aggregators, leveraging acquisitions as a way to grow their companies. Though Garcia Braschi was not specific, he did say the company’s valuation is approximately double following this round than the previous seed round.

Solid, which rebranded from Wise in 2021, raised a $63 million Series B round of funding to continue providing its fintech-as-a-service offering for companies wanting to launch and scale their own fintech products.

The investment, which was shelled out equally by the parent firm Animoca Brands and MUFG Bank, the largest bank in Japan with 360 years of history, comes at a time when the country is tightening regulations around the crypto industry. Asia crypto games and web3 investment powerhouse Animoca Brands is making inroads into Japan as its local unit picks up $45 million in financing at a $500 million pre-money valuation. Line’s 90 million users in Japan can now store their NFTs in their Line-powered digital asset wallet and trade NFTs with friends. MUFG, which was formed from a merger between Bank of Tokyo-Mitsubishi and UFJ Bank, isn’t the only financial group in Japan to have embraced NFTs.

It’s now teaming up with fintech unicorn Revolut to allow users to donate directly to homeless people through the Revolut app, making it the first U.K. homelessness organization added to the Revolut Donations feature. Revolut users will now be able to donate to Beam, help homeless people raise funds for training, work tools, travel costs, childcare or rental deposits, directly through the app. Beam says it has since raised £3.2 million from members of the public and supported more than 850 homeless people into stable jobs and homes by matching them with ethically-checked landlords and employers. Funds donated to Beam through Revolut Donations are distributed equally between Beam’s beneficiaries.

By focusing on e-commerce, Shergill said Highbeam is able to provide a single financial view of the business, where cash is coming in and going out, and help entrepreneurs decide the right credit option and offer insights on common situations. Highbeam, a New York-based neobank built for people building e-commerce brands on marketplaces like Shopify and Amazon, raised $7 million in seed funding to continue developing banking tools that cater to these entrepreneurs’ needs. The one-year-old fintech startup, started by Samir Shergill and Gautam Gupta, provides banking features, access to transparent credit and cash management insights. Sustainable profit growth has become more important for brands, especially when e-commerce growth exploded during the pandemic and has pulled back some as stores reopened, Shergill said.

Nomad, a token bridge that allows users to send and receive tokens between Avalanche (AVAX), Ethereum (ETH), Evmos (EVMOS), Moonbeam (GLMR) and Milkomeda C1 blockchains, was attacked on Monday, with hackers draining almost all of the protocol’s funds. This meant that when a user transferred funds from one blockchain to another, Nomad allegedly never checked the amount, enabling the user to withdraw funds that didn’t belong to them. Approximately $190.7 million in crypto was stolen from the bridge, according to decentralized finance tracking platform DeFi Llama, which shows that the current total value locked — the amount of user funds deposited in a DeFi protocol — is less than $12,000 at the time of writing. The attack comes just days after Nomad revealed that a number of high-profile crypto investors, including Coinbase Ventures, OpenSea, Polygon and Crypto.com Capital, had participated in its $22 million April seed round, which landed the company a $225 million valuation.

Opening a business bank account should be fairly easy, but after seeing firsthand just how hard it was, Salomon Zarruk and Sebastian Ortiz decided they didn’t want another Latin American business to run into the same kind of difficulty.

While Binance.US says it’s not a subsidiary or affiliate of Binance itself, the company launched as a legal independent entity in 2019 and is tied to Binance through its founder, Changpeng Zhao, as well as through its licensing agreements with Binance that cover its core technology and naming rights.

Backbase — an Amsterdam-based startup that provides a platform that banks and others can use to better structure and leverage the data that they have, and to then use that to build more personalization and other new features into those banks’ customer-facing services — has raised €120 million ($128 million at today rates).

all had track records of working in digital businesses where they saw, not just for themselves but their customers, an opportunity to build a bank that took all of that into account (so to speak) and built a financial management service that fit those dynamics.

Like other European fintech players like open banking specialists Tink and Truelayer, as well as others in the embedded finance space like 10x and Thought Machine — both of which have raised healthy amounts of funding also from investors that include large financial incumbents.

Pebble’s 5% cash back is higher than what traditional credit cards tend to offer because traditional credit card providers rely on middlemen like Visa and Mastercard as well as fraud protection services and other third parties to process their transactions, leaving less in reward cash for the customer, Bai explained.

Tel Aviv-based Classiq, a startup that wants to make it easier for developers to build quantum algorithms and applications, today announced that it has raised additional funding for its service.

Robinhood brokerage cash sweep program used to offer an interest rate of 0.5% to customers that were enrolled for its Cash Management feature, according to the company. 1% APY (annual percentage yield) may not sound like a particularly sexy return.

Terraform Labs, the organization behind UST, cryptocurrency Luna and Luna Foundation Guard, emptied its treasury wallet of all of its bitcoin, about 42,530 bitcoin, or $1.3 billion, on Monday.

Mentum is out to change that in Latin America, and is working on customizable investment APIs and widgets so businesses in Latin America can build and offer fully digital investment products, like local mutual funds, ETFs and stocks, to their customers. All of them came to the U.S. from Latin America to study and work, and in the course of using some of the investment apps offered in the U.S., they struggled to find similar products in Latin America that provided a way to fully invest.

The margins might be thin on any digital payment — one reason why even a company that looks like it’s growing and doing a lot of business might still fail: The numbers need to be huge to work out in its profitable favor — but this is why so many payments companies work on vast scale, and why building in a number of extra valued-added services in hopes of them getting picked up by customers (and customers’ customers), as Stripe is doing here, is smart business, one way that it hopes to sustain itself for the long (and likely public) haul. Stripe has been making a number of acquisitions to bring in extra functionality into its platform to close up some of the gaps — for example almost exactly a year ago it acquired TaxJar to help automatically calculate sales tax and provide related tools to its customers — but it looks like Financial Connections was built in-house, but powered by MX and Finicity (as pointed out by Mary Ann here). Stripe’s selling point for these tools, beyond a more seamless integration with its other products, is that it helps its customers make more transactions. Details like these can in turn be used to help underwrite risk for loans; to track spending patterns and automatically pay bills; and more — in other words, financial data that’s useful or necessary to run financial transactions over other Stripe services like Stripe Connect, ACH payments or Stripe Capital-powered loans. Just yesterday, I wrote about an interesting startup called Kevin (okay, kevin.) that’s building a whole new set of payment rails and APIs for account-to-account payments that link straight into bank accounts, bypassing card rails and legacy account-to-account payment methods that are harder to implement.

As long as the shares have been fully paid for by the customer, Robinhood says it will match customers with interested borrowers to take the loans and that customers will get paid once their shares are successfully placed.

In addition to building the card product, Sample intends to use the new funding to acquire its first customers for the loans and card businesses — the majority of its customers are using the grant matching product — and onboarding new employees.

Now, Cogni has raised a $23 million funding round led by Hanwha Asset Management and CaplinFO with a new mandate — bringing web2 and web3 services together on one platform, Ravishankar said.

A developer-focused bank Column emerges from stealth today to — if Hockey’s pronouncements are to be believed — turn the fintech industry on its head. By contrast, Column, a nationally chartered bank with a direct connection to the Fed, has an in-house ledger and data model to power various fintech services.

In 2021, Gandhi started Creative Juice alongside Ezra Cooperstein, the president of Night, a management company representing top digital creators like makeup maven Safiya Nygaard, underwater treasure hunter DALLMYD and stunt YouTuber MrBeast, who also sits on the Creative Juice cap table.

Founded in 2007 by Perez and Oscar Garcia Mendoza, who now serves as chairman of Novopayment’s board, NovoPayment had been bootstrapped since inception until it raised its Series A round earlier this year, the company announced today. Novopayment has been focused since its founding on building out a tech stack that ties all the critical processes together for financial institutions to build out their digital banking services.

Union54 can reach an agreement with participating central banks and issue its own domestic and continental debit card, it can shorten settlement time and integrate more local payments native to the region. Mlambo also added that through his and a few colleagues’ work via the African Renaissance Conference, Union54 has gotten in touch with three central banks keen to explore how settlement agreements would work with a new card scheme.

The idea with Wagestream is not just to give those workers faster liquidity when they need it, but to give them the ability to use that money in different ways — for example with features to invest small amounts into stocks, and to bring in controls to save money incrementally in a way that makes the most practical sense for those users.

Ghost Financial is developing API integrations with point-of-sale systems, like Toast, and delivery apps, like DoorDash, so it can pull metrics that represent areas including operational health and efficiency, hourly and daily sales, average food preparation ties, ratings and reviews to determine credit limit and provide an instant loan decision. After operating his own ghost kitchen, Keto Kitchen, in Austin for the past year, serial entrepreneur John Meyer saw that fintech resources for the industry were lacking.

Hayes stepped down from his prior role as CEO of BitMEX in October 2020, though sources told The Block that he played a role in the layoffs, in part through his support of BitMEX pivoting away from its core focus on derivatives.

Of course, Robinhood also warned of risks in extended-hours trading, but noted the additional hours would give customers the ability to trade based on quarterly earnings announcements made after the market closes, as well as based on activity taking place in foreign markets.

Digits itself is not a data ingestion tool: Chang notes that it essentially sits on top of Intuit’s Quickbooks (note: that choice was deliberate because Quickbooks accounts for about 80% of the small business accounting software market in the U.S. today, although over time Digits will work with other sources as demand dictates it).

Capital markets focus on giant sums of money handled through foreign exchange, equity swaps and other major capital transactions typical of big banks, but at the end of the day, a lot of the systems in place that big banks use to make these transactions are based on old infrastructure, with money moving through many transaction points that can create delays and, therefore, costs. Canapi Ventures, 9Yards Capital, and SVB Capital led the round.

After hearing from clients that they want to tap into the capital markets, but find it challenging to rely on banks and credit cards, Rodriguez says the second step of Finally is to unlock a credit opportunity. In 2018, after a career as a network engineer, Rodriguez and his wife, Glennys Rodriguez, began helping small and mid-sized businesses manage their finances, and after joining with Edwin Mejia, founded Finally.

Originally founded by Nick Ogden, who was also the founder of WorldPay (which Fidelity acquired for $43 billion, which was at the time the biggest deal ever made in international payments sector), ClearBank currently has 200 customers — large financial institutions and fintechs using its infrastructure to enable faster transactions — with the list including UK businesses like Tide and Oaknorth, but also international companies like Coinbase, which uses ClearBank for clearing and payments services for its UK customers.

But while that seems to foreshadow that Lunar definitely has ambitions to move beyond its Nordic shores (with a name and stratospheric association to match that), the startup is actually still focused on building out services that ferret out what the incumbents are still not providing, to build those services into the Lunar platform, not least because he points out that Nordic consumers and businesses are some of the most lucrative not just in Europe but the world in terms of the value-added services they take, the money they transact with and so on.

The press release lays out seven major goals of the executive order with added detail: Protect U.S. Consumers, Investors, and Businesses Protect U.S. and Global Financial Stability and Mitigate Systemic Risk Mitigate the Illicit Finance and National Security Risks Posed by the Illicit Use of Digital Assets Promote U.S. Leadership in Technology and Economic Competitiveness to Reinforce U.S. Leadership in the Global Financial System Promote Equitable Access to Safe and Affordable Financial Services Support Technological Advances and Ensure Responsible Development and Use of Digital Assets Explore a U.S. Central Bank Digital Currency (CBDC) For those in the crypto sector concerned about aggressive government intervention, the order language seems to signal that the Biden White House is uninterested in sweeping near-term reforms and is instead merely focused on ensuring that agencies are on the same page in researching and observing the national security implications of the crypto industry.

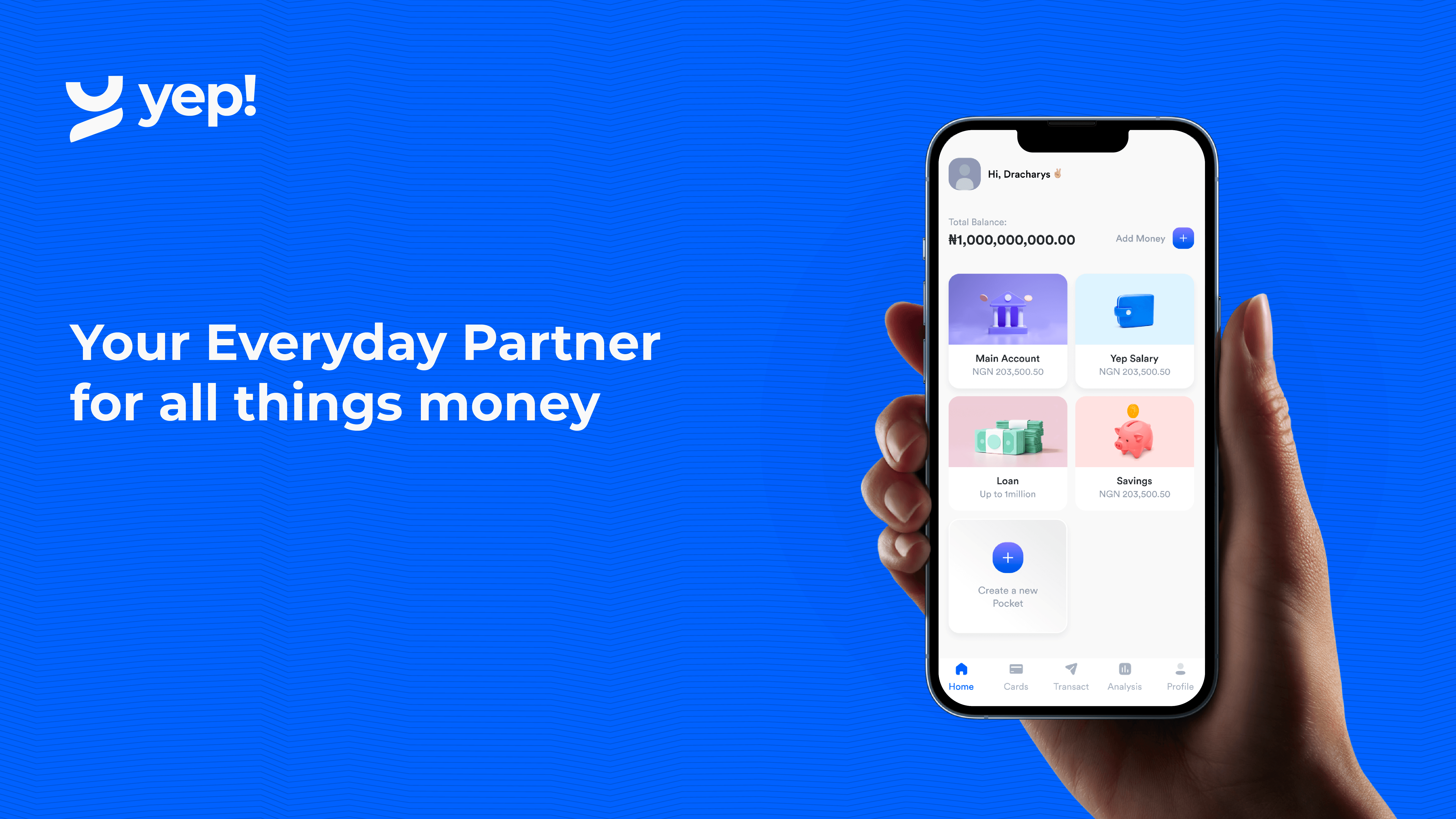

What gives Yep! an edge, according to its founders, is a superior experience in raising debt capital for lending purposes — a practice where agency banking providers supply working capital to their agents who in turn lend to their end consumers.

Upon carefully studying different models pioneered by digital-first banks such as TymeBank, Kuda and FairMoney, they saw a big gap for building a savings product that helps solve what they think is the biggest problem facing African consumers: inflation and currency devaluation.

MD Olly Thornton-Berry said that he and Jack Bidgood first came upon the idea for Thirdfort after a friend of theirs lost £25,000 while buying a flat in London due to a phishing attack: fraudsters had picked up some data about the deal, and created a domain similar to that of the legal firm the friend was using for the purchase, and with that wrote an email impersonating the friend’s lawyer, asking for the sum to be transferred via a link.

So, users from different countries — Ghana, Nigeria and Kenya, for now — can connect their bank or mobile money accounts to Dash, pay bills, and send and receive money to other users while the platform handles currency conversions.

Shop owners who intend to offer loans to their end consumers get higher credit lines from Chari, which shares the data collated from Karny (on end consumers’ purchasing behaviour) with FMCG companies that pay for the cost of the higher loans.

Two years later, after the platform did not make enough revenue from developers, the team chose to go vertical to what it is today, Stax, a universal money app on USSD rails for African users. The company, founded by Ben Lyon, Jess Shorland and David Kutalek, fetches all these codes from multiple accounts together into an app users can access offline, letting them perform transactions without dialling any USSD code.

Say a company uses Sudo Africa to issue cards for employee expense management; what happens is that employees are given cards with a low balance so whenever they need to use the card, an API is called each time to decide whether to approve or deny that transaction in real time.

The story begins years ago when Root wanted to build new kinds of banking services. Co-founder and CEO Nick Root is a computer science graduate and former CTO, COO, CFO and CEO who did 12 years in the London banking industry before starting Intergiro.

Ayorinde said CrowdForce will use the funding to distribute more point of sale terminals to its partners in the next 12 to 18 months as the company, in a statement, said it aims to bring financial services within one kilometer, or within 15 minutes, of all Nigerians.

The approach is a relatively new one in the U.K., although Fenwick believes that this will likely (and rapidly) evolve not just because HELOC businesses like Selina’s are being given the green light, but because of the ubiquity of home ownership; and the fact that more people, as they move around less due to the pandemic, have turned their attention to spending bigger amounts on things like home renovations or less-frequent but much bigger vacations.

Human rights activist and Mos founder Amira Yahyaoui couldn’t afford to go to college, so when she first launched a platform to connect students to scholarships, the innovation felt full circle. It an evolution from Mos as an edtech business built to help students navigate their way through applying and attending college into a fintech that can support the same user base through all of life’s similarly complicated demands.

To underscore the demand for solutions to address this, today a startup called Wayflyer — which has built a new kind of financing platform, using big data analytics and repayments based on a merchant revenue activity — is announcing a big round of funding, $150 million. In terms of competitors, the size of the loans it typically makes, and the frequency — depending on the nature and size of the customer, loans could be made as frequently as monthly — has partly meant that Wayflyer doesn’t compete against, but complements, some of the other companies that have emerged as financiers to e-commerce businesses. E-commerce has continued to boom in the wake of the COVID-19 pandemic, but running an e-commerce business has also become significantly more chaotic, with unpredictable supply chains, logistics hiccups and overall higher costs upending even the best-laid plans. The company’s technology is a classic big-data play: It uses a number of sources of data, from Shopify and Woo Commerce through to TrustPilot reviews and Google Analytics and even wider information about how shipping services are performing, to determine how a merchant is doing as a business.

Given that it’s not a big leap between financial services and fintech — indeed, in cities like London which have strong industries in tech and financial services, the two have long competed heavily to recruit technical talent — it’s surprising that we haven’t seen more banks trying to built personalization in house rather than look to a third-party provider like Personetics.

Routefusion cofounders Colton Seal and Richard Scappaticci attempted to launch a neobank in 2016, but they ran into significant hurdles when trying to integrate with banks to help their customers move money to other countries.

Finclusion Group, a fintech that uses AI algorithms to provide financial services to African customers via an array of credit-centric products, has raised $20 million in debt and equity pre-Series A financing.

Pinwheel is also the only company providing direct deposit switching and payroll data that is classified as a Consumer Reporting Agency (CRA) in compliance with the Fair Credit Reporting Act, meaning that if consumers are adversely affected by Pinwheel’s data, the company would be legally accountable.

Conduit aims to be a one-stop shop for neobanks and financial institutions to plug their own products into the DeFi ecosystem, which Gertman said is made easier because Conduit itself is regulated and compliant, taking the compliance burden off of companies using its tools.

This, in fact, can also potentially provide a steer to Novo on what might be most popular and potentially worth considering as in-house products in the future, but for now it serves another couple of key purposes: it makes Novo more useful for its customers, and it provides more data sources to Novo to build future products.