FinTech news in banking-as-a-service category

As part of the latest funding announcement Synctera said is also announcing that it is partnering with the National Bank of Canada to help companies launch fintech apps and embedded banking products in the country.

The company plans to use its new capital to continue building out its new integrated partner marketplace (similar to what Synctera is doing) and multi-bank network — which is currently made up of 16 banks — as well as develop new products and services, including lending options. Treasury Prime co-founder and CEO Chris Dean believes that the best outcomes for consumers will result from traditional banks and fintechs working together. Over time, it has expanded its offering and today says it gives businesses of all sizes a way to integrate with banks so they can offer new services, lower the cost of deposits and ultimately generate more revenue. San Francisco-based Treasury Prime, which has raised about $73 million since its 2017 inception, started out by building software tooling that helps banks automate and accelerate routine tasks.

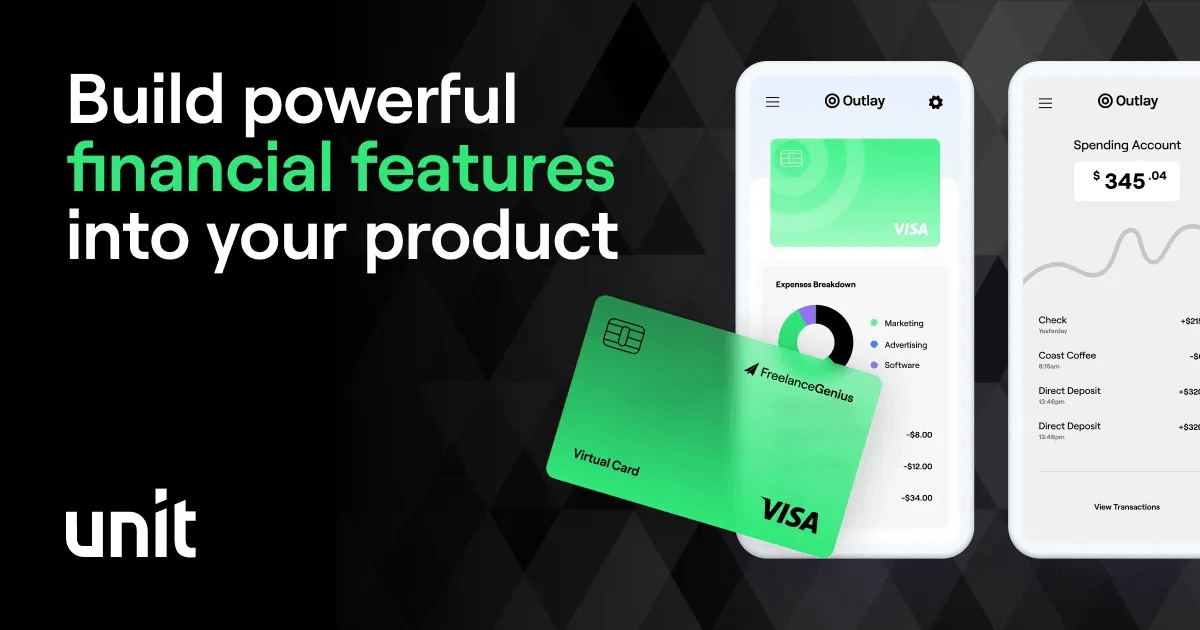

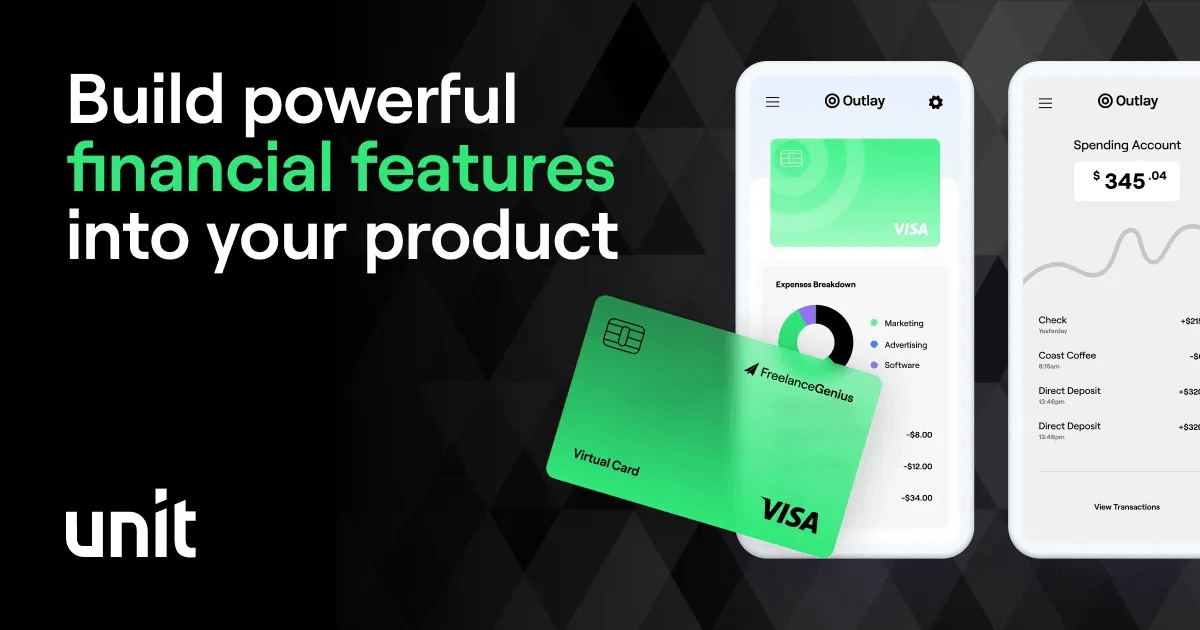

Customers can offer their customers a charge card, credit card, revolving loan or any other credit products that Unit’s bank partners offer. Charge cards, which are more popular than credit cards for small businesses, give Unit a way to enable customers to build and offer lending products, even though the startup is not a lender itself. Unit claims that a card swipe transaction will yield 0.5% more interchange revenue when done with a credit card compared to a debit card. The company gives companies a way to embed financial services into their product — and after already launching debit cards, Unit is officially breaking into the charge card game.

The fintech, recently selected to participate in the Mastercard Start Path Global program for seed, Series A and later-stage startups, also wants to introduce new products to enhance its existing consumer banking, agency banking and merchant payment solutions and expand into African countries that fintechs from Nigeria rarely move to: Angola and Liberia. According to Berry, NowNow wants to set itself apart from the competition with the development of NFC-enabled tech that will allow tap-in functionality within its ecosystem of products, where users can use virtual or physical cards against an NFC-enabled phone or POS and tap from wallet to wallet using two phones. NowNow claims to have built an end-to-end ecosystem of financial products catering to agents, individual consumers and small businesses. When CEO Sahir Berry and his co-founder Mahesh Nair founded NowNow in 2016, they wanted to provide solutions to financial inclusion and job creation, two of the most significant pain points they thought were facing Nigeria and the rest of the continent.

Anchor claims to be transacting several millions of dollars while growing 200% month-on-month. After testing these features with a select few, Anchor is coming out of stealth with a $1 million+ pre-seed and making its platform public.

In other words, Unit touts that companies using its technology in a variety of industries — such as freelance or creator economy and personal financial management, for example — can build financial products directly into their software.

In 2014, Riverwood Capital and Antonio Soares — who now serves as Dock’s CEO — bought out 100% of Conductor and essentially created the company that is Dock today. The company’s client base includes fintechs, retailers, banks and technology companies that are focused on not only improving the customer experience for the currently banked population, but also on helping bring previously unbanked and underbanked consumers into the digital payments and banking systems.

Founded in 2007 by Perez and Oscar Garcia Mendoza, who now serves as chairman of Novopayment’s board, NovoPayment had been bootstrapped since inception until it raised its Series A round earlier this year, the company announced today. Novopayment has been focused since its founding on building out a tech stack that ties all the critical processes together for financial institutions to build out their digital banking services.