FinTech news in Banking category

Perhaps persuaded by Slash’s 20,000-person-strong customer base, NEA, Menlo Ventures, Connect Ventures, Y Combinator, Soma Capital, Global Founders Capital and angel investors poured $19 million into Slash’s Series A and seed rounds.

All in all, the market madness has seemingly created a bullish sentiment in the crypto economy; as traders responded positively to the news, the overall market cap rose on the week and crypto app downloads increased.

The vulnerability in Fortra’s GoAnywhere file-transfer software came to light on February 2 after security journalist Brian Krebs publicly shared details of Fortra’s security advisory because the tech company had put the advisory behind a login prompt.

Highbeam, a startup that provides banking features, credit and cash flow insights to e-commerce customers, today announced that it raised $10 million in debt from TriplePoint as it looks to expand the reach of its digital product portfolio.

Into this fray has stepped Bling, a startup founded by a 20-year-old, that offers a finance platform aimed specifically at families, which is designed so that parents can do financial planning for their children, from pocket money to first investments. It now raised a €3.5M Seed round of financing from Peak (based out of Amsterdam); La Famiglia ; angels such as Lea-Sophie Cramer, Verena Pausder, Felix Haas (co-founder IDnow), Jakob Schreyer (Co-Founder Orderbird), former ING-Diba CEO Ben Tellings, football world cup winner Andre Schürrle, family ‘influencer’ Carmen Kroll, Angel Invest and Prediction Capital . Prior to Bling, Feigenwinter founded three other companies in the youth segment, including Switzerland’s largest student magazine, family merchandise and licensing house, as well as a consultancy agency specialized in young adult topics, leading him to be described as the ‘fintech wunderkind’ by German media. After that, family members and the community join Bling via links, thus contributing to savings pots and investment plans, managing household spending and prepping for critical financial events.

U.K. fintech GoHenry is announcing $55 million in funding to double down on the opportunity. This also played out, interestingly, among young people, GoHenry said, with the company seeing a surge of new users during the pandemic and an increased rate of activity among existing customers.

Red River West led Jiko’s Series B financing, which also included participation from Trousdale Ventures, Owen Van Natta, Temaris & Associates, La Maison Partners, BPI France, Airbus Ventures, Anthem Ventures, Upfront Ventures and Radicle Impact.

However, according to Revolut breach disclosure to the authorities in Lithuania, first spotted by Bleeping Computer, the company says 50,150 customers are impacted by the breach, including 20,687 customers in the European Economic Area and 379 Lithuanian citizens. Fintech startup Revolut has confirmed it was hit by a highly targeted cyberattack that allowed hackers to access the personal details of tens of thousands of customers. However, the breach disclosure states that hackers likely accessed partial card payment data, along with customers’ names, addresses, email addresses, and phone numbers. But Revolut warned that the breach appears to have triggered a phishing campaign, and urged customers to be careful when receiving any communication regarding the breach.

Banks and card issuers typically use fraud detection algorithms for crypto that aren’t nearly granular enough, Ranjan said, meaning around half of the customers who attempt to transact using fiat-to-crypto onramps through traditional platforms are declined as fraudulent.

It is a digital wallet and password manager for financial services and banking apps, but Soffio calls it a financial digital passport, which helps with user identification, making the task less cumbersome for both consumers and financial services. Soffio said Portabl chose Harlem Capital to lead the round after a call he’ll never forget: Yenkalov, a Ukrainian citizen, was trapped in the country as the war with Russia broke out in the middle of a fundraising call with the firm. Yenkalov noted the emergence of decentralized identifiers, verifiable credentials and zero-knowledge proofs, saying that the industry is closer than ever to enabling financial organizations to benefit from consumers owning and sharing their own data.

Allocations just got valued at $150M to help private equity funds lure smaller investors Payall lands $10M in a16z-led seed round to help banks facilitate more cross-border payments Lease-to-own fintech startup Kafene raises $18M to battle BNPL Southeast Asian fintech Fazz raises $100M Series C to serve businesses of all sizes Nigerian financial management app for merchants Kippa bags $8.4M in new funding Composer raises $6M for automated investing platform Redfin CEO, DoorDash co-founder invest in new startup, Far Homes, which is building a portal for Mexico real estate German software firm Candis raises $16M to expand AP automation Splitit drives installments-as-a-service growth with a $10.5M funding PortX launched as new entity by ModusBox and secures $10M in new funding Adyen announced on September 15 that it has become the first fintech to partner with Cash App (Block) to offer Cash App Pay, a mobile payment method, to its U.S. customers. In 2020, digital bank Varo became the first-ever all-digital nationally chartered U.S. consumer bank — meaning it received approval from the Office of the Comptroller of the Currency to become an actual bank, as opposed to partnering with one as most digital banks do.

When DolarApp founders Zach Garman, Álvaro Correa and Fernando Terrés were living in the United States and Europe, they would spend time in Latin America, where they saw problems that friends were having when it came to finances and access to banking in dollars.

Power’s first product is the credit card issuance program, which is designed for companies, brands and banks to offer embeddable fintech experiences, like customized credit card programs, targeted promotions and personalized rewards, into existing mobile and web applications. Power, a fintech infrastructure startup, is now kicking off its full-stack credit card issuance platform after a year in stealth mode and with $16.1 million in seed funding and $300 million in a credit facility.

Northzone raised half a billion round in Europe, while LatAm VCs raising their biggest funds yet

Solid, which rebranded from Wise in 2021, raised a $63 million Series B round of funding to continue providing its fintech-as-a-service offering for companies wanting to launch and scale their own fintech products.

Anchor claims to be transacting several millions of dollars while growing 200% month-on-month. After testing these features with a select few, Anchor is coming out of stealth with a $1 million+ pre-seed and making its platform public.

Enter Deposits, a Dallas-based finance startup offering a cloud-based, plug-and-play feature to simplify the implementation of digital banking tools for companies like credit unions, community banks, insurers, retailers and brands.

By focusing on e-commerce, Shergill said Highbeam is able to provide a single financial view of the business, where cash is coming in and going out, and help entrepreneurs decide the right credit option and offer insights on common situations. Highbeam, a New York-based neobank built for people building e-commerce brands on marketplaces like Shopify and Amazon, raised $7 million in seed funding to continue developing banking tools that cater to these entrepreneurs’ needs. The one-year-old fintech startup, started by Samir Shergill and Gautam Gupta, provides banking features, access to transparent credit and cash management insights. Sustainable profit growth has become more important for brands, especially when e-commerce growth exploded during the pandemic and has pulled back some as stores reopened, Shergill said.

Sanchez argues that Savana has an advantage in its experience building digital systems for banks and financial institutions. One fintech that competes almost directly with Savana is London-based 10x Future Technologies, which helps larger, established banks build both next-generation services and tools to help their older services work more efficiently.

Founded last year by Kelly Ifill, the company aims to narrow the racial wealth gap by providing financial services to Black small businesses and creators. As a result, Ifill hopes Guava will help Black entrepreneurs receive access to the financial support needed to weather every kind of financial storm, especially as another recession looms. And yet, Black founders receive less than 2% of all venture capital funding, and only 3% of Black women run mature businesses. At the same time, Bloomberg reported that Black founders — Black women specifically — were the fastest growing cohort of entrepreneurs.

Digital collectible platforms, according to the proposal issued by Tencent, Ant Group, and others, should hold relevant regulatory permits, ensure the security of underlying blockchain technologies, enforce user real-identity checks, step up intellectual property protection, resolutely ban financial speculations, and promote rational consumption among users.

Opening a business bank account should be fairly easy, but after seeing firsthand just how hard it was, Salomon Zarruk and Sebastian Ortiz decided they didn’t want another Latin American business to run into the same kind of difficulty.

Narmi offers products including digital account opening, business digital account opening, consumer digital banking, business digital banking, and an administrator console. While New York, New York-based Narmi isn’t a bank, it provides mobile, online, and digital account banking to regional and community financial institutions.

While much of the deep, fundamental research and infrastructure development in the blockchain space still takes place in the US, Southeast Asia is ideal for web3 startups offering consumer-facing services, said Amy Zhao, lead at crypto investment firm Ocular.

Amex users have been waiting for an announcement like this for some time, as its competitors Visa and Mastercard have already launched their own crypto rewards credit cards through partnerships with digital asset companies, such as Visa’s crypto rewards card offered in conjunction with BlockFi and the Mastercard-powered card issued by crypto exchange Gemini.

Backbase — an Amsterdam-based startup that provides a platform that banks and others can use to better structure and leverage the data that they have, and to then use that to build more personalization and other new features into those banks’ customer-facing services — has raised €120 million ($128 million at today rates).

all had track records of working in digital businesses where they saw, not just for themselves but their customers, an opportunity to build a bank that took all of that into account (so to speak) and built a financial management service that fit those dynamics.

Lalji said that Ivella will focus on products to support couples at any stage of their relationship, including joint accounts, credit products and joint investment products, long-term.

The objective of the partnership is to bring programmable money, or digital money that can be coded to act in a certain way based on predetermined conditions, into the Japanese market, said Digital Asset in a separate statement.

When people have little or no confidence in the financial system, or they don’t know certain financial services that meet their needs exist or they don’t have formal identification documents to seek these services, achieving optimal financial inclusion can prove herculean.

The previous share purchases refers to an existing relationship between the two: Nets already had a stake in Orderbird as a result of an acquisition it had made of payments company Concardis, and it increased that stake to 40% in a secondary transaction in September 2021.

Meld’s customers bring their own third-party service providers onto the platform, and Meld is responsible for integrating each service provider onto the singular API and dashboard the customer uses. Bengani, who previously ran Square’s platform and partnerships team, said he noticed while he was onboarding developers there that they often had to spend more time building and managing third-party integrations than on developing their own products.

Sold as a SaaS itself — basic pricing is 5% + 50 cents per transaction — Paddle premise follows the basic principle of so many other business tools: payments is typically not a core competency of, say, a video conferencing or security company (one of its customers is BlueJeans, now owned by Verizon, which used to own journalist; another is Fortinet).

Mentum is out to change that in Latin America, and is working on customizable investment APIs and widgets so businesses in Latin America can build and offer fully digital investment products, like local mutual funds, ETFs and stocks, to their customers. All of them came to the U.S. from Latin America to study and work, and in the course of using some of the investment apps offered in the U.S., they struggled to find similar products in Latin America that provided a way to fully invest.

They include Breyer Capital, Propel VC, Better Tomorrow Ventures, FT Partners, Bain Capital, Lateral Capital, a few family offices, HNIs and a multibillion-dollar crossover fund also known for investing in smaller funds. Rali_cap, an early-stage venture capital firm focused on emerging markets fintech, has launched a $30 million fund.

Binance, the world largest crypto exchange by volume, has gained regulatory approval to provide digital asset services in France, the first European country where it has acquired such permission, the company said in a blog post on Thursday. Binance has been busy trying to show European regulators its commitment to practice compliance and promote the region’s blockchain ecosystem. Many Chinese-founded crypto firms have moved their core management to Singapore, which is quickly emerging as a regional hub for blockchain startups. Originally founded in China, Binance has largely pulled out of the country following Beijing’s sweeping crypto ban.

Kard manages the relationships with each business looking to offer rewards to promote their brand, making it easy for a new issuer to mix-and-match from Kard’s offerings and integrate those rewards into the issuer’s own user interface, CEO and founder Ben Mackinnon told journalist in an interview. Kard‘s rewards-as-a-service API streamlines the process for card issuers, allowing them to create a customized rewards program tailored to their particular customer base by choosing from Kard set of merchant partnerships.

Now, Cogni has raised a $23 million funding round led by Hanwha Asset Management and CaplinFO with a new mandate — bringing web2 and web3 services together on one platform, Ravishankar said.

In 2021, Gandhi started Creative Juice alongside Ezra Cooperstein, the president of Night, a management company representing top digital creators like makeup maven Safiya Nygaard, underwater treasure hunter DALLMYD and stunt YouTuber MrBeast, who also sits on the Creative Juice cap table.

PayU, as a provider and builder of fintech solutions, will be able to leverage Treinta as a channel for getting its own customer-facing tech deeper into the market in Colombia and the rest of Latin America, but Treinta will also become another retail channel for PayU’s under-the-hood technology.

Founded in 2007 by Perez and Oscar Garcia Mendoza, who now serves as chairman of Novopayment’s board, NovoPayment had been bootstrapped since inception until it raised its Series A round earlier this year, the company announced today. Novopayment has been focused since its founding on building out a tech stack that ties all the critical processes together for financial institutions to build out their digital banking services.

The idea with Wagestream is not just to give those workers faster liquidity when they need it, but to give them the ability to use that money in different ways — for example with features to invest small amounts into stocks, and to bring in controls to save money incrementally in a way that makes the most practical sense for those users.

The verdict that China web3 community has been waiting for months is here: NFTs, or the tokens used to prove the ownership and authenticity of an item, must not be used for securitization or transacted in cryptocurrencies, said China’s banking, securities and internet financial associations in an announcement on Wednesday.

Umba said it brings a wide range of transparent and accessible financial products to those underserved by legacy banks across Africa — only 43% of the region’s population are account holders at financial institutions. However, the new funding will allow the company to test this out as it prepares to launch in new markets, including Egypt, Ghana and Kenya, where mobile money is prominent.

Stenn — which applies big data analytics, taking a few datapoints about a business (the main two being what money it has coming in and going out based on invoices) and matching them up against an algorithm that takes some 1,000 other factors into account to determine its eligibility for a loan of up to $10 million; and on the other side taps a network of institutions and other big lenders to provide the capital for that financing — has raised $50 million in equity funding to expand its business after seeing accelerated growth.

The startup, founded by a former Palantir engineer and a Freddie Mac exec, is taking a data-integration focused approach inspired by the data giant and applying it to the real estate capital markets, its co-founder and CEO Charles McKinney

Datanomik’s goal is to connect financial institutions across LatAm through its B2B open finance API, which gathers a company’s banking information on one platform, Strauss told journalist. Now, dLocal and AstroPay co-founder Sergio Fogel has teamed up with AstroPay’s former head of product, Gonzalo Strauss, to launch another fintech out of Montevideo, Uruguay, called Datanomik.

The latest to receive funding to continue developing its financial infrastructure for the freelance economy is Archie, which raised $4.5 million in funding from B Capital Group and others. As more people moved to remote work over the past few years, there was also an uptick in people choosing freelance or contract work, leaving companies to figure out how to manage that worker segment.

Of course, Robinhood also warned of risks in extended-hours trading, but noted the additional hours would give customers the ability to trade based on quarterly earnings announcements made after the market closes, as well as based on activity taking place in foreign markets.

Originally founded by Nick Ogden, who was also the founder of WorldPay (which Fidelity acquired for $43 billion, which was at the time the biggest deal ever made in international payments sector), ClearBank currently has 200 customers — large financial institutions and fintechs using its infrastructure to enable faster transactions — with the list including UK businesses like Tide and Oaknorth, but also international companies like Coinbase, which uses ClearBank for clearing and payments services for its UK customers.

The product is for early-stage startups only, with Mercury offering between 25% to 50% of a startup’s equity round in debt.

But while that seems to foreshadow that Lunar definitely has ambitions to move beyond its Nordic shores (with a name and stratospheric association to match that), the startup is actually still focused on building out services that ferret out what the incumbents are still not providing, to build those services into the Lunar platform, not least because he points out that Nordic consumers and businesses are some of the most lucrative not just in Europe but the world in terms of the value-added services they take, the money they transact with and so on.

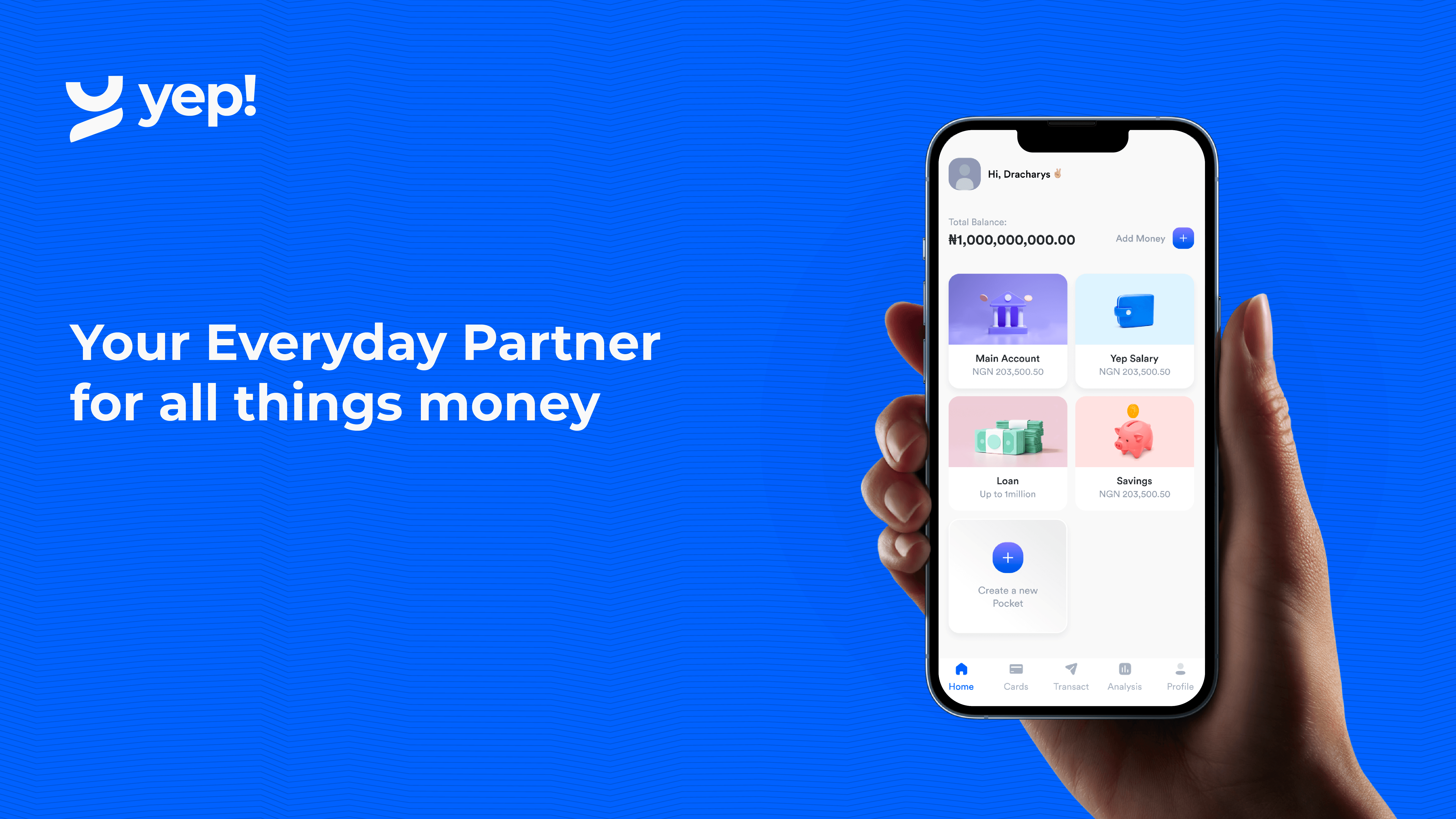

What gives Yep! an edge, according to its founders, is a superior experience in raising debt capital for lending purposes — a practice where agency banking providers supply working capital to their agents who in turn lend to their end consumers.

Shop owners who intend to offer loans to their end consumers get higher credit lines from Chari, which shares the data collated from Karny (on end consumers’ purchasing behaviour) with FMCG companies that pay for the cost of the higher loans.

Bank accounts, payments, virtual and physical cards as well as real-time FX rates and digital wallets can be offered HUBUC, because is sits as a layer between the financial partners it works with and the company’s product.

London-based early-stage European VC fund Backed is bolstering its position by adding €75 million to its seed fund, while adding another €75 million via a new follow-on fund vehicle.

The story begins years ago when Root wanted to build new kinds of banking services. Co-founder and CEO Nick Root is a computer science graduate and former CTO, COO, CFO and CEO who did 12 years in the London banking industry before starting Intergiro.

American Express has launched its first all-digital consumer checking account, the company announced on Tuesday. The new offering, American Express Rewards Checking, is currently available for eligible U.S. Consumer Card Members. The launch comes as the emergence of digital banking services is causing traditional banks to enhance their digital strategies and offer more competitive banking \[…\]

In a market full of challenger banks — and some very close Vivid competitors such as Sequoia-backed neobroker Trade Republic — Vivid’s backers believe the company’s traction and all-in, easy approach that appeals to new consumer investors will see the company picking up more users and usage as it expands.

Given that it’s not a big leap between financial services and fintech — indeed, in cities like London which have strong industries in tech and financial services, the two have long competed heavily to recruit technical talent — it’s surprising that we haven’t seen more banks trying to built personalization in house rather than look to a third-party provider like Personetics.

Routefusion cofounders Colton Seal and Richard Scappaticci attempted to launch a neobank in 2016, but they ran into significant hurdles when trying to integrate with banks to help their customers move money to other countries.

The startup sells a salary-advance service to employers to offer their staff — charging companies a commission for the tech rather than levying a fee on users to withdraw a portion of their salary early (as some other salary startups do).

The funding will be used to continue growing GPS’s business — which includes a range of fintech services such as payments, direct debits, and standing orders; virtual cards; mobile wallets; fraud prevention; expense management; cryptocurrency management; BNPL and more.

Unlike most developed countries, the West African nation lacks an advanced credit bureau system to detail people’s credit histories, so there’s some scepticism to how Fintech Farm will use credit cards to operate.

Other startups in the space using traditional banking infrastructure to make payments more efficient have hit a ceiling on how fast and cheap they can offer payments because of fees charged by these intermediaries, particularly between countries that don’t transact as regularly, said Paysail cofounder Nicole Alonso.

This, in fact, can also potentially provide a steer to Novo on what might be most popular and potentially worth considering as in-house products in the future, but for now it serves another couple of key purposes: it makes Novo more useful for its customers, and it provides more data sources to Novo to build future products.