FinTech news in financial services category

It is a digital wallet and password manager for financial services and banking apps, but Soffio calls it a financial digital passport, which helps with user identification, making the task less cumbersome for both consumers and financial services. Soffio said Portabl chose Harlem Capital to lead the round after a call he’ll never forget: Yenkalov, a Ukrainian citizen, was trapped in the country as the war with Russia broke out in the middle of a fundraising call with the firm. Yenkalov noted the emergence of decentralized identifiers, verifiable credentials and zero-knowledge proofs, saying that the industry is closer than ever to enabling financial organizations to benefit from consumers owning and sharing their own data.

Its customers are asset managers looking to offer these alternative investment opportunities to their private wealth clients, who tend to be high-net-worth individuals that meet regulatory accreditation requirements applied to many alternative assets, Advani explained. Advani started Allocations in 2019 as a response to challenges he faced in trying to set up his own investment funds and realizing that none of the tools available to him at the time could help him spin up funds quickly enough to stay competitive in the increasingly fast-paced private markets. Less than three years after its founding, the company, which provides APIs to help private fund managers streamline processes, has crossed $1 billion in assets under administration on its platform, its CEO and founder Kingsley Advani told journalist in an interview. Taking a page from KKR’s book, Advani said Allocations is in the early stages of exploring a blockchain offering as he thinks the technology can help meaningfully streamline fund administration.

Formerly known as Fazz Financial Group, Fazz goal is to close the $300 billion funding gap for MSMEs, which has been exacerbated by the pandemic, and give them the same tools as larger businesses. The equity investment came from returning investors Tiger Global, DST Investment, B Capital, Insignia Ventures Partners and ACE & Company, with participation from Ilham Ltd, EDBI, InterVest, Y Combinator managing director Michael Seibel and GGV Capital managing partner Hans Tung.

The fintech, recently selected to participate in the Mastercard Start Path Global program for seed, Series A and later-stage startups, also wants to introduce new products to enhance its existing consumer banking, agency banking and merchant payment solutions and expand into African countries that fintechs from Nigeria rarely move to: Angola and Liberia. According to Berry, NowNow wants to set itself apart from the competition with the development of NFC-enabled tech that will allow tap-in functionality within its ecosystem of products, where users can use virtual or physical cards against an NFC-enabled phone or POS and tap from wallet to wallet using two phones. NowNow claims to have built an end-to-end ecosystem of financial products catering to agents, individual consumers and small businesses. When CEO Sahir Berry and his co-founder Mahesh Nair founded NowNow in 2016, they wanted to provide solutions to financial inclusion and job creation, two of the most significant pain points they thought were facing Nigeria and the rest of the continent.

The company numbers are small compared to other layoffs that have taken place within Africa’s tech ecosystem over the past few months, especially among startups that have raised vast sums of venture capital within the last year or two; for instance, Swvl laid off 400; Wave, approximately 300; 54gene, 95; and Vezeeta, 50. Meanwhile, it was just last August that the digital bank, which provides zero to minimal fees on cards, account maintenance and transfers and is one of Africa’s soonicorns, raised $55 million — money that it planned to use to not only double down on new services for Nigeria but also to prepare its launch into more countries on the continent like Ghana and Uganda — in a Series B round that saw it valued at $500 million. As Kuda positions itself for pan-African and international expansion amidst an uncertain venture capital environment, it depicts the recent cut in its workforce as part of strategic steps for sustainable growth. When Kuda held a town hall meeting last month, cutting down seemingly redundant roles and dismissing nonperforming staff to reduce costs and extending runway were topics of conversation in light of current macroeconomic trends, according to sources.

Solid, which rebranded from Wise in 2021, raised a $63 million Series B round of funding to continue providing its fintech-as-a-service offering for companies wanting to launch and scale their own fintech products.

Weekly news about Paystand, Alloy, Payday, QED Investors, Metromile, Lemonade, Wiseasy, Attentive, Robinhood, Opendoor, Savana, Lami, Bluecopa, Geopagos, Mudafy, Parafin, FinanZero, PayIt, NG.CASH, Legalpad, Weltio and others.

In the latest development, Youverify, a Lagos and San Francisco–based identity verification company helping African banks and startups automate KYC and other compliance procedures, is announcing that it has secured a $1 million seed round extension. However, in a bid to serve more clients, the company launched its proprietary technology, the Youverify OS (YVOS), which provides a single platform for automating due diligence and combines risk and compliance management with its core identity verification platform to deliver these fintechs an enterprise-grade compliance solution. Nearly two-thirds of Nigeria’s commercial banks, such as Standard Chartered, Standard Bank and Fidelity Bank, use the platform’s identity verification and KYC products, Youverify said. In addition to verifying identities beyond Nigeria’s bank verification number (BVN) and addresses, Odegbami says Youverify layers KYC and compliance products such as transaction monitoring.

Sanchez argues that Savana has an advantage in its experience building digital systems for banks and financial institutions. One fintech that competes almost directly with Savana is London-based 10x Future Technologies, which helps larger, established banks build both next-generation services and tools to help their older services work more efficiently.

China billionaire tech boss Jack Ma plans to cede control of Ant Group, the fintech powerhouse closely affiliated with Alibaba, the e-commerce giant he founded, The Wall Street Journal reported on Thursday. Ant informed regulators of Ma’s intention to relinquish control as the company prepared to transition into a financial holding company, The Wall Street Journal reported. The pair has been symbiotic, with Ant’s Alipay app deeply integrated into Alibaba’s suite of retail services and its financial services touted to business owners on Alibaba’s marketplaces. Ant started out as a payments processor of Alibaba, which Ma, at the time the e-commerce firm’s CEO, spun out in 2011.

Founded last year by Kelly Ifill, the company aims to narrow the racial wealth gap by providing financial services to Black small businesses and creators. As a result, Ifill hopes Guava will help Black entrepreneurs receive access to the financial support needed to weather every kind of financial storm, especially as another recession looms. And yet, Black founders receive less than 2% of all venture capital funding, and only 3% of Black women run mature businesses. At the same time, Bloomberg reported that Black founders — Black women specifically — were the fastest growing cohort of entrepreneurs.

But in May, Union54 began experiencing some operational issues with its product, resulting in the temporary suspension of its Bank Identification Number (BIN), the first four to six numbers on a payment card that identifies a card issuer. They attributed the virtual dollar card service disruption to an update from a card partner — which happens to be Union54 — without citing a definite recommencement time. This April, when we covered Union54, whose API allows companies to issue debit cards to their customers and employees without needing a bank or a third-party processor, it had just raised a seed extension, bringing its total seed round to $15 million (Tiger Global led both rounds). Many have begun searching for alternative options, which include Sudo Africa, another card-issuing platform and other fintechs, which claim to be unaffected by Union54’s downtime (as a result of using another provider), such as Chipper Cash, Mono and Bitmama.

The company is also building out some bonus adds, like billing and subscription management, so that users can start with off-the-shelf, white-label apps and then transition to more specialized offerings when needed, or when they want to control the full experience without interrupting its back end data or services.

Opening a business bank account should be fairly easy, but after seeing firsthand just how hard it was, Salomon Zarruk and Sebastian Ortiz decided they didn’t want another Latin American business to run into the same kind of difficulty.

The funding, a Series C, is coming from a single investor, Blackstone Growth, and PayCargo — based out of Coral Gables, FL — said that it will be used to expand into more geographies, to build out more products around financial and business data, and potentially also for M&A, since the area of providing services to the shipping industry is as fragmented as the shipping industry itself. The core of the PayCargo platform is a set of cloud-based tools for those ordering shipping services by land, sea or air to send payments, and for vendors to receive them, a set of APIs to integrate the tools into a company’s existing FMS and other IT, as well as financing services for those who do not want to pay for the shipments up front. PayCargo is not disclosing its valuation, but notably, the company is an example of one of the kinds of startups that is not finding it challenging to raise money at the moment: it is profitable, and it has been since it was founded in 2009; it is working in an enterprise vertical that still has a long way to go before it saturated with competing services filling the same need PayCargo is; and that enterprise vertical itself represents a massive opportunity with the continued growth and globalization of e-commerce overall. As with others building IT services for the freight and shipping industries — they include Zencargo, FreightHub, Sennder, Flexport, and Cargo.com — the opportunity is about building more cloud-based services that work smoothly and securely and with other pieces of the operations puzzle; but in many cases, it’s still just about providing tools to replace paper and fax machines.

Backbase — an Amsterdam-based startup that provides a platform that banks and others can use to better structure and leverage the data that they have, and to then use that to build more personalization and other new features into those banks’ customer-facing services — has raised €120 million ($128 million at today rates).

That where Constrafor comes in: as a SaaS construction procurement platform with embedded financing, it streamlines information and documentation for how general contractors work with subcontractors, while its Early Pay Program assumes the risk for the subcontractor invoice, freeing up cash flow and reliance on traditional and costly lending options.

When people have little or no confidence in the financial system, or they don’t know certain financial services that meet their needs exist or they don’t have formal identification documents to seek these services, achieving optimal financial inclusion can prove herculean.

Fintech startup and alternative credit asset manager Viola Credit, has closed its latest $700 million fund which provides asset-based lending capital to FinTech, PropTech, and InsurTech startups.

The exchange says it will not receive payment for order flow (PFOF), a method for order fulfillment Robinhood became notorious for that involves the exchange receiving payment from market makers for directing orders their way.

The previous share purchases refers to an existing relationship between the two: Nets already had a stake in Orderbird as a result of an acquisition it had made of payments company Concardis, and it increased that stake to 40% in a secondary transaction in September 2021.

African payments company Interswitch has secured a $110 million joint investment from LeapFrog Investments and Tana Africa Capital to scale its digital payment services across the continent, the two private investment firms said in a statement Wednesday. Alongside existing investors, LeapFrog and Tana plan to work with management to continue to drive Interswitch’s pan-African strategy.

Since its Series C, the company acquired Qualis, which is focused on bringing private market investments to retail investors, according to Nair — a growing area of interest among wealth managers seeking to provide their clients with differentiated returns from the public markets. The round brings the company’s valuation to $842 million, nearly doubling the $447 million it was valued at after its Series C. Investment manager Franklin Templeton and fintech venture firm Motive Partners joined the latest round as new investors, the company says.

Robinhood brokerage cash sweep program used to offer an interest rate of 0.5% to customers that were enrolled for its Cash Management feature, according to the company. 1% APY (annual percentage yield) may not sound like a particularly sexy return.

Meld’s customers bring their own third-party service providers onto the platform, and Meld is responsible for integrating each service provider onto the singular API and dashboard the customer uses. Bengani, who previously ran Square’s platform and partnerships team, said he noticed while he was onboarding developers there that they often had to spend more time building and managing third-party integrations than on developing their own products.

Mentum is out to change that in Latin America, and is working on customizable investment APIs and widgets so businesses in Latin America can build and offer fully digital investment products, like local mutual funds, ETFs and stocks, to their customers. All of them came to the U.S. from Latin America to study and work, and in the course of using some of the investment apps offered in the U.S., they struggled to find similar products in Latin America that provided a way to fully invest.

Akshay Krishnaiah, the founder and CEO of Line, thinks he can get users onboard for his vision of a more inclusive financial network. The company also said registrations are up 100% month over month, and have grown the service from instant cash to larger checks as rapport is built.

Ondo is primarily focused on building many of the functions typically associated with the middle and back office of an investment bank on-chain, Allman explained, noting that it does not currently have plans to directly offer advisory services to DAOs or crypto companies as a traditional investment bank might.

In a statement Ashutosh Bhatt, CEO of Pillar, said: Ever since I moved to the U.K. and found I couldn’t access any of the everyday products I had in India this has been a problem I have been passionate about solving. Adding to this roster is fintech startup Pillar, which has now raised a pre-seed round of £13 million ($16.9 million) led by Global Founders Capital and Backed VC. The company claims it will be able to provide immigrants with access to credit products when moving to a new country. Founded by Revolut alumni Ashutosh Bhatt and CTO, Adam Lewis, Pillar has an Open Banking-led data and analytics engine that will be launched in Q3 in 2022.

Umba said it brings a wide range of transparent and accessible financial products to those underserved by legacy banks across Africa — only 43% of the region’s population are account holders at financial institutions. However, the new funding will allow the company to test this out as it prepares to launch in new markets, including Egypt, Ghana and Kenya, where mobile money is prominent.

After a decade at Alibaba and its fintech affiliate giant Ant Group, Max Ma founded SwooshTransfer in 2021 to facilitate cross-border payments for small- and medium-sized enterprises, as well as individuals such as overseas students, for whom tuition payments are often a hassle.

The startup, founded by a former Palantir engineer and a Freddie Mac exec, is taking a data-integration focused approach inspired by the data giant and applying it to the real estate capital markets, its co-founder and CEO Charles McKinney

ImaliPay’s pilot was based on Furusa’s encounter: a buy now, pay later (BNPL) fuel product, but for two-wheeler gig platforms as the company partnered with a few fuel stations in Ibadan, Nigeria to offer this service to SafeBoda riders.

Khazna plans to launch additional products before the end of the year; this product expansion and user growth is what Saleh points out when asked how Khazna stays ahead of the competition. The company, founded by Omar Saleh, Ahmed Wagueeh, Fatma El Shenawy, and Omar Salah in 2019, provides basic banking and various financial services focusing on middle and lower-income earners. In a country where 50% of its 100 million people are active smartphone users, two out of every three individuals have little or no access to formal financial services in Egypt.

Dapio’s launch is a sign of where the U.K. payments scene is currently — where contactless payments aided by NFC technology have exploded, making up a quarter of all payments in the country.

Kwik, a Nigeria and French-based startup that provides logistics services to B2B merchants, from social vendors to e-commerce platforms, has raised $2 million in Series A funding. Since launching in Lagos in 2019 and extending its presence to Abuja, the company has onboarded more than 100,000 merchants who use Kwik’s site and mobile apps to run the logistical, commercial and financial needs of their businesses.

They started off building a universal e-commerce API for reading and writing data so that tech customers can integrate with commerce platforms and access financial data points to offer loans, launch in new marketplaces and streamline inventory syncing for brand management.

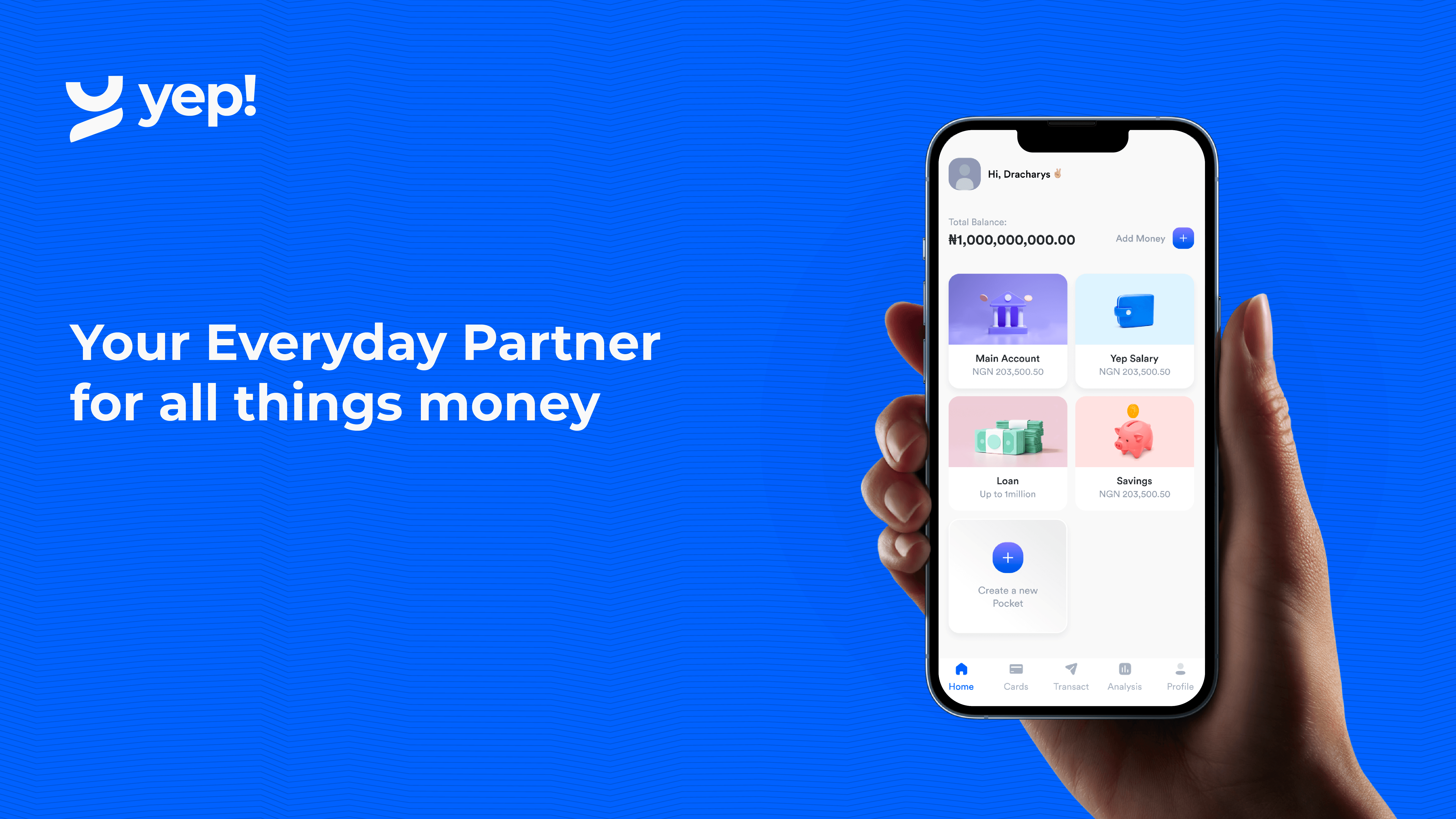

What gives Yep! an edge, according to its founders, is a superior experience in raising debt capital for lending purposes — a practice where agency banking providers supply working capital to their agents who in turn lend to their end consumers.

Digging into the Alkami Technology IPO Tacora’s fund is backed by prominent venture capitalist Peter Thiel, whose Mithril Capital Management, an investment firm he co-founded with Ajay Royan, left the Bay Area for Austin in 2018.

OkHi’s grand mission, the founder says, is to get these people who don’t have a physical address included in the global address system.

MD Olly Thornton-Berry said that he and Jack Bidgood first came upon the idea for Thirdfort after a friend of theirs lost £25,000 while buying a flat in London due to a phishing attack: fraudsters had picked up some data about the deal, and created a domain similar to that of the legal firm the friend was using for the purchase, and with that wrote an email impersonating the friend’s lawyer, asking for the sum to be transferred via a link.

Ayorinde said CrowdForce will use the funding to distribute more point of sale terminals to its partners in the next 12 to 18 months as the company, in a statement, said it aims to bring financial services within one kilometer, or within 15 minutes, of all Nigerians.

Consumers are able to pay without entering financial data, no need to create an account, no financial details are shared, authorization is biometric and the merchant receives the funds in real time.

According to him, about 87% of Thndr users invested for the first time through the platform; 40% of its users come from outside of Cairo and Alexandria — rural areas with zero access to financial institutions; and Thndr accounts for 36% of all new registrations in the local Egyptian exchanges in 2021.

The investors that participated in the round include China-based Chuangshi Capital, Yunshi Equity Investment Management, Trust Capital, Chengyu Capital and private equity fund AfricaInvest.

Simone explained that financial advisors don’t often ask clients about their medication costs or health conditions, so some of the pillars the company helps advisors and their clients identify include health plan selection and if you may need long-term care planning — which Simone estimated 70% of people usually do.

Karny gives Chari valuable data on the loans provided by grocery stores to their customers and allows Chari to credit-assess the unbanked shop owners, determining the most applicable payment terms to give each.

Given that it’s not a big leap between financial services and fintech — indeed, in cities like London which have strong industries in tech and financial services, the two have long competed heavily to recruit technical talent — it’s surprising that we haven’t seen more banks trying to built personalization in house rather than look to a third-party provider like Personetics.

Finclusion Group, a fintech that uses AI algorithms to provide financial services to African customers via an array of credit-centric products, has raised $20 million in debt and equity pre-Series A financing.

The startup sells a salary-advance service to employers to offer their staff — charging companies a commission for the tech rather than levying a fee on users to withdraw a portion of their salary early (as some other salary startups do).