FinTech news in digital bank category

Earlier this year, Majority announced that users can register for an account without needing a social security number or U.S. documentation, and instead use an international government-issued ID and proof of U.S. residence — a move the startup says could make its services more accessible. The fintech announced today that it has raised a $37.5 million Series B, $30 million of which is in equity financing led by Valar Ventures and other existing investors, and the remaining $7.5 million in debt financing from an undisclosed U.S.-based commercial bank. Nine months after raising a Series A round, Majority has raised tens of millions in both equity and debt financing for its mobile bank for migrants. Creating physical spaces has helped the Majority gain trust with consumers, Larsson explained, showing that the company won’t just show up, handle money and disappear in a few weeks due to the volatility of startups.

The company numbers are small compared to other layoffs that have taken place within Africa’s tech ecosystem over the past few months, especially among startups that have raised vast sums of venture capital within the last year or two; for instance, Swvl laid off 400; Wave, approximately 300; 54gene, 95; and Vezeeta, 50. Meanwhile, it was just last August that the digital bank, which provides zero to minimal fees on cards, account maintenance and transfers and is one of Africa’s soonicorns, raised $55 million — money that it planned to use to not only double down on new services for Nigeria but also to prepare its launch into more countries on the continent like Ghana and Uganda — in a Series B round that saw it valued at $500 million. As Kuda positions itself for pan-African and international expansion amidst an uncertain venture capital environment, it depicts the recent cut in its workforce as part of strategic steps for sustainable growth. When Kuda held a town hall meeting last month, cutting down seemingly redundant roles and dismissing nonperforming staff to reduce costs and extending runway were topics of conversation in light of current macroeconomic trends, according to sources.

Anchor claims to be transacting several millions of dollars while growing 200% month-on-month. After testing these features with a select few, Anchor is coming out of stealth with a $1 million+ pre-seed and making its platform public.

Left Lane led Arc’s Series A financing, which also included participation from NFX, Y Combinator, Bain Capital Ventures, Clocktower Technology Ventures, Torch Capital and Atalaya, as well as founders from Wayflyer, Plaid, Column, Chargebee, Vouch and Jeeves.

When Pedro Conrade started Brazilian digital bank Neon in 2016, he was a 23-year-old business school student who was frustrated with the service and costs associated with traditional banking in his country.

In an interview with journalist, Neo co-founder and CEO Andrew Chau shared that he and co-founders Jeff Adamson, Chris Simair and Kris Read started Neo to challenge the Big Five banks that own some 90% of the country’s market share.

Seattle-based Copper offers features such as personalized debit cards, access to 50,000 ATMs and support for digital wallets like Apple Pay, Google Pay and Samsung Pay. Fiat Ventures General Partner Alex Harris, who was head of growth at digital bank Chime in its early days, is joining Copper’s board as part of the financing.

Khazna plans to launch additional products before the end of the year; this product expansion and user growth is what Saleh points out when asked how Khazna stays ahead of the competition. The company, founded by Omar Saleh, Ahmed Wagueeh, Fatma El Shenawy, and Omar Salah in 2019, provides basic banking and various financial services focusing on middle and lower-income earners. In a country where 50% of its 100 million people are active smartphone users, two out of every three individuals have little or no access to formal financial services in Egypt.

With these funds focusing solely on crypto and its surrounding ecosystem and investing more in these startups than traditional fintechs at the moment, why is Luno Expeditions choosing a dual focus on crypto and fintech instead of going head-on with crypto?

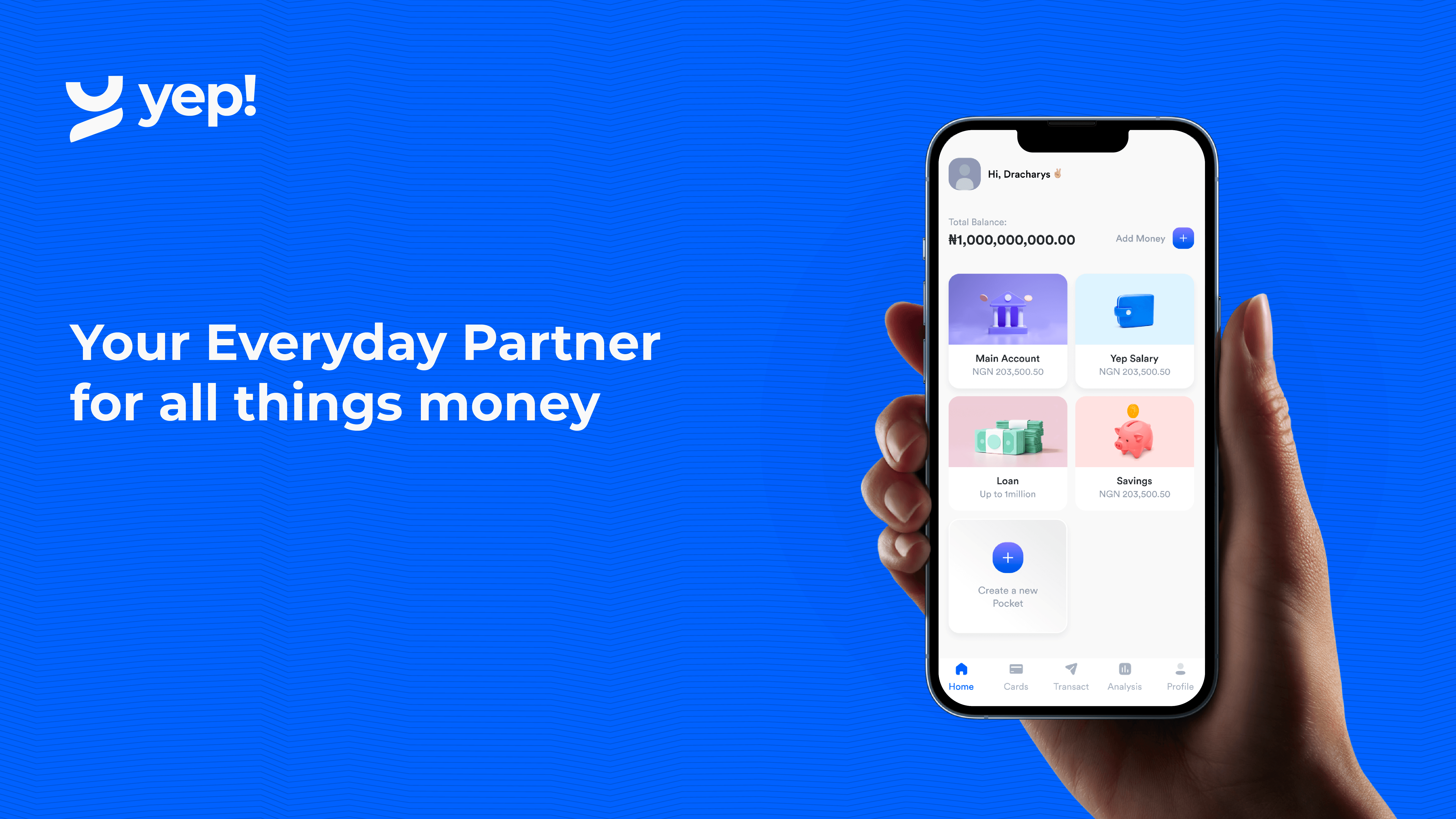

What gives Yep! an edge, according to its founders, is a superior experience in raising debt capital for lending purposes — a practice where agency banking providers supply working capital to their agents who in turn lend to their end consumers.

Pinwheel is also the only company providing direct deposit switching and payroll data that is classified as a Consumer Reporting Agency (CRA) in compliance with the Fair Credit Reporting Act, meaning that if consumers are adversely affected by Pinwheel’s data, the company would be legally accountable.