FinTech news in Brex category

Besides seeking to snag market share from incumbents such as Concur, Brex is also taking on startups such as Navan (formerly called TripActions) — which actually started its business focused on travel expense management before broadening its offering and also Ramp, which itself expanded into travel last year.

Brex CEO Henrique Dubugras is currently working to raise over a billion dollars in a weekend to help fund an emergency bridge credit line that he believes will help startup customers impacted by Silicon Valley Bank collapse be able to make payroll next week.

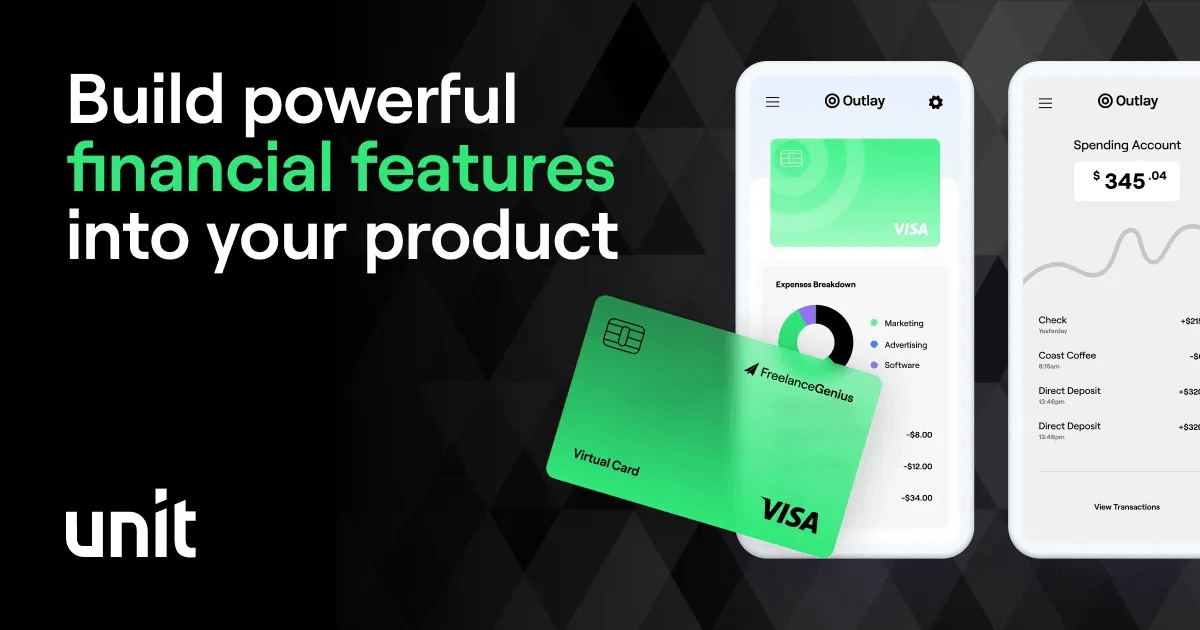

Customers can offer their customers a charge card, credit card, revolving loan or any other credit products that Unit’s bank partners offer. Charge cards, which are more popular than credit cards for small businesses, give Unit a way to enable customers to build and offer lending products, even though the startup is not a lender itself. Unit claims that a card swipe transaction will yield 0.5% more interchange revenue when done with a credit card compared to a debit card. The company gives companies a way to embed financial services into their product — and after already launching debit cards, Unit is officially breaking into the charge card game.

After the layoffs, Brex has just over 1,150 employees. Unsurprisingly, Brex cited the challenging macro environment in its decision.

We found that fintech startups raised $1.5 billion from June 16 to June 23 across 39 deals — compared to $1.4 billion raised across 53 deals the week prior and $1.2 billion across 59 deals 2 weeks prior.

Brex decision to stop serving SMB customers surprised many in the startup and fintech community. Businesses affected, he said, are mostly brick & mortar businesses such as bakeries, restaurants and small design agencies — many of whom would argue are being impacted by rising inflation and a challenging macro environment the most.

He has declined to reveal hard revenue figures, but previously told journalist Brex was still focused on growth and not yet profitable. Three months after announcing it would make a big push into software and enterprise, fintech giant Brex is apparently abandoning the very segment it started out to serve – small and medium-to-sized businesses.

all had track records of working in digital businesses where they saw, not just for themselves but their customers, an opportunity to build a bank that took all of that into account (so to speak) and built a financial management service that fit those dynamics.

Its acquisition of Pry is not only reflective of Brex’s new emphasis on offering strong software products, but also its continued commitment to early-stage startups — the demographic which was the company’s target customer in its own early days. Dubugras said that Brex valued the startup less on its own metrics and more on the value it believed it could generate for Brex by cross-selling into its existing customer base.

With 12 million users and nearly $200 million in annual recurring revenue, expense software provider Emburse has built much of its business in the enterprise. Historically, it has competed with legacy players like Concur and Expensify and ERP players. But now Emburse is making a big push into the SMB space and going head-to-head with \[…\]

Today, decacorn Brex revealed that it is making a big push into financial software with the release of a new spend management product called Brex Empower. Brex is one of a number of companies in the corporate spend management space that has grown increasingly crowded — and competitive — in recent years.

Starlight’s core customers are companies who need to convert some of their cash into crypto, many of which are digitally native but new to web3, Nguyen said. He added that Starlight has also seen interest in its product from crypto-native entities, including DAOs, which often invest in other companies, creating a need for them to convert cash into crypto and vice versa.

Quick thoughts: This is another area that YC clearly sees as beginning to show promise, with past YC companies that include CrowdForce (which raised $3.6 million in funding last month) and Kudi (it raised $55 million last summer at a $500 million valuation). Blocknom Website: https://blocknom.com Founded: 2021 Location: Jakarta, Indonesia Team size: 6 Promises include: Providing an alternative payment infrastructure without the need for a payment card or consumer app so that customers can pay businesses from their phones without internet access. Among them is Mina Shahid, co-founder and CEO, who says he is a two-time founder and previously worked with co-founder Ben Best at another lending company in Ghana that failed.

When customers move money to their wallet via credit card, debit card, or ACH transfer, Sardine assigns a risk score to the card or bank account being used through an algorithm and assumes fraud liability for the transaction.

As its earlier customers have grown and matured, Brex is now adapting to also serve mid-market to larger businesses which have different financial needs as they grow. In terms of customers, Brex continues to serve startups or e-commerce companies that might be smaller businesses but with higher growth.