FinTech news in Gradient Ventures category

Gradient Ventures and Fin Capital co-led Vault’s US$3.7 million seed raise, which closed last year and included participation from The Fintech Fund, Exponent Capital and Thirdbase Capital. Vault says it partners with regulated financial institutions and that its customers can see which financial institution is holding their funds via their accounts page.

Similar to how Plaid leverages a user-permissioned data platform for banking, Axle allows users to connect their insurance account to trusted companies in seconds through a developer-friendly API or one of Axle’s low-code or no-code options.

The Boston-based startup aims to reduce operating costs by up to 80% for enterprises running staking nodes and APIs as a service, the two co-founders, Sean Carey and Chris Bruce, said to journalist. BlockJoy, a startup providing white label blockchain nodes as a service, raised a total of $12 million from its seed and Series A rounds, the company exclusi1vely shared with journalist. Carey, who also the Helium co-founder, and Bruce, a four-time founder, began BlockJoy as a staking service side project. In the long term, BlockJoy hopes to make its technology more accessible so that running a node is easy enough that anyone can do it, Bruce said.

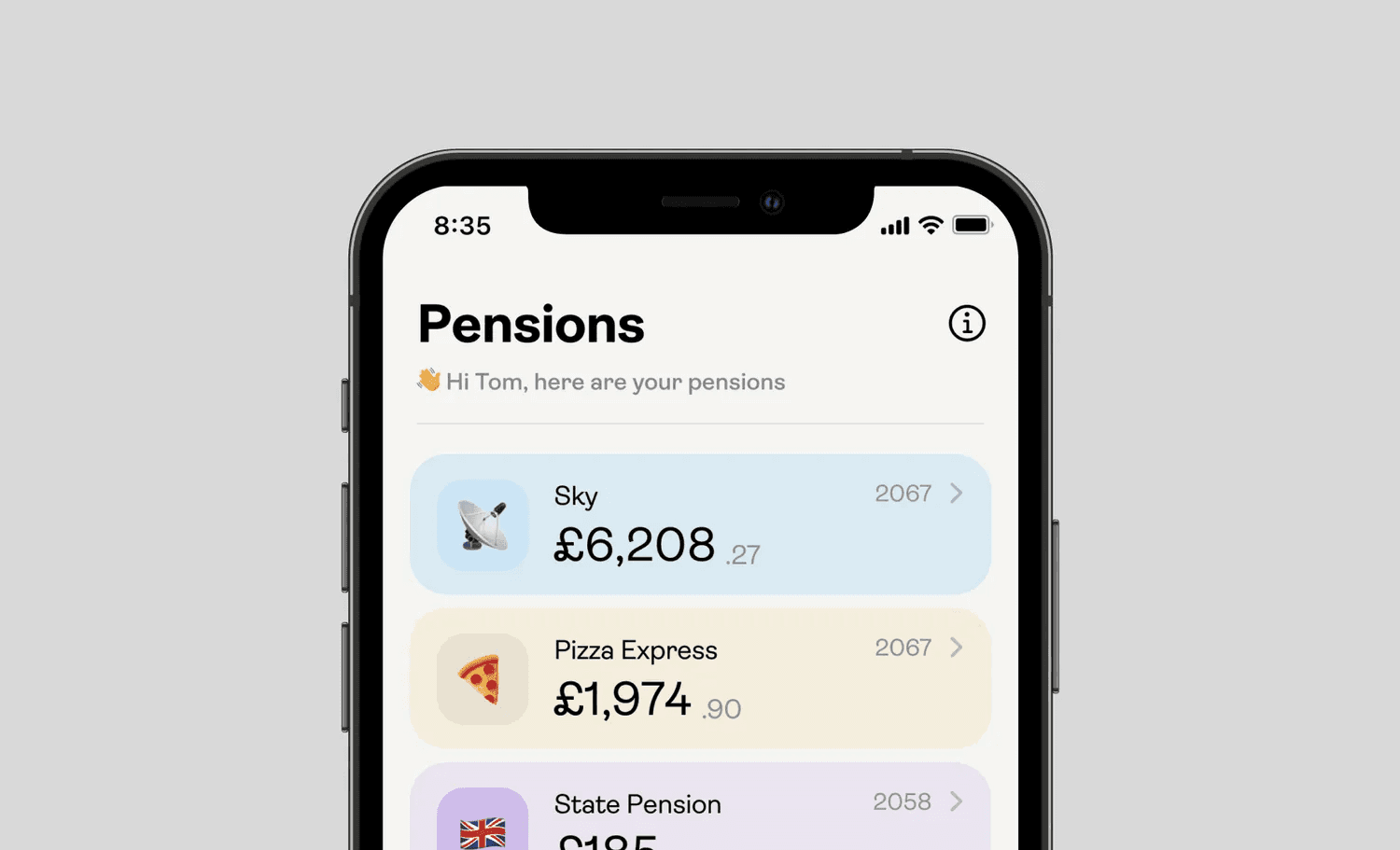

Given that the average worker only remains in the same job for a few years, when they move to a new employer, a new pension fund automatically begins — quite probably with a completely different provider to their previous one — which creates this giant fragmented pension palaver.

Walnut works with healthcare providers so that a patient’s bill can be paid back through $100-a-month increments for 30 months, instead of one aggressive credit card swipe Many BNPL startups, Walnut included, do cash-flow underwriting, in which the company connects to users’ bank accounts to see daily income, spending patterns and savings to see if a loan will likely get repaid by the end of month.