FinTech news in payments category

As journalist’s Connie Loizos reported at the time, Finix told employees that soon after issuing its check, Sequoia concluded that Finix competes too directly with Stripe, the payments company that represented one of Sequoia’s biggest private holdings and that in turn counted Sequoia as one of its biggest outside investors. Serna believes that Finix’s latest move only drives the two closer toward each other despite the disparity in size (Finix has 130 or so employees and Stripe had just under 7,000 as of last November) and funding (Finix has raised about $133 million in funding and Stripe has raised nearly $9 billion). Block (formally known as Square) is often viewed as a payment processor, is actually built on top of other payments technology and itself works with a number of payment processors to provide direct connection into networks, Serna noted. Serna believes that Finix’s tech stands out because it was built from the ground up, and not built through a number of acquisitions as in the case of some legacy providers.

Founded last year by former Adyen product manager Sophia Goldberg and ex-Affirm software engineer JT Cho, San Francisco-based Ansa is building what it describes as a white-labeled digital wallet infrastructure to help businesses process small payments and offset high credit card fees for smaller transactions.

Checkout.com is building a full-stack payments company — it acts as a gateway, an acquirer, a risk engine and a payment processor

Our action products bring together a company’s data and provide APIs to give developers and business stakeholders in a company the ability to build more sophistication in their payment stack to address issues such as churn, risk, and cost

Its API covers over 170 markets for card payments, and 85 markets for local payments collection, which means its customers can accept payments in different countries without having to set up local entities.

Narayanan and O’Dowd were used to card alternative payments after living in Singapore, and saw an opportunity to use the U.K. open banking payments stack to build a Visa and Mastercard alternative, Narayanan told us. Atoa co-founder Sid Narayanan told journalist that he and co-founder Cian O’Dowd developed the idea for Atoa after selling their previous startup, expense management platform KlearCard, to Singapore fintech Validus in 2021. Mastercard and Visa payment rails can cost small merchants and their customers net margins of 51%, with card machine fees of about 1.75%, Narayanan said. To incentivize more customers to use Atoa, the startup also plans to add rewards and loyalty benefits, like digital scratch cards that can let them get cash rewards into their existing U.K. bank accounts.

In an interview with journalist, Anderson explained that while Plaid will be personally facilitating payments through its Transfer offering, it will also continue working with its dozens of payments partners, which include the likes of Square, Stripe, Marqeta, Gusto and Silicon Valley Bank. In its own way, Anderson pointed out, Plaid has been involved in digital payments for years, by enabling nearly a billion ACH transactions for things like account funding and account-to-account transfers. In working with its payment partners over the years, Anderson said that Plaid saw a consistent challenge — that it usually took several days for an ACH transfer to complete. Specifically, Stripe’s Financial Connections was designed to give that company’s customers a way to connect directly to their customers’ bank accounts, to access financial data to speed up or run certain kinds of transactions — exactly what Plaid has done historically.

Elon Musk detailed his vision for Twitter plan to enter the payments market during a live-streamed meeting with Twitter advertisers, hosted on Twitter Spaces on Wednesday. The new Twitter owner suggested that, in the future, users would be able to send money to others on the platform, extract their funds to authenticated bank accounts, and later, perhaps, be offered a high-yield money market account to encourage them to move their cash to Twitter. In today’s meeting, Musk explained how paid verification, which Twitter is rolling out now with its revamped Twitter Blue subscription, as well as support for a creator ecosystem could pave the way for a payments system on its platform. Musk then explained how this payments system could scale saying that, once users gained a cash balance, Twitter could prompt them to move that money on its platform.

So the pair spent nights and weekends building a prototype for Loop, a startup that sits at the intersection of logistics and payments, before leaving Uber in May of 2021 to focus full time on the business. And, McKinney claims, it can bring payments down Loop makes money by taking a percentage of total payments volume. Matt McKinney was a data science manager at Uber, helping launch Uber Freight, along with software engineer Shaosu Liu. One of the tailwinds that helped Loop, believes McKinney, is the COVID pandemic-driven secular shift of paper to electronic methods of payments.

They include helping city governments provide food stamps to users (which are deposited as a sum on Satispay to be used for food purchases); and a surge of use during COVID when people wanted to pay for items remotely or even in person without even tapping phones or taking out cards, using just Satispay’s app on their devices to complete purchases. The ever-expanding group also includes companies like Dwolla in the U.S. (which Dalmasso says is probably the most similar to Satispay in terms of how it operates); peer-to-peer payment efforts like PayPal’s Venmo and Square’s Cash App; buy-now, pay-later services; and the plethora of blockchain-based efforts to build out new currencies and means of buying and selling; and much more. Today, a startup out of Italy called Satispay — which operates an independent payment network that bypasses big banks and credit companies and promises lower transactions fees plus other benefits like better budget control to its users — is picking up a massive round of funding on the back of strong demand for its services. One of these is that users essentially deposit money into a Satispay account from their existing bank accounts to spend over a period of time, much like a pre-pay account, which helps them control what they spend monthly.

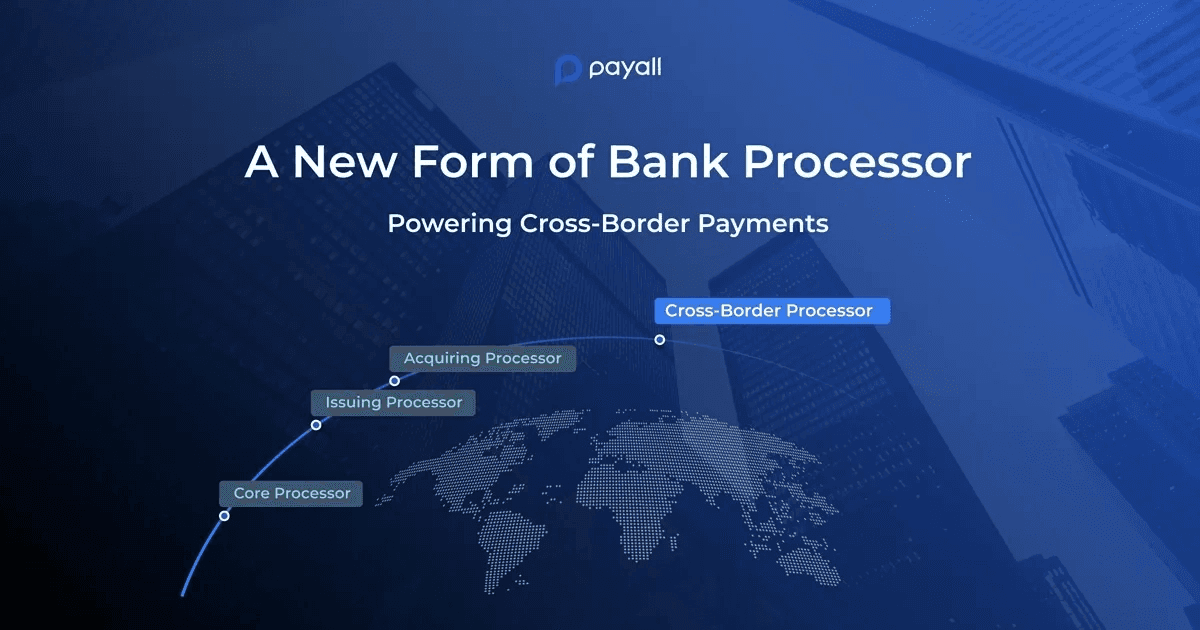

Payall differentiates itself from other startups in the cross-border payments space in that rather than competing with banks, it works with them by white labeling its software. Indeed, with the COVID-19 pandemic fueling more remote work globally, the need to provide cross-border payments for business and individual clients has never been as pressing for banks. He founded Payall, a cross-border processor for regulated banks, in 2018.

In a series of moves last year, the Reserve Bank of India indefinitely barred Mastercard, American Express and Diners Club from issuing new debit, credit or prepaid cards to customers over noncompliance with local data storage rules (PDF). should provide a boost to the local banks and fintechs that for over a year have been able to largely offer customers debit and credit cards powered by Visa and Rupay, a homegrown card network that is promoted by the National Payments Corporation of India, a special body of RBI. The resumption of American Express’ business in India Unveiled in 2018, the local data-storage rules require payments firms to store all Indian transaction data within servers in the country.

With Dutchie POS and Dutchie Pay, the cannabis tech company is now offering cannabis operators one of the most comprehensive platforms to manage dispensaries. Called Dutchie POS, this comes just weeks after the company announced a new payment platform, Dutchie Pay. Dutchie today is announcing a new cannabis point of sale platform, including a dual-screen terminal for dispensaries. Zach Lipson spoke to journalist ahead of the Dutchie POS launch, saying this solution is built to accommodate dispensaries of all sizes.

The two moves put Finix squarely on Stripe’s turf, though its CEO and co-founder Richie Serna told us that Finix differs from Stripe in its focus on creating an open ecosystem. Read more.

Rakuten Capital said that it saw a huge market potential for Indian-based rewards business opportunities, and Twid was well positioned to take advantage of this opportunity to build and scale its business model. In parallel with Rakuten, Google’s addition is expected to help Twid expand its model of enabling customers to make purchases using their multiple reward points.

BAI Capital, GIC and GGV Capital co-led the equity portion of the deal, which also included participation from other existing and new investors.

Swedish buy now, pay later giant Klarna is reportedly close to inking a new round of funding that would slash its valuation to $6.5 billion – about 7x of what the company was valued in June of 2021.

The new functionality is only available to users in the U.S., and for security reasons, PayPal says it has implemented an additional identity verification process for users before they can transfer any crypto.

Ecuadorian payments infrastructure company Kushki has raised $100 million in an extension to its Series B round, more than doubling its valuation to $1.5 billion. Put simply, Kushki aims to help make it easier, cheaper and more secure for businesses across LatAm to send and receive/process digital payments.

Affirm — which was founded by PayPal co-founder Max Levchin — has built technology that can underwrite individual transactions, and once determining a customer is eligible offer them the option to pay on a biweekly or monthly basis. Some customers are in fact charged interest but Affirm says it doesn’t charge late fees and that there are no surprises with the amount of interest it charges. In an interview earlier this year, Libor Michalek, Affirm’s president of technology emphasized the company’s efforts to be transparent.

Finix is not coming out of nowhere. The SaaS startup — which started out in early 2020 by selling its payments tech to other businesses — raised a $35 million Series B led by Sequoia.

The investment marks SpotOn third raise in the past year alone and Dragoneer’s sixth time investing in the company over a three-year period. For context, SpotOn’s Series E raise at a $3.15 billion valuation was about 5x of its $625 million valuation at the time of its Series C round. It comes on the heels of a year in which the company says it saw 100% year-over-year ARR growth.

Key among these are features for managing podcast storage across devices, tools to enable annual podcast subscriptions and the newly announced Apple Podcasts Delegated Delivery system that will soon allow creators to more easily distribute their podcasts directly to Apple Podcasts from third-party hosting providers.

Facebook has been in payments since 2009 and says people use its platforms to make payments in 160 countries and 55 currencies, including person to person, business to business, and business to consumer payments. Facebook Pay will soon be renamed Meta Pay, according to a blog post written by Meta head of fintech, Stephane Kasriel.

In 2014, Riverwood Capital and Antonio Soares — who now serves as Dock’s CEO — bought out 100% of Conductor and essentially created the company that is Dock today. The company’s client base includes fintechs, retailers, banks and technology companies that are focused on not only improving the customer experience for the currently banked population, but also on helping bring previously unbanked and underbanked consumers into the digital payments and banking systems.

In addition to payment methods, Arrow also integrates shipping information and affiliated loyalty programs, so customers see everything on a single checkout page. Arrow can be integrated into shopping platforms like WooCommerce or Magneto or through APIs that let merchants replace their existing storefronts with Arrow.

The ability to raise a relatively large seed round so soon after inception speaks to the experience of the company’s founders, which include Juan Pablo Ortega, the co-founder of on-demand delivery unicorn Rappi (which as of last July was valued at $5.25 billion) and Julián Núñez, an early Rappi employee. Yuno wants to bring to Latin American companies an easy online checkout solution that solves the pain point of managing multiple payment methods.

At that time, New York-based Selfbook was valued at $125 million — so it has essentially seen a 2.4x increase in valuation from the fourth quarter of 2021 to the first quarter of 2022 and a 38x increase after it raised a $2 million seed round in April of 2021. Hotel payment software provider Selfbook has completed a $15 million extension of its Series A financing that values the company at $300 million.

Two years later, after the platform did not make enough revenue from developers, the team chose to go vertical to what it is today, Stax, a universal money app on USSD rails for African users. The company, founded by Ben Lyon, Jess Shorland and David Kutalek, fetches all these codes from multiple accounts together into an app users can access offline, letting them perform transactions without dialling any USSD code.

Promise works with utilities and government agencies to provide flexibility in payments for people who can’t cover their whole water or electricity bill at once.

Philippines-based fintech PayMongo, which enables merchants to accept digital payments, announced today it has raised $31 million in Series B funding with an eye on regional expansion.

Split Payments was introduced alongside the news that Messenger is launching new voice message recording controls so users can pause, preview, delete or continue recording a voice message before sending it. The company said that its feature offering end-to-end encrypted group chats and calls in Messenger is now fully rolled out. The launch of Split Payments comes as Messenger added Venmo-like QR codes for person-to-person payments last summer. Messenger also added another security feature that will alert users if someone snaps a photo from Messenger’s disappearing messages.

Apple has announced plans to introduce a new Tap to Pay feature for iPhone that turns the device into a contactless payment terminal. The company says that later this year, U.S. merchants will be able to accept Apple Pay and other contactless payments, including Google Pay, by using an iPhone and a partner-enabled iOS app. \[…\]

American Express has launched its first all-digital consumer checking account, the company announced on Tuesday. The new offering, American Express Rewards Checking, is currently available for eligible U.S. Consumer Card Members. The launch comes as the emergence of digital banking services is causing traditional banks to enhance their digital strategies and offer more competitive banking \[…\]

Other startups in the space using traditional banking infrastructure to make payments more efficient have hit a ceiling on how fast and cheap they can offer payments because of fees charged by these intermediaries, particularly between countries that don’t transact as regularly, said Paysail cofounder Nicole Alonso.

Checkout.com is building a full-stack payments company — it acts as a gateway, an acquirer, a risk engine and a payment processor.