🗓 All FinTech news in September 2022

Uniswap Labs is in early stages of putting together a new round, according to four sources familiar with the matter, as the parent firm of the world largest decentralized exchange gears up to broaden its offerings. One of the new offerings will allow customers to trade NFTs on Uniswap from a number of marketplaces, Uniswap Labs COO Mary-Catherine Lader told news outlet Decrypt. Uniswap Labs, which counts a16z and Paradigm among its existing backers, raised its last funding round — a Series A — in August 2020, according to Web3 Signals. The startup is engaging with a number of investors, including Polychain and one of Singapore’s sovereign funds, to raise an equity round of $100 million to $200 million at a valuation of about $1 billion, two of the sources said, who, like others, requested anonymity sharing private information.

HSBC Asset Management, the investment arm of Britain HSBC Group, has led a seed round of $4 million in Singapore’s customer intelligence and risk assessment startup Bizbaz, the two said Friday. The startup is exploring to deploy its solutions within parts of HSBC in Asia and Europe, Hakobyan said, adding that it would continue to have the autonomy and the ability to bring in other partners as well as customers including new banks and insurance companies. The startup also aims to upgrade its Web presence, recruit more data and software developers as well as data and behavioral analysts and spend some resources on product development, Hakobyan told journalist. The development team at Bizbaz mainly works from the Middle East, while its data team is in India and its sales, business development and product teams operate from Southeast Asia.

The insurtech market has been through a rough time this past year, so we reached out to eight active investors in the space to get a read on what been cooking as the markets aggressively recalibrated what an insurtech startup is worth. When insurtech company Metromile went public via a special purpose acquisition company (SPAC) in February last year, it was valued at over $1 billion. The bulk of the buyers, however, would likely be companies involved in insurance themselves — either insurtech companies acquiring some of their peers or legacy players. As the markets turned early this year, insurtech left most generalist investors’ playbooks almost as fast as Metromile and its peers’ plummeting valuations.

It was at that point that TripActions made the decision to accelerate the timeline for its fintech expense product, TripActions Liquid, which had launched only a month before the pandemic. At that time, the company told me that transaction volume processed via TripActions Liquid more than doubled (by 107%) from January 2022 through March 2022, up 1,231% year-over-year. Citing an unnamed source, Business Insider broke the news on Wednesday that the company had filed confidential paperwork with the U.S. Securities and Exchange Commission for an initial public offering. Prior to the COVID-19 pandemic, TripActions was primarily known for merging many aspects of corporate trip booking — flights, hotels and rental cars — with expense tracking.

The firm uses its existing management fees to fund salaries and general fund operations, but then uses the supplemental revenue to scale. Hustle Fund, an early-stage-focused venture firm built by former 500 Startups partners Elizabeth Yin and Eric Bahn, is growing into its name. The fund is Hustle Fund biggest standalone investment vehicle to date, and propels the firm’s total AUM to more than $125 million. Not all of it has worked as hoped: Bahn admits that Hustle Fund used to run a revenue-based financing fund called Flywheel, but shut it down due to economics being too small.

While there are other NFT marketplaces both in Latin America and around the world, Minteo plans to differentiate itself through its infrastructure and focus on working with local artists and brands, among other things, Santiago Rodríguez, CEO of Minteo, said to journalist. With that said, Rodríguez said he is already seeing a lot of interest for NFTs in Latin America. Investors in the round include Fabric Ventures, Dune Ventures, CMT Digital, Impatient VC, Susquehanna Private Equity Investments, SevenX Ventures, FJ Labs, Big Brain Holdings, G20 Ventures, Alliance DAO, Zero Knowledge and several angel investors. The capital will be used to build up the platform, get artists on board from Colombia and Mexico then over time expand into other Latin American countries, Rodríguez said.

Series A investment was led by AlbionVC and includes Aldea Ventures, as well as previous investors Seaya Ventures, Speedinvest, SIX FinTech Ventures and angel investors, including Leandro Sigman, board member at Endeavor Spain.

Solvo is meeting a clear need for investors today, offering products that are focused on high quality assets, that provide diverse exposure and reduced risk as well as an attractive yield.

U.S. senators Marsha Blackburn, Republican of Tennessee, and Cynthia Lummis, Republican of Wyoming, exclusively shared with journalist the reformed legislation, the Cryptocurrency Cybersecurity Information Sharing Act, which would amend the Cybersecurity Information Sharing Act of 2015 to include cryptocurrency firms. As regulators around the world try to provide frameworks for the digital asset industry, two U.S. senators have introduced a bill to help crypto companies report cybersecurity threats. In general, Lummis has been a vocal supporter of the crypto industry and has sponsored and proposed new bills focused on the crypto industry in recent months. In June, Lummis proposed a bipartisan crypto bill alongside Senator Kirsten Gillibrand, Democrat of New York, with a goal of installing guide rails around the digital asset sector.

More than 10 of the largest projects on Solana are already working on projects that leverage Backpack’s protocol, according to Ferrante. Ferrante’s iPhone analogy seems particularly apt when one considers that as an ecosystem, Solana has chosen to invest in hardware. The Discord community around Backpack has about 2,000 members today, which Ferrante said has been intentionally locked up until today’s announcement that Coral will launch Backpack in private beta and open-source its code, giving members of the Discord priority access. The Backpack wallet, Ferrante said, is like the iPhone’s iOS operating system, where a user can manage their private keys and access xNFTs, which are like the apps on the iPhone. Ferrante said the Coral team is in close contact with the team behind Saga and that he eventually hopes to see xNFTs run as native apps on the smartphone.

Billtrust, a company developing a platform to automate the invoice-to-cash process, today announced that it agreed to be acquired by EQT, the Sweden-based private equity firm, for $1.7 billion in an all-cash deal. It quickly grew to offer software-as-a-service (SaaS) products to manage billing for companies, including electronic billing and payments for consumer and business billing services. Approved by Billtrust board of directors, the transaction is expected to close in Q1 2023 subject to the green light from Billtrust’s shareholders and regulators. Prior to going public through a SPAC merger in 2020, Billtrust made nine acquisitions — most recently of Order2Cash, a cash processes management platform — and raised over $100 million in venture capital.

They include helping city governments provide food stamps to users (which are deposited as a sum on Satispay to be used for food purchases); and a surge of use during COVID when people wanted to pay for items remotely or even in person without even tapping phones or taking out cards, using just Satispay’s app on their devices to complete purchases. The ever-expanding group also includes companies like Dwolla in the U.S. (which Dalmasso says is probably the most similar to Satispay in terms of how it operates); peer-to-peer payment efforts like PayPal’s Venmo and Square’s Cash App; buy-now, pay-later services; and the plethora of blockchain-based efforts to build out new currencies and means of buying and selling; and much more. Today, a startup out of Italy called Satispay — which operates an independent payment network that bypasses big banks and credit companies and promises lower transactions fees plus other benefits like better budget control to its users — is picking up a massive round of funding on the back of strong demand for its services. One of these is that users essentially deposit money into a Satispay account from their existing bank accounts to spend over a period of time, much like a pre-pay account, which helps them control what they spend monthly.

To bridge the gap, Uganda-based fintech Numida has opted to focus its digital lending business on small enterprises as part of its strategy for driving financial inclusion in emerging markets. Spurred by an increase in demand for its services, Numida is currently eyeing growth opportunities beyond Uganda, saying that it has a proven business model that can be adopted across the continent to unlock the potential of MSMEs. The growth plans come against the backdrop of a $12.3 million pre-Series A equity-debt funding round led by Serena Ventures with participation from Breega, 4Di Capital, Launch Africa, Soma Capital and Y Combinator, VCs that are all making their first investment in Uganda. Micro, small and medium-sized enterprises (MSMEs) across Africa make up the bulk — over 90% — of businesses in the continent but are still marginalized in accessing credit from formal institutions because of the nature of their operations; for instance, many often lack the kind of collateral that is acceptable by banks.

While many layer-1 blockchains out there were built for a pretty general purpose, other networks were designed around very specific use cases. Sei, a layer-1 blockchain designed for trading, has launched a $50 million ecosystem and liquidity fund to support new decentralized finance (DeFi) applications on its platform, its co-founders Jeff Feng and Jay Jog \[…\]

Scale is still investing from its seventh fund, and partner Alex Niehenke told journalist that the plan is to deploy capital from the new fund starting in early 2023. The timing of the new fund is about right for the firm, which has raised a new fund every two years since 2016, according to O’Driscoll. O’Driscoll explained that limited partners were on board with the new fund, though they wanted to make sure that Scale wasn’t raising a larger fund than it could deploy successfully. As such, the firm wanted to raise its fund sooner rather than later so if there were entrepreneurs pitching the firm in the fourth quarter, the fund was closed and ready.

Meet Roundtable, a new startup backed by eFounders that wants to bring community-driven angel investments to European startups. Once it has polished this experience for one-off deals, the company wants to empower super angel investors who wants to become solo general partners with their own small VC fund. Roundtable could be particularly useful for existing angel investors who want to unlock some additional capital for their portfolio companies. Down the road, Roundtable can also handle partial exits in case some investors want to get out of a startup while others want to remain shareholders.

At one point, John began having more visibility into the company’s records and found there were inconsistencies in how Better was managing loan documents, post-closings and HR documents. To get a better understanding of what’s happening on a human level, we talked to several former employees of the embattled startup who have been laid off in recent months, as well as current ones impacted by the new leave policy. In the meantime, workers who stayed at the company despite all the goings-on of the past year — only to be laid off with far less in severance pay than those who were laid off before them — feel betrayed.

A number of high-profile angel investors also put money in the round including 12-time NBA All-Star Chris Paul, Super Bowl Champion Vernon Davis, early-stage investors Tim Fong, VSC’s Jay Kapoor and athletes Jimmer Fredette and Kyle Hines.

While French retailers, online shops and businesses can use Stancer starting today, Iliad has already been using Stancer for many of its activities already, including as the payments processing platform to bill Free mobile and internet subscribers. When it comes to online payments, Stancer clients can accept card payments as well as SEPA direct debits. There are many ways to accept Stancer payments — an API, a pop-in or iframe, a Stancer-hosted payment page and CMS plugins. Stancer is already teasing more products down the road, such as split payments and Stancer-designed online shops.

The platform is a part of the Startup with Chainlink program and will be working closely with the oracle network to extend the capabilities of smart contracts so blockchain developers can build multi-chain decentralized applications (dApps) alongside analytical insights in a low-cost, decentralized way. Space and Time, a decentralized data platform, has raised $20 million in strategic funding to help businesses grow through smart contract technology. The capital raise was led by Microsoft venture fund M12 and included investors like Framework Ventures, HashKey, SevenX Ventures, Foresight Ventures, Polygon and Avalanche’s ecosystem fund Blizzard, among others. In the near term, Space and Time wants to help web3 dApp developers simplify their data ecosystems and architectures, Holiday said.

Ultimately, Cohen-Shohet’s goal is to build a holistic, all-encompassing business management platform for small business owners in the beauty and wellness space. GlossGenius has over 40,000 customers in the beauty and wellness space today and sees about $2 billion in annualized transaction volume on its platform, CEO and founder Cohen-Shohet told journalist in an interview. The company plans to use the new funding to grow its employee base of 150 with a focus on engineering, product and design as well as marketing, Cohen-Shohet said. Helping small businesses run big operations is core to the company’s mission, Cohen-Shohet said.

Jaskiw attributes Tactic’s success in closing the round this summer to a few different factors — investors who have a long-term belief in the crypto ecosystem as well as the company’s focus on catering to larger clients who are processing thousands of transactions each month. CEO and founder Ann Jaskiw launched Tactic in 2021 while she was working on a different crypto project and realized from her conversations with founders in the space that they were struggling to close their books each month and stay compliant with accounting principles. Perhaps that part of the reason why less than five months after journalist covered Tactic’s $2.6 million seed round, the crypto accounting software startup has managed to bag $11 million despite a painful market downturn for the sector in what it says was an oversubscribed raise. Looking ahead, Jaskiw said Tactic hopes to become a one-stop shop for companies to manage their crypto accounting processes.

Notably, Robinhood says it won’t charge Robinhood Wallet users network or gas fees for transactions, differentiating its non-custodial offering from other popular non-custodial wallets such as Metamask and Coinbase Wallet. Robinhood rolled out a custodial crypto wallet to its users earlier this year and says it plans to complete a full rollout of the non-custodial wallet to 1 million+ users on the waitlist after the beta is complete, sometime before the end of 2022. Over time, the Robinhood team plans to build out multichain support for the wallet beyond the Polygon ecosystem, Robinhood crypto product manager Seong Seog Lee told journalist. Robinhood is finally rolling out a beta version of its non-custodial crypto wallet to 10,000 customers on its waitlist after announcing the product in May, its CTO and general manager of crypto, Johann Kerbrat, told journalist.

ECB President Christine Lagarde said the central bank must be careful that a digital euro won’t crowd out commercial bank deposits.

According to a press release from New York Attorney General Letitia James, Nexo and Nexo Capital failed to register with the state securities and commodities brokers or dealers and lied to investors about their registration status. Crypto platform Nexo is being sued by eight U.S. state securities regulators representing New York, California, Kentucky, Maryland, Oklahoma, South Carolina, Washington and Vermont. Separately, California’s Department of Financial Protection and Innovation issued a cease-and-desist order against Nexo’s crypto-interest-bearing accounts, according to a document released by the state. Nexo isn’t the first crypto company to land in hot water with U.S regulators over interest-bearing accounts, which have been viewed as securities in select cases in the past.

Given that building a new accounting platform is extremely complex if you want to comply with all accounting rules, Regate partners with software companies that have been working on accounting software for many years. For accounting firms, they can add Regate to their accounting stack and communicate with their clients directly from Regate. There are two types of clients for Regate — companies that have their own accounting department, or accounting firms working with small and medium companies. Regate is currently working with 10,000 clients — many accounting firms as well as many companies directly, such as Le Slip Français, Jimmy Fairly, Cityscoot and Skello.

The Samsung Axis Bank Credit Card, powered by Visa, is our next big India-specific innovation that will change the way our customers buy Samsung products and spend on services through a series of industry-leading features. The South Korean giant said it has partnered with the Mumbai-headquartered Axis Bank and global payments processor Visa to launch the cards, which it is calling the Samsung Axis Bank Credit Card. Samsung has launched two credit cards in India, entering a crowded category that sees more than 50 companies fiercely compete for consumers’ attention in the world second largest internet market. Indian banks have issued over a billion debit cards to customers in the country, but fewer than 25 million unique individuals in the nation have a credit card, according to industry estimates.

Joining them in the round were Kevin Johnson, former CEO of Ebates at Rakuten, f7 Ventures, Blackbird Ventures, Scribble Ventures, Hyper, Susa Ventures, Liquid 2 Ventures, Wischoff Ventures, Exits Capital, Knight Capital; Ancestry CEO Deborah Liu; Firstbase CEO Chris Herd; and XMTP co-founder and president Shane Mac. Enter Checkmate, a company they started 18 months ago that aims to compete against online deal aggregators, like Honey, Capital One Shopping and Vetted, to provide a shopping tool that gathers all the online discount codes, gift cards and personalized deals from your inbox and automatically applies them at checkout. The new funding is Checkmate total funding to date, and Dixon and Garton-Smith say the company will deploy the funds into product development, customer growth and additional brand partnerships. The more coupon codes we can find for online shopping the better, but Harry Dixon, Rory Garton-Smith and Elliot Rampono thought something was missing: the ability to house all of the various savings we receive in one place.

Nibiru, a new crypto derivatives protocol co-founded by Tribe Capital GP Arjun Sethi, has raised $7.5 million in seed funding at a valuation of $100 million, two sources familiar with the matter told journalist. Sethi co-founded the startups with four industry veterans — including Sankha Banerjee, formerly with Credence Capital and Binance; and Boris Revsin, who co-founded Republic Capital. Currently in private testnet, Nibiru decentralized protocol unifies derivatives trading, spot trading, staking and bonded liquidity, and aims to serve users across over 40 blockchains, it says on the website. Nibiru has attracted nearly two dozen contributors from firms including Meta, Reddit, JP Morgan and Yahoo, an investor deck obtained by journalist showed.

Inclined, he adds, not only opens up the option to borrow against whole life insurance policies to more people — something that has historically been reserved for the wealthy — it also gives banks a way to better participate in the market at scale. Whole life insurance policies differ from term life in that they accumulate value that is available permanently, rather than just paying for coverage. After a short break from those two stints, Shaw teamed up with Josh Wyss and Graham Gerlach in 2020 to start his third company: Inclined. And when whole life policyholders want to access their cash value, they often choose to do so via a loan, rather than withdrawing the money directly, which is less efficient, he explains.

While Indonesia isn’t the most crypto active in the region — total crypto value received was less than half of Thailand’s from July 2021 to June 2022, according to Chainalysis — the country is thought to hold huge potential for web3 adoption, thanks to a young and sizable (270 million) population as well as a vibrant Web 2.0 industry. As such, SerMorpheus recently closed a $2.5 million seed round to create a user-friendly platform for businesses to create NFTs; end users, on the other hand, can buy and trade digital assets on the platform with the local currency rupiah. The platform is still manually onboarding businesses and brands — so far 25 of them, including Indonesia Comic-Con — but the next step is to make SerMorpheus as automated as creating a Facebook page. Its seed round was led by Intudo Ventures, with participation from 500 Global, Febe Ventures, AlphaLab Capital, BRI Ventures and Caballeros Capital.

Giesecke message was sent to around 500 Klarna employees, including in IT and and recruiting, though Klarna tells us in a separate statement that the job cuts will impact fewer than 100 employees globally. In May, the company shrunk its global workforce by an estimated 10%; it also raised funds at a $6.7 billion valuation in an $800 million round, down from the somewhat aspirational $45.6 billion valuation that Klarna was assigned by SoftBank when the Japanese conglomerate led a $640 million round in the company in June of last year. Our organization is built on 700 fast-moving teams that are constantly changing, and Klarna employees move between teams and departments every week. When layoffs follow layoffs, as is happening at a growing number of companies (TC’s Natasha Mascarenhas has observed this trend at Robinhood, On Deck, Gemini and others, for example), morale can sink further still.

Most tech companies, including Apple and Microsoft, use a similar bug bounty methodology, but the practice was less well employed in web3, in part because hackers can sometimes be far more incentivised to steal the money rather than report the bug, especially when millions of might be dollars might be on offer. So Immunefi developed a bug bounty standard which scales, to encourage projects to pay rewards for big vulnerabilities at a rate equivalent to 10% of the funds at potential risk. Immunefi connects web3 projects that need their code checked and secured with whitehat hackers who report vulnerabilities and claim monetary rewards. It was around this time last year that we reported that Immunefi — one of the emerging bug bounty and security services platforms for DeFi — had raised $5.5 million in funding.

The announcement comes two months after the country’s financial watchdog said it is proving $3.4 billion in abnormal money transfers, possibly related to crypto activities after South Korea’s two largest commercial banks — Shinhan Bank and Woori Bank — internally inspected and found some dubious foreign currency transfer in June. The FSS also said the probe found that 82 corporations, including travel-related and cosmetic firms, have been involved in the abnormal money transfers so far. The authorities confirmed that most dubious foreign money remittances involved crypto-related activities because the transactions were transferred from cryptocurrency exchanges to local companies, then sent abroad. U.S. dollars accounted for 81.8% of the abnormal money transfer, while Japanese Yen and Hong Kong dollars were 15.3% and 3.1%, respectively.

He will continue developing the company’s technology, including automating the process of acquiring merchants on Shopify and accelerating the operational efficiencies running these online stores through OpenStore, even going so far as to reduce the acquisition offer from the current 24 hours down to an hour, the company said. The early success of the company may lie in the makeup of its founders: OpenStore is led by some heavy hitters, including Founders Fund general partner Keith Rabois and Jack Abraham, Atomic founder and managing partner, who started the company along with Matt Lanter and Jeremy Wood. In addition, while funding to aggregators has slowed to a comparative trickle — $9 billion of funding went into aggregators by September 2021, compared with $2 billion over the same period in 2022, per the Financial Times — the Miami-based company is among the recipients of some of those recent investment dollars. The company said this is a 25% increase in the company’s valuation from its previous round of $75 million in funding announced in November 2021.

Shingal, the startup’s CEO, said crypto hedges and investment funds often run with a small number of staff, and the process of calculating tax and performing compliance is time consuming because they have to pull data from multiple sources, merge it and then adhere to different compliance and reporting regulations for each type of transaction. Founded in May 2022 by Tonmoy Shingal and Pankaj Garg and based in Bangalore, Binocs currently has over 1,000 users, including retail and institutional investors who need to perform forensic accounting and risk management. He added that regulations are one of the biggest obstacles to more adoption of crypto, with about 15 to 20 countries that currently tax crypto investments, and 60 to 70 that will in the future. Binocs’ founders point to figures from the Coin Market Cap that say the total market cap of the crypto industry rose from about $325 billion in September 2020 to $1 trillion in September 2022.

UPI Lite, which was first proposed earlier this year, processes payments below 200 Indian rupees ($2.5) and is aimed at lowering the burden on banks’ infrastructure, executives said at a conference Tuesday. He said a lighter version of the payments system, called UPI Lite, is now live in the country with eight banks including HDFC, SBI and Kotak. The payments network, which was built by a coalition of banks, is India’s attempt to challenge card companies in an open market, bring hundreds of millions of people into the fold of digital payments and curb the proliferation of corruption. On Tuesday, Das said two new offerings of UPI — one expands its usercase while the other will helps it continue to scale — have gone live.

Ledgy’s platform today covers tools for finance, HR, legal and VC teams as well as employees themselves, and is used both to provide a snapshot of the state of a company’s equity at a given moment, and to help employees and companies manage what they may choose to do with that over time. While a number of companies like Carta, and more recently AngelList and Pulley (respectively valued at $6.8 billion, $4 billion, and up to $300 million for the younger Pulley) continue to make waves in the U.S. market, Ledgy has spotted an opportunity to build for scenarios where companies want to provide international employees with equity and need to balance the differences in regulations and culture when doing so. Ledgy, a startup out of Zurich that builds cap table management software specifically for companies and their employees working across multiple countries, has raised $22 million, a Series B that it is using for hiring, further product development and to bring on more users. We are starting to see a lot more European startups opting to remain in Europe to raise funding and scale rather than transplant to the U.S. as they would have been expected to do in the past, and with that the issue of equity awards for those companies’ employees is only growing.

Retail investors within and outside Africa will then be able to access and trade cross-border stocks and bonds via white-labeled apps launched by brick-and-mortar brokers and powered by SecondSTAX or third-party wealth tech apps such as Bamboo, HashApp, Robinhood and Hisa. While local retail apps such as Bamboo and Chaka offer U.S. and foreign stocks to individual consumers, they are as constrained as traditional brokers when it comes to helping consumers buy stocks and bonds across different capital markets within Africa. Per reports, major regional exchanges in Africa have raised over $80 billion in equity capital markets and $240 billion in debt capital markets. However, at launch, it will launch in the first two, enabling routing of market orders for all stocks across Ghanaian and Kenyan exchanges and allowing cross-border transactions within both capital markets through its sponsoring broker partnerships.

The Singapore-based VC focuses on early-stage financial tech startups, but it operates with a pretty expansive view of what constitutes fintech; its portfolio includes startups working on AI, healthcare, crypto and (of course) several buy now, pay later schemes. Arbor Ventures, funder of fintech and shopping startups like installment loan company Tabby and Amazon brand factory Heyday, has locked down $193 million toward its largest fund to date, journalist has learned. Other fintech investors to make headlines lately include New York Kli Capital, which is raising a $50 million third fund, and Jakarta, Indonesia-based AC Ventures, which is targeting $250 million for its fifth fund. Arbor did not respond to requests for comment on its plans for the money, but its deals over the past year seem as varied as ever; they span wholesale shopping site Ralali, AI insurance data firm Planck and HR startup HiBob.

Mark Mullen, co-founder of Bonfire Ventures, the firm that invested in Brightflow’s seed stage, said the company’s initial customers were e-commerce, which made it easier to understand the pain points. However, Brightflow founder and CEO Robbie Bhathal told journalist that the company differentiates itself by focusing on the automation of financial services and disseminating that information in a way that a business owner can understand. The San Francisco–based company cash flow calculator grabs financial data from platforms like Shopify, Amazon, QuickBooks, Facebook and Google Ads, and then provides a real-time look at cash flow. Brightflow AI is injecting technology into this problem with its forecast and analysis tools so that small businesses can assess their cash flow and make data-driven decisions in real time.

It’s why Julaya launched its services in the west African country and has since expanded into Senegal, where mobile market penetration is around 80% as well as other countries in the UEMOA (West African Economic and Monetary Union) region, which also have prevalent mobile money usage. Proceeds from this financing round will assist the fintech in further expansion plans across Francophone West Africa as it plans to open offices in Benin, Togo and Burkina Faso, hire talent and boost product development including the launch of a credit product targeting 200,000 SMEs in the UEMOA region. EQ2 Ventures, Kibo Ventures, angel syndicates Unpopular Ventures and Jedar Capital, existing investors Orange Ventures, Saviu, 50 Partners and Ivorian business angel Mohamed Diabi and professional football player Édouard Mendy also invested in the round. The company, which facilitates B2B payments for businesses in Francophone West Africa, mainly via mobile money channels, has raised a total of $7 million in the financing round.

Pie Insurance, which provides workers’ compensation insurance to small businesses, has closed on a $315 million Series D round of funding. Notably, workers’ compensation insurance is the only commercial insurance mandated for nearly every company in the United States, points out Lauren Kolodny, founding partner at Acrew Capital.

Noble today emerged from stealth and announced the close of a $15 million Series A round led by Insight Partners with participation from Cross River Digital Ventures, Plug & Play Ventures, Y Combinator, Flexport Fund, TLV Partners, Operator Partners, Verissimo Ventures, Interplay Ventures and the George Kaiser Family Foundation.

Nilos also helps you manage your crypto transactions as you can orchestrate crypto-to-crypto payments as well as crypto-to-fiat payments. The startup currently takes a fees on crypto-to-fiat transactions, but the company plans to move to a more traditional software-as-a-service subscription model as it’s more transparent for the end users. Meet Nilos, a startup that wants to bridge the gap between crypto wallets and traditional business bank accounts. The company provides a dashboard that displays all your transactions — whether those are fiat transactions or crypto payments.

However, according to Revolut breach disclosure to the authorities in Lithuania, first spotted by Bleeping Computer, the company says 50,150 customers are impacted by the breach, including 20,687 customers in the European Economic Area and 379 Lithuanian citizens. Fintech startup Revolut has confirmed it was hit by a highly targeted cyberattack that allowed hackers to access the personal details of tens of thousands of customers. However, the breach disclosure states that hackers likely accessed partial card payment data, along with customers’ names, addresses, email addresses, and phone numbers. But Revolut warned that the breach appears to have triggered a phishing campaign, and urged customers to be careful when receiving any communication regarding the breach.

This week, we’re getting a look at what SoftBank is doing to diversify how it deploys capital with a little less direct risk to itself: DTCP says that SoftBank has taken a major stake in its next fund, part of a $300 million tranche that it has raised to double down on growth rounds in Europe. DTCP’s first fund in 2015 and second fund in 2018 totaled $410 million and was invested in 32 enterprise software companies across Europe, Israel, USA and Asia, and DTCP notes that 11 of those investments have been acquired or gone public so far. This fund, DTCP’s third, is a mark of how far the European ecosystem has come along when it comes to growth rounds: once it would have been a rarity to raise growth rounds in this region, with the more promising startups founded in Europe decamping to the U.S. to tap investors there if they wanted to scale. While SoftBank is likely to continue making direct investments, investing in a fund like DTCP helps it source more deal flow, both as an indirect backer and to vet more companies that it might want to pursue directly as well.

Scratchpay raised the $35 million in a Series C round led by Norwest Venture Partners, with participation from Alumni Ventures, Companion Fund, Struck Capital, SWS Venture Capital and TTV Capital, among others. Although they allow someone to purchase services first and pay it back gradually, Keatley said the services offered are helping the user with their needs instead of enabling them to buy a want. The company has been focused on its recent endeavor of expanding its finance services from veterinary care to include human healthcare. By the end of the year, Scratchpay is expected to have processed over $1 billion in patient — human and nonhuman — payments across all its markets in over 10,000 practices, according to the company.

The Tel Aviv-based firm aggregates crypto data across different wallets, accounts and platforms, so crypto entities’ financial teams can better understand what happening internally at their business without needing the crypto-native knowledge and experience to gather the information, Zackon said. Its platform can onboard any on-chain or centralized finance data sources and enable financial workflows like balance calculations or auditing and reporting so businesses can monitor and manage their web3 assets both on-ramp and off-ramp, Zackon added. To date, Tres has monitored and analyzed more than $40 billion of crypto assets for customers like Hivemind Capital, non-custodial staking platform Stakely and blockchain infrastructure firm Blockdaemon across the U.S., Israel and Europe, its press release stated. Something like that doesn’t exist today, you have to look at Ethereum data or Solana data one at a time.

As previously reported in the Irish media, documents filed in the Companies Registration Office in Dublin, Ireland, where Web Summit was originally launched, show that Cosgrave, Web Summit CEO, is listed as a director of the Web Summit Ventures Management Ltd. While it’s been previously reported that Web Summit co-founder, Paddy Cosgrave, will imminently launch his new vehicle, Web Summit Ventures (WSV), the nature and size of the fund has not, until now, been revealed. The move follows an acrimonious fallout between Web Summit’s co-founders, who first started the now-defunct Amaranthine VC fund in 2018, in part to join the ballooning investment ecosystem that had grown up around the Web Summit events. The Amaranthine Fund was set up by Cosgrave; David Kelly, a Web Summit co-founder; and Patrick Murphy, a fund manager, in 2018.

An investment is typically part of a broader strategic play by the banking industry juggernauts, and Monese’s latest tie-up is no different — HSBC is looking to leverage Monese’s banking-as-a-service platform, which it unveiled last year to help other financial institutions easily develop online money management and related digital services.

Banks and card issuers typically use fraud detection algorithms for crypto that aren’t nearly granular enough, Ranjan said, meaning around half of the customers who attempt to transact using fiat-to-crypto onramps through traditional platforms are declined as fraudulent.

Evgeny Gaevoy, the founder and chief executive of Wintermute, disclosed in a series of tweets that the firm decentralized finance operations had been hacked, but centralized finance and over the counter verticals aren’t affected. Wintermute, a leading crypto market maker, has lost about $160 million in a hack, a top executive said Tuesday, becoming the latest firm in the industry to suffer a breach.

Kuila said PhonePe never held any stake in Zopper, and the startup, which counts Tiger Global among its backers, continues to be supported by its early backers and new investors. Zopper currently has presence in over 1,200 Indian cities and has partnered with over 150 players in the industry, including retail group Amazon, ride-hailing startup Ola, retail chain Croma, phonemaker Xiaomi, Japanese conglomerate Hitachi, and Equitas Small Finance Bank. He said Zopper is initially aiming to first reach nearly $1 billion in revenue, and over the course of about five years it will file for an initial public offering. That business, an API platform for insurance infrastructure, said on Tuesday it has raised $75 million in new funding.

In this, Sequence and its investors believe the startup is an early mover in building building payments software that allows businesses to capture data in real time and to feed that into dynamic pricing and payments flows. The role of no-code and low-code software has often been described in terms of being more efficient, or just to cut through red tape in helping non-technical people get more hands-on with the digital products they are themselves using, but it has more recently taken on a more pragmatic, fiscally-minded purpose: at a time when companies are reevaluating their spend on new product and projects and how they allocate their talent resources, services like billing and payments are also getting revisited. Sequence, which wants to create what it describes as a new kind of FinOps stack for B2B businesses — APIs and other tools to create more responsive pricing, billing and related services, leveraging data and analytics to do so — has raised $19 million, a seed round that it will be using to continue developing its products and hiring more talent. Companies like Stripe, Paddle and Modern Treasury have opened the door to making it easier for digital businesses — which are not necessarily at their core payments and billing companies — to use APIs to incorporate more modern payments, billing, reconciliation and other revenue-related services into their financial stack.

Much of the shopping technology focuses on e-commerce, but Swiftly’s technology taps into that online shopping experience to make shopping at a brick-and-mortar store just as engaging and easy. It also provides analytics and advertising, so that those stores can compete against e-commerce retailers using their operational strength without being disadvantaged by an aging or non-existing technology platform. If you’re feeling some déjà vu, you would be right: this is the second $100 million the retail technology company has raised in the past six months — and in a tough fundraising market, too. Swiftly Systems entered unicorn territory after announcing today that it grabbed another round of $100 million, this time in a Series C.

The company collects data from places like Shopify, QuickBooks and Google Analytics and gives each customer its own data warehouse backed up by managed data pipelines. Bainbridge Growth, a Boston-based software startup providing data, analytics and financial modeling for e-commerce companies, inked $4 million in seed funding. Tregoe, CEO, told journalist that while helping brands like Casper, Peloton and Warby Parker understand how to do more effective Facebook advertising, they realized they were building big data systems and modeling revenue on a per customer basis. Bainbridge started with a financial model and added analytics to help the financial model make better assumptions and then a data system.

Baldwin describes Boundless Rider as a standalone motorcycle, e-bike and power sports product that can be purchased directly from the company or eventually, bundled with another carrier’s homeowner or car insurance product or purchased through a manufacturer at the time of purchase. CoverTree CEO Adarsh Rachmale – who left his product management role at LinkedIn to focus on building the insurtech with Rishie Modi and Divyansh Sharma – says the goal of the company is to only focus on pre-fab or manufactured home residents. As of 2019, about 10% of new single-family homes (including manufactured homes) were categorized as manufactured homes. Boundless Rider is a new insurance company founded specifically to serve riders of motorcycles, e-bikes and power sport vehicles.

Founded by Kamesh Goyal, an ex-KPMG executive with more than three decades of experience in the insurance industry, Digit has simplified the process of buying insurance, allowing users the ability to self-inspect, claim submissions and process service requests from their smartphones, it said in the filing last month. The Securities and Exchange Board of India (SEBI), the Indian market regulator, updated the status of Fairfax-backed Digit to note that it had moved the process of issuance of observations for the startup’s filing into abeyance. The Indian startup, valued at $3.5 billion and which also counts Sequoia Capital India, TVS Capital, A91 Partners and cricketer Virat Kohli and actress Anushka Sharma among its backers, filed the draft red herring prospectus to go public last month. SEBI’s move comes at a time when several local startups, including budget hotel chain Oyo and financial services platform MobiKwik, have delayed their IPO plans as they closely monitor the condition of the global market, which has reversed much of the gains from the 13-year bull run.

Two years before Youcef Oudjidane co-founded Sudanese fintech Bloom after failing to find startups tackling currency depreciation in Africa to invest in, he was the managing partner and head of EMEA (Europe, Middle East and Africa) at Class 5 Global, a San Francisco-based venture fund with a keen interest in emerging markets. The early-stage fund — which has made four investments: Ceviant, Apata, Thepeer and Anchor — consists of four venture partners, mainly founders that Oudjidane has backed: Ahmed Sabbah (Telda CEO), Prince Boampong (Dash CEO), Shekinah Adewumi (Apata CEO) and Kieran Gibbs, a professional soccer player. Oudjidane believes Africa is at the intersection of opportunity, that is, the next billion people to come online — and judging by its current portfolio of pre-seed stage startups, fintech is what intrigues his fund. Investing in startups building financial infrastructure is one of Byld Ventures’ principal themes, in addition to startups reversing Africa’s brain drain and repeat founders.

The division is backed by Barry Silbert Digital Currency Group and the blockchain protocol NEAR (from which OWC previously spun out), Jeff Lavoie, head of investments at OWC Ventures, said to journalist. Open Web Collective, a blockchain and web3 accelerator, has launched a new division called OWC Ventures to invest in early-stage crypto startups, the team exclusively told journalist. Aside from investing in developers, OWC Ventures will also deploy capital in other sectors like DeFi, SocialFi and gaming, Lavoie said. NEAR protocol’s focus has been on improving developer language, documentation, the technology and other things they’ve created, Lavoie said.

It is a digital wallet and password manager for financial services and banking apps, but Soffio calls it a financial digital passport, which helps with user identification, making the task less cumbersome for both consumers and financial services. Soffio said Portabl chose Harlem Capital to lead the round after a call he’ll never forget: Yenkalov, a Ukrainian citizen, was trapped in the country as the war with Russia broke out in the middle of a fundraising call with the firm. Yenkalov noted the emergence of decentralized identifiers, verifiable credentials and zero-knowledge proofs, saying that the industry is closer than ever to enabling financial organizations to benefit from consumers owning and sharing their own data.

Allocations just got valued at $150M to help private equity funds lure smaller investors Payall lands $10M in a16z-led seed round to help banks facilitate more cross-border payments Lease-to-own fintech startup Kafene raises $18M to battle BNPL Southeast Asian fintech Fazz raises $100M Series C to serve businesses of all sizes Nigerian financial management app for merchants Kippa bags $8.4M in new funding Composer raises $6M for automated investing platform Redfin CEO, DoorDash co-founder invest in new startup, Far Homes, which is building a portal for Mexico real estate German software firm Candis raises $16M to expand AP automation Splitit drives installments-as-a-service growth with a $10.5M funding PortX launched as new entity by ModusBox and secures $10M in new funding Adyen announced on September 15 that it has become the first fintech to partner with Cash App (Block) to offer Cash App Pay, a mobile payment method, to its U.S. customers. In 2020, digital bank Varo became the first-ever all-digital nationally chartered U.S. consumer bank — meaning it received approval from the Office of the Comptroller of the Currency to become an actual bank, as opposed to partnering with one as most digital banks do.

We don’t know how long this economic situation is going to carry on, and so I think it’s going to really start to weed out the business models that are really sustainable through different economic cycles and those that are going to struggle. So we repositioned the business to continue to invest and build products that customers are going to love and are going to fulfill the mission but scaled back a little bit on other areas of expense. I think what’s going to be really interesting, over these next few quarters, is to see how the kind of tough decisions we made early on to become a bank will really make a lot of sense. There’s a lot of oversight in being a real bank, not just a tech company partnering with a bank, and the flip side of that is it allows us to control our own regulatory destiny.

CRED partnered with LiquiLoans last year to launch CRED Mint, a service that allows CRED customers to lend to one another at an interest rate of up to 9% annually. CRED, backed by Tiger Global, Sequoia India, Alpha Wave Ventures and Dragoneer and valued at $6.4 billion, also engaged with Amazon-backed Smallcase earlier this year, initially to explore an investment and later for a majority acquisition, journalist reported earlier. CRED plans to invest about $10 million in its lending partner LiquiLoans as the Indian fintech startup broadens its ownership in financial services, journalist has learned and confirmed. The Bengaluru-headquartered startup investment in Mumbai-headquartered LiquiLoans increases the lender’s valuation to close to $200 million, the firms said in a statement.

The beauty of having Stanford students within this network was that our Stanford students pulled the other students into the networks that the Stanford students are so fortunate to have. What’s really wonderful about it is that we did have Stanford students, but we had students from University of Texas, with other students from Yale and Penn and WashU, so it it actually spanned multiple different universities . . . and we’re really excited to try to expand to as many universities as possible. And in fact, in the relationships that I have with my students, I will tell certain students who I know really well, ‘You have these incredible skill sets that are so unique and not found in many people that you should go to a large company; you will have so much impact there.’ Now, co-founding partner Ann Miura-Ko and Tyler Whittle, a senior associate with the firm, have developed a new program to help student teams similarly develop an understanding of what big ideas look like — and why most concepts are not big ideas.

They include Mask Network, MetaWeb Venture, Eniac Venture, Tess Venture, Stratified Capital, Fundamental lab, Incuba Alpha, Zeuth Venture, Cogitent Venture, Atlas Capital; Impossible Finance, RSS3, ShowMe and ETHsign’s co-founders Yan Xin and Potter Li. That’s why Yu, along with his former BTC China colleague Errance Liu, set out to build KNN3, a permissionless (hence decentralized) tool for developers to draw insight from cross-blockchain user data. One of KNN3’s better-known customers is Mask Network, which enables users to send cryptocurrencies on Web 2.0 services and is now building a decentralized identity system using KNN3’s tech. The latest to get VC recognition is KNN3, a Singapore-based startup working to help developers make sense of relational data across blockchains.

Its customers are asset managers looking to offer these alternative investment opportunities to their private wealth clients, who tend to be high-net-worth individuals that meet regulatory accreditation requirements applied to many alternative assets, Advani explained. Advani started Allocations in 2019 as a response to challenges he faced in trying to set up his own investment funds and realizing that none of the tools available to him at the time could help him spin up funds quickly enough to stay competitive in the increasingly fast-paced private markets. Less than three years after its founding, the company, which provides APIs to help private fund managers streamline processes, has crossed $1 billion in assets under administration on its platform, its CEO and founder Kingsley Advani told journalist in an interview. Taking a page from KKR’s book, Advani said Allocations is in the early stages of exploring a blockchain offering as he thinks the technology can help meaningfully streamline fund administration.

With this first upgrade, the community decided to swap the proof-of-work chain with this proof-of-stake chain upon hitting a certain Total Terminal Difficulty (TTD) value on the original Ethereum blockchain. Previously, the Ethereum blockchain relied on proof-of-work, a consensus mechanism that requires a lot of computational effort from all the decentralized nodes participating in the blockchain. How the upcoming Ethereum Merge could change crypto’s rewards, costs and reputation Which Ethereum-focused startups will survive the Merge? According to the Ethereum Foundation, today transition reduces Ethereum’s energy consumption by 99.95%.

Kenya’s MotiSure rides on micro-payments to drive personal mobility insurance growth International startups shrug off US insurtech meltdown Why 2022 insurtech investment could surprise you Driven by a viable business model, the startup, which also has operations in Uganda and Nigeria, has entered its growth phase and is eyeing more partnerships in a bid to drive mass market insurance adoption in Africa. Through API integration Turaco’s partners like PayGo companies (M-KOPA), ride-hailing platforms (SafeBoda), fintechs and micro-finance institutions are able to bundle insurance with their core products or services. Through its B2B2C model, Turaco has created an expansive distribution channel that is enabling it to tap into a large pool of potential customers in its markets, providing insurance to a group that has never consumed it before.

Tech-talent marketplace MVP Match has raised €5 million ($5 million) seed funding from Stage 2 Capital to double down its strategy for pairing companies with talent from across the globe. Wense, who founded the startup in 2020 together with Philipp Petrescu, added that MVP Match acts as an Employer of Record, which enables it to manage the whole recruiting process including the establishment of local office spaces and talent onboarding. MVP Match said it uses product and technology executives like CTOs and experienced domain experts to vet talent before recommending them to companies. The plan to grow its reach follows the launch of a new hub in Egypt that MVP Match will use to tap talent in Africa — with the aim of creating more networks in the region.

To that end, Denim provides financial products, operations tools and automated workflows for freight brokers — the middlemen between shippers and carriers. CEO and co-founder Bharath Krishnamoorthy tells journalist that the new cash, a combination of equity ($26 million) and debt ($100 million), will be put toward scaling the business and providing Denim customers with working capital. Why Convoy’s Dan Lewis expects digital freight to go mainstream within the year Denim competes with other fintech firms in the space, including TriumphPay, HaulPay and OTR Capital. But he did volunteer that Denim has connected more than 7,000 freight brokers, shippers and carriers since its launch three years ago.

These will likely become more acute as customers begin to use BNPL for routine expenses, the agency said — the CFPB found that BNPL customers are increasingly paying for purchases like groceries and gas, spurred by macroeconomic pressures including inflation.

The transition occurred at block 15537393 on September 15 at 1:42:42 a.m. EST. There were no big hiccups, with one exception. A single block was missing, leading some investors to describe the merge event as the best-case scenario.

Ratio gives SaaS companies capital upfront so they can offer customers more flexible payment options. Co-founder and CEO Ashish Srimal founded Ratio in 2021 with CTO Mason Blake, and they have been heads down ever since working on the company’s concept, which is to help SaaS and technology companies tap into the $1.5 trillion subscription market for recurring revenue.

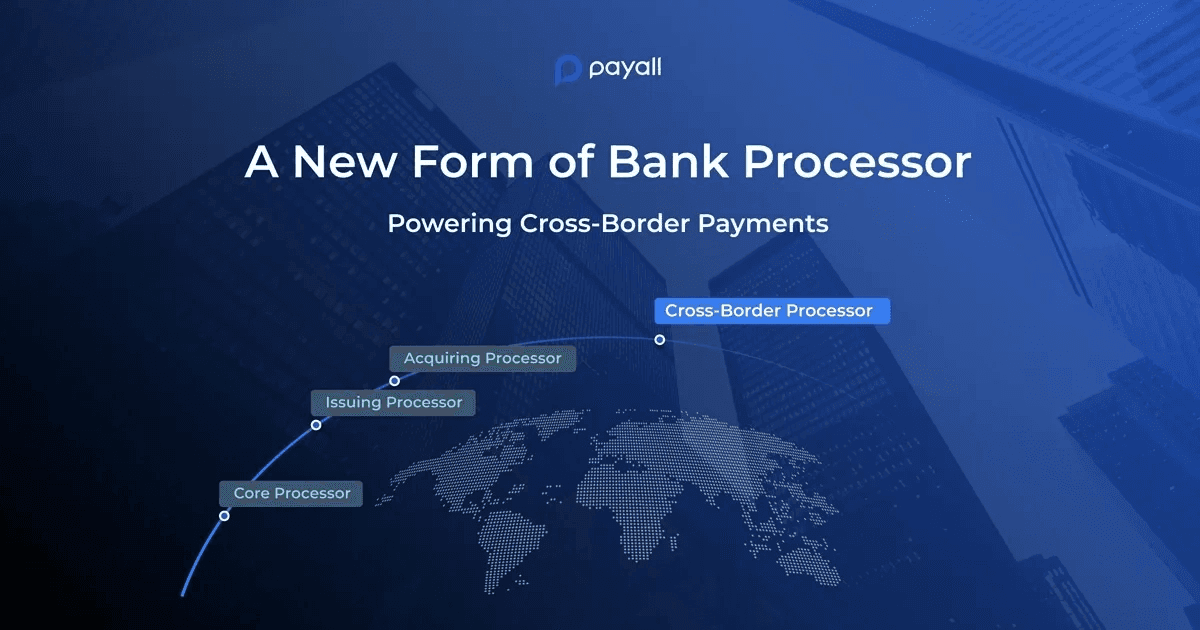

Payall differentiates itself from other startups in the cross-border payments space in that rather than competing with banks, it works with them by white labeling its software. Indeed, with the COVID-19 pandemic fueling more remote work globally, the need to provide cross-border payments for business and individual clients has never been as pressing for banks. He founded Payall, a cross-border processor for regulated banks, in 2018.

Earlier this year, Majority announced that users can register for an account without needing a social security number or U.S. documentation, and instead use an international government-issued ID and proof of U.S. residence — a move the startup says could make its services more accessible. The fintech announced today that it has raised a $37.5 million Series B, $30 million of which is in equity financing led by Valar Ventures and other existing investors, and the remaining $7.5 million in debt financing from an undisclosed U.S.-based commercial bank. Nine months after raising a Series A round, Majority has raised tens of millions in both equity and debt financing for its mobile bank for migrants. Creating physical spaces has helped the Majority gain trust with consumers, Larsson explained, showing that the company won’t just show up, handle money and disappear in a few weeks due to the volatility of startups.

The team’s goal is to tap the blockchain to build a music creation suite that bakes in an open source ethos, allowing producers to sample a wide variety of songs and sounds while the platform ensures that credit always flows back to original creators appropriately. Arpeggi Labs, a new crypto startup focused on using blockchains to make music creation more collaborative, has scored $5.1 million in seed funding from Andreessen Horowitz crypto arm alongside a host of artists including names like Steve Aoki, 3LAU and Wyclef Jean. To make this dream happen, Arpeggi is aiming to go beyond developing a protocol and build an entire in-browser digital audio workstation that allows producers to mix blockchain-minted beats while integrating with the wider arena of Web 2.0 and web3 music platforms. While the company hasn’t landed on whether they’re looking to issue a token for the platform down the road, the founders say they are mainly focused on enticing music professionals who haven’t already aligned themselves with the web3 mantra but are excited about the idea of the industry doubling down on open source.

Meet Prediko, a new startup that sits at the intersection of e-commerce, fintech and software as a service. Prediko has built an online dashboard that lets you review your inventory position as well as plan and order more products. Customers connect Prediko with their Shopify store directly — the startup is building integrations with other e-commerce platforms. After that, they can generate inventory reports to see fast-moving products, slow-selling items and the current retail value of the inventory.

Investors such as Inovo, Credo, LauncHub, Vitosha, VentureFriends, and Marathon VC are all VCs of varying sizes who are — as we speak — roaming everywhere from Estonia and Poland all the way down to Greece and Turkey looking for early-stage startups to write checks for. Started in 2016, 500 Istanbul began with a $10.5 million fund and invested in 40 companies from Turkey, Hungary, Romania, Bulgaria, Greece, Ukraine and Poland, and has three unicorns in its portfolio. What happened to Western European VCs in the last 15 years started to happen to Central and Eastern (and South Eastern) VCs about two to three years ago and is now gathering pace. That may be the case but as the past recedes, having those U.S. connections are less interesting, as other VCs in the region will make their own connections to U.S. networks and U.S. VCs.

Crypto exchange and marketplace Reku has been riding the wave with what it says are the lowest fees on the market, and a platform that is aimed at both newcomers and experienced traders. Its founders say that Reku’s five years of operation mean that they know how to scale and endure fluctuations in the market, including the pandemic and this year’s recession. It is compliant with Indonesia’s commodities future trading agency (BAPPEBTI) and emphasizes user safety by offering only well-established cryptocurrencies like Bitcoin and Ethereum. Today, the startup, founded in 2017, announced it has raised $11 million in Series A funding, led by AC Ventures (ACV) with participation from Coinbase Ventures and Skystar Capital.

He notes that by using Kojo, supervisors spend about 38% less time on materials management, back-office staff save approximately 75% of time processing purchase orders and customers save around 3 to 5% on materials. Earlier this year, the startup rebranded to Kojo and expanded from serving just one construction trade — electrical — to eight, including mechanical, concrete, drywall, roofing, flooring, site preparation and self-perform general contractors. In other words, it provides software to help contractors get the best price for the materials they use in construction projects so they save a lot more money, move faster and have less waste. Kojo claims it can help contractors save as much as hundreds of thousands of dollars in materials annually due to far less waste, while also cutting down their order process time by 50%.

When DolarApp founders Zach Garman, Álvaro Correa and Fernando Terrés were living in the United States and Europe, they would spend time in Latin America, where they saw problems that friends were having when it came to finances and access to banking in dollars.

Power’s first product is the credit card issuance program, which is designed for companies, brands and banks to offer embeddable fintech experiences, like customized credit card programs, targeted promotions and personalized rewards, into existing mobile and web applications. Power, a fintech infrastructure startup, is now kicking off its full-stack credit card issuance platform after a year in stealth mode and with $16.1 million in seed funding and $300 million in a credit facility.

Despite concerns that the EWA technology is replicable, Aris Xenofontos, partner at Seaya, is of the belief that EWA is a defensible business model because the moving parts are complex enough to deter corporations from coming up with their own solutions. For accounts that start on an employee-pays model, employers will get a better understanding of how EWA improves employee productivity and retention over time. What we’ve found is that EWA startups typically service a mix of customers across both models, where the employer pays in some cases and the employee pays in others. Despite a few different EWA models seeing varying success at the moment, Ho believes the model that places the cost on the employer is the one that will win.

The company’s co-founder and CEO Kevin Li said that while Goldsky closed the seed round before this summer’s dropoff in crypto prices, the company’s focus on infrastructure has given it an edge to weather bear market conditions. By automating the creation of data pipelines, Goldsky enables its customers to spend more time working on building their core products rather than parsing the data feeding into those products, Li explained. While there are other startups such as The Graph working to solve similar problems, Li said Goldsky’s differentiation lies, in part, in its focus on providing accurate real-time data to companies. Goldsky, a data infrastructure company for crypto startups, has raised $20 million in a seed round led by Felicis and Dragonfly Capital.

It’s worth noting that the OWF doesn’t intend to develop a digital wallet itself or create any new standards — it’s all about fostering a collaborative, community effort to develop an open foundation for any organization to create their own digital wallets atop. But digital wallets have gradually morphed beyond payments and are emerging as potential replacements for everything you might keep in your physical wallet — Apple, for example, now lets drivers store their license in digital form on their iPhones. The Linux Foundation has announced plans for a new collaborative initiative designed to support interoperability across digital wallets, built on an open source bedrock. The OpenWallet Foundation (OWF), as the new effort is called, is the brainchild of Daniel Goldscheider, CEO of open banking startup Yes.com, though today announcement reveals a broad gamut of buy-ins from multiple industry players, including Okta, Ping Identity, Accenture, CVS Health and OpenID Foundation, among several other public and private bodies.

AC Ventures (ACV), a venture firm focused on early-stage startups in Indonesia and the rest of Southeast Asia, has reached the first close of its fifth investment fund (Fund V). Li said global investors are drawn to Southeast Asia as it continues to show evidence of being a maturing market, with the successful IPOs of unicorns like GoTo and Bukalapak, an increase in later-stage capital and more secondary exits. Li said that ACV typically invests in 10 to 12 companies per year across its funds, and that continues despite the global slowdown in venture capital investing. ACV’s efforts to help founders include several key appointments who will work closely with startups — Lauren Blasco as head of ESG, Leighton Cosseboom as head of PR and communications, and Alan Hellawell as a senior adviser and venture partner.

The fourth fund will continue to focus on early-stage investments in enterprise software and deep tech, such as open source software, machine learning, quantum computing startups, finance, education and healthcare. Founded by the teams behind the Acronis and Parallels software companies, Runa Capital has so far more than 100 early-stage investments in Europe and North America. The first investments of the new fund include Barcelona-based embedded finance provider Hubuc and Paris-based open source enterprise software developer OpenReplay. Technology entrepreneur Serguei Beloussov (who has since taken the name Serg Bell and Singaporean citizenship) co-founded Runa after starting Acronis, and has since gone on to also establish the Acronis Cyber Foundation, which has partnered with UNICEF, built schools and educated migrants to Switzerland.

While crypto mining, the process that verifies and adds new transactions to the blockchain using the proof-of-work method, is costly to join and prone to regulatory clampdown, crypto staking, enabled by the Merge, offers enhanced censorship resistance thanks to its low barriers to entry both in terms of cost and the computing power required. The Merge, the much-anticipated network update on Ethereum that’s slated to unfold this week, could provide a new way for China’s crypto enthusiasts to participate in the blockchain economy two years after the country began phasing out the lucrative crypto mining industry. Before China banned crypto mining, the country accounted for as much as two-thirds of Bitcoin’s worldwide hash power, the energy consumed to carry out proof-of-work. Big hopes for the upcoming Ethereum Merge Users who are more crypto-savvy could opt for decentralized protocols, which use algorithms to facilitate peer-to-peer transactions rather than relying on a centralized intermediary, allowing for a higher degree of anonymity.

Formerly known as Fazz Financial Group, Fazz goal is to close the $300 billion funding gap for MSMEs, which has been exacerbated by the pandemic, and give them the same tools as larger businesses. The equity investment came from returning investors Tiger Global, DST Investment, B Capital, Insignia Ventures Partners and ACE & Company, with participation from Ilham Ltd, EDBI, InterVest, Y Combinator managing director Michael Seibel and GGV Capital managing partner Hans Tung.

Essentially, Kafene’s model is based on the premise that at the point-of-sale, the prime consumer will probably go with BNPL, while the subprime consumer doesn’t have the credit score to do so and would typically do lease-to-own as their alternative financing mechanism.

Northzone raised half a billion round in Europe, while LatAm VCs raising their biggest funds yet

Pakistan embedded finance platform Neem has raised $2.5 million in a seed funding round as it works to support underbanked communities in the country.

In the latest development, EQT — the private equity and venture firm based out of Stockholm — is announcing that it has closed a €2.2 billion ($2.2 billion) fund for EQT Growth, which it will be using for investing in European and Israeli founders and startups in areas like enterprise, consumer, health and climate tech, with typical rounds ranging between €50 million and €200 million. Sovereign wealth funds may well be playing a big part here: they have more generally been proving to be strong forces in offsetting current declines, betting when the market is low, with the Saudi state fund recently investing some $7 billion in U.S. stocks; and Norway’s sovereign wealth fund, currently the biggest in the world, also still looking bullish.) This is the first fund EQT Growth has raised specifically for tech investments, Brochado added, and it stands as one of the biggest first-time growth funds in Europe to date. The fact that the IPO market very much remains closed for the moment gives a company like EQT a foot in the door for providing finance to companies that might have otherwise looked at that kind of exit, either to position themselves as consolidators, or simply to keep scaling on their own steam, at a time when money is harder to come by, and thus needing to be treated more carefully than before.

The new experience combines the company’s successful Starbucks Rewards loyalty program with an NFT platform, allowing its customers to both earn and purchase digital assets that unlock exclusive experiences and rewards. As you gain more points, you may earn invites to special events hosted at Starbucks Reserve Roasteries, or even earn a trip to the Starbucks Hacienda Alsacia coffee farm in Costa Rica. Brewer says Starbucks is already imagining how some of the activities that earn NFTs will be connected to real-world Starbucks purchases, for instance. To engage with the Starbucks Odyssey experience, Starbucks Rewards members will log in to the web app using their existing loyalty program credentials

Janngo Capital is one of the few female-founded, owned and led venture capital and private equity firms that see a clear investment opportunity in addressing Africa’s gender funding gap by making long-term commitments to back female-founded and female-led startups. So far, Janngo Capital has invested in 11 startups across Africa, including Sabi, a growth-stage B2B e-commerce platform with a female CEO and female-led Ivorian online freight marketplace Jexport while other startups, like fintech Expensya have male founders. After stints at Jumia as its former managing director at its Nigerian office and founding CEO of its Ivorian office, Fatoumata Bâ, a veteran of the African tech space, announced that her firm Janngo Capital was raising a €60 million fund (~$63 million) in 2019. The four-year-old venture capital firm doesn’t invest in only female-founded and female-led teams, though.

This week in FinTech, banks vs FinTechs and billion dollar acquisitions

Before Capiter, Mahmoud was the co-founder and COO of Egypt-born and Dubai-based ride-hailing company SWVL (the company, which went public via a SPAC deal last year, laid off 32% of its staff this May) Egyptian startup Capiter raises $33M to expand B2B e-commerce platform across MENA B2B e-commerce platforms operate either asset-light or inventory-heavy models. The latter requires more capital and for Capiter, which employs a hybrid model, it’s unclear how the company has exhausted its funds and is already looking to sell after raising millions from Quona Capital, MSA Capital, Shorooq Partners, Savola and others last year. This information was further corroborated in a local news report where Capiter’s Board allegedly said that the founders had not been reporting to the board, its representatives and shareholders during on-site in-person due diligence for a potential merger.

Others include existing and new investors such as Adaverse, Flori Ventures, Tekedia Capital, GreenHouse Capital, ODBA, Five35 Ventures, Chrysalis Capital, Enrich Africa, Thrive Africa, Angellist Ventures and angel investors, including Rene Reinsberg, Marek Olszewski and Honey Ogundeyi. According to the CEO, Bitmama launched Changera at the intersection of blockchain payments and lifestyle, mainly targeting non-crypto-savvy people who are more comfortable using platforms with basic UI interfaces and less crypto jargon to communicate. The blockchain company will use the pre-seed to expand its operational presence, strengthen its team, consolidate its product offerings and plot market penetration across Africa while rapidly scaling new use cases for cryptocurrency within the continent, it said in a statement. Subsequently, they built a crypto exchange platform and allowed these users to access virtual assets formally and explore other use cases, including buying, selling and swapping crypto and peer-to-peer transactions.

Still, Drive hoped to sell more of its traditional peers on its vision, and while co-investors abound, no other coastal VCs have opened an outpost in Columbus despite the legwork Drive has done to prime the area. The car insurance company was started in Drive’s offices and went on to raise many hundreds of millions of dollars from East and West Coast investors, including Ribbit Capital, Redpoint, Tiger Global and Coatue, before going public in October 2020. Also, you can listen to our longer conversation with Olsen about where else Drive investing in the U.S., the firm’s newest investments, and the changing nature of board seats, right here. In the meantime, using Columbus as its home base for a much broader regional strategy has certainly paid off with one of Drive’s deals: Columbus-based Root Insurance.

For this week City Spotlight: Minneapolis, I had the honor of interviewing Mary Grove, managing partner of Bread & Butter Ventures, and Justin Kaufenberg, managing director of Rally Ventures, about their investment strategies. We happen to be focused on the three sectors: food tech, digital health and enterprise SaaS, but if you look at the titans of industry, we have Ecolab, Cargill, General Mills, Mayo Clinic, United Healthcare, Target, Securian, US Bank … We’ve actually got a number of companies on both coasts who have effectively decided to build their entire go-to-market sales organization based in Minneapolis. Both are based in Minneapolis, and they are using the city as a lookout tower for what’s happening across the U.S.

London-based regulatory technology (regtech) startup SteelEye has raised $21 million in a Series B round of funding. Founded in 2017, SteelEye works with banks, hedge funds, brokers, asset managers and more, to help them comply with strict regulatory procedures and requirements in their respective industries. SteelEye essentially brings compliance to the cloud via a SaaS \[…\]

Coinbase and Robinhood already dominate the crypto exchange space, but Rush believes Stack stands out from the crowd by offering features like access to the tax and control advantages of a Uniform Transfers to Minors Act (UTMA) account and a trading environment designed specifically for teens. The founding team has an eclectic background that includes teen fintech app Copper and securities for Rush, while Mascarenas helped digitize the cookie ordering system for the Girl Scouts and Young was a T-Mobile engineer. He would also see Reddit posts from teens trying to get into crypto using their parents’ information to create an account on exchanges like Coinbase or Robinhood and having them be frozen — and rightly so — for not being of-age to have an account. How the upcoming Ethereum Merge could change crypto rewards, costs and reputation Edited to change the name of the company to Stack instead of Stack.io.

Sequoia India and Southeast Asia has launched a new program to help its portfolio early-stage founders connect with international operators who can help the startups expand to new markets, the venture firm said, as it aggressively scales its offerings in the key regions. The program will open up to much of the venture firm’s portfolio, but Sequoia expects early-stage startups — in seed and Series A stages — will find it especially useful, said Harshjit Sethi, managing director at Sequoia India, in an interview. In addition to providing founders with advice, connections and help, the operators will also invest in the startups as part of the program, called Pathfinders, the storied venture firm said. The firm, which launched a $2.85 billion fund for India and Southeast Asia earlier this year, chanced upon the idea of Pathfinders on a Zoom call in 2020 while discussing ways to provide greater help to firms looking to expand outside of the country.

Michael Mignano has joined the consumer practice of the sprawling venture firm Lightspeed Venture Partners, after previously co-founding the podcasting platform Anchor and then leading Spotify talk audio business after the streaming giant acquired Anchor in 2019 for more than $150 million. Former New York Times reporter Lydia Polgreen, who was helping to run the podcast studio Gimlet, which Spotify bought for a reported $230 million in February 2019, meanwhile left the company in April to rejoin the Times. Interestingly, Mignano joins a firm that did not invest in Anchor, though he says in a new Medium post that he first met Lightspeed when he was out fundraising for his then-nascent startup. It’s a matter of money, largely, says Mignano, writing that podcast revenues are expected to exceed $2 billion this year, while YouTube generated nearly $29 billion in video ad revenue last year alone.

HotStreak itself makes money both from the entry fees it charges players to use its platform, which it says are listed on the app at the start of each game, and plans to monetize its software by selling it to other sports betting platforms, according to Dean. While Dean admitted that the overall market for DFS providers could shrink as more U.S. states bring legalized sports betting online, he believes the overall sports gaming market is still set to grow significantly. HotStreak’s decentralized SHARP protocol aims to tackle both sides of the issue from a payments and custody perspective by facilitating near-instant payments and handling custody of assets based on a set of rules pre-determined within the protocol itself rather than relying on counterparties to initiate payments to other players. Focusing on DFS to start gives HotStreak a regulatory advantage, he explained, although the platform will likely expand into offering more traditional sports betting products, which typically require more expensive legal disclosures.