🗓 All FinTech news in November 2022

Late Tuesday night, TBD, the Bitcoin-focused division of Jack Dorsey payments company Block (formerly Square), announced an ill-thought-out plan to trademark the term, which refers to its vision for a decentralized, privacy-focused iteration of the future web that TBD has been promoting in recent months. For several months, TBD has been promoting the term Web5, explaining how Web5 technologies could bring decentralized identity and data storage to applications while returning ownership of data and identity to individuals. In theory, Web5 would allow users to connect with apps using their decentralized identity, instead of constantly creating new profiles for services they wanted to try. This move, however, did not fly with the TBD community, as many pushed back at the idea that free and open-source technology needed such a gatekeeper.

The world’s largest crypto trading platform has acquired 100% of Sakura Exchange BitCoin for an undisclosed amount, a registered crypto exchange in Japan, the company said Wednesday. Binance gets regulatory nod in France, paving the way for Europe push Japan’s gaming blockchain builder Oasys raises $20M in private token sale Aside from France and Japan, Binance has also obtained regulatory approvals or authorizations in Italy, Spain, Bahrain, Abu Dhabi, Dubai, New Zealand, Kazakhstan, Poland, Lithuania, and Cyprus. Buying an exchange regulated by the Japan Financial Services Agency has certainly smoothed Binance’s legal path into the country.

The Seoul Southern District Prosecutors Office confirmed to journalist that it is seeking arrest warrants for eight people including Terraform Labs co-founder Daniel Shin, three Terraform investors, and four engineers of the cryptocurrencies TerraUSD (UST) and Luna, but did not disclose the identities of most individuals. South Korean prosecutors said Wednesday they have requested arrest warrants for eight people related to Terraform Labs for the alleged fraud as the local authorities widen their investigation into the collapse of the TerraUSD and Luna tokens that wiped tens of billions of dollars from the crypto market earlier this year. The prosecutors suspect Shin of taking illegal profits worth approximately $105 million (140 billion won) by selling Luna at the peak without disclosing properly to investors ahead of the Terra-Luna collapse, according to a local media report Yonhap. Shin’s lawyer said Shin left Terraform two years ago before the Terra-Luna collapse, and that he has no ties with the failure, according to local media.

The three-year-old company has been dealing with shrinking market share and layoffs, yet according to a Financial Times piece from earlier this year, its founder was able to take $195 million worth of shares off the table while also retaining nearly 40% of the company and voting control. In a story just tonight about Pipe, journalist’s Mary Ann Azevedo writes that the three-year-old marketplace has only one outside board member who is not a cofounder of the company, and that individual has been a VC for three years. And, Gurley pegs secondary sale transactions (red flag #8) as an obvious danger. Another issue is dual-class shares (red flag #3), which in many cases give entrepreneurs the power to ignore the wishes of investors.

The startup, which offers users the ability to manage and pay their credit card and scores of other bills on time as well as access to D2C brands and loans, backed peer-to-peer lender Liquiloans two months ago, invested in lender CredAvenue earlier this year and expense management platform HapPay in December. CRED is acquiring CreditVidya, a SaaS startup that helps firms underwrite first-time borrowers, in the latest of a series of investments from the Bengaluru-headquartered fintech as it broadens its infrastructure and offerings. The two firms will continue to operate independently and CRED will extend its employee stock program and other benefits to CreditVidya workforce, CRED said in a statement. The 10-year-old CreditVidya — headquartered in Hyderabad and backed by Navroz Udwadia, Kalaari Capital and Matrix Partners — had raised $10 million in previous financing rounds and was last valued at about $30 million post-money.

The startup declined to name its crypto mining-related customers, but notably, Pipe had a public partnership with Compass Mining, a now beleaguered crypto mining company that is reportedly facing its own fair share of struggles. Meanwhile, a Form-D signed by Pipe Senior Counsel Peter Chiaro with the U.S. Securities and Exchange Commission in late September reveals that the company recently secured $7.12 million in debt financing, which could be construed as a positive alternative to the kind of highly structured inside round that many startups are closing currently. Besides Fin Capital, other VCs to lead investments in Pipe on the part of their investment firms include Marlon Nichols, a managing director at MaC Venture Capital, and Ashton Newhall, a longtime investor with Greenspring Associates and now a partner with StepStone Group, which acquired Greenspring in September of last year. Other backers in the company include Morgan Stanley’s Counterpoint Global, CreditEase FinTech Investment Fund, 3L, Japan’s SBI Investment, Marc Benioff, Alexis Ohanian’s Seven Seven Six, Republic and Craft Ventures, which led the company’s $6 million seed funding in February 2020.

Cameroon’s Ejara raises $2M to offer crypto and investment services in Francophone Africa Chateau-Diop – who noted that Ejara has seen revenue growth 10x and achieved a 15% month-on-month transaction volume growth since last October despite crypto’s meltdown – expects users on the platform to reach 100,000 by the end of the year. By providing users in Francophone Africa with an option to buy, sell, exchange and store their crypto investments, CEO Nelly Chatue-Diop and her co-founder Baptiste Andrieux saw an opportunity to increase crypto activity in the region. With this product, the Cameroonian fintech asserts that users do not need to set up a bank account to access savings products but can instead start that journey with Ejara by downloading its app and depositing a minimum of 1,000 CFA franc (~$1.5). Ejara, a Cameroonian fintech offering an investment app that allows users to buy crypto and save through decentralized wallets, has raised $8 million in Series A investment.

Narayanan and O’Dowd were used to card alternative payments after living in Singapore, and saw an opportunity to use the U.K. open banking payments stack to build a Visa and Mastercard alternative, Narayanan told us. Atoa co-founder Sid Narayanan told journalist that he and co-founder Cian O’Dowd developed the idea for Atoa after selling their previous startup, expense management platform KlearCard, to Singapore fintech Validus in 2021. Mastercard and Visa payment rails can cost small merchants and their customers net margins of 51%, with card machine fees of about 1.75%, Narayanan said. To incentivize more customers to use Atoa, the startup also plans to add rewards and loyalty benefits, like digital scratch cards that can let them get cash rewards into their existing U.K. bank accounts.

Crowdz, which secured $10 million in capital co-led by Citi and Dutch growth equity firm Global Cleantech Capital, said this year it expanded from providing invoice-based financing to SaaS-focused SMEs to also providing them with recurring revenue access to upfront capital they need without having to dilute their equity. With that buy — its first — Pipe created a new media and entertainment division called Pipe Entertainment with the aim of giving independent distributors the opportunity to trade their revenue streams in the same way a SaaS company could. The three co-founders of alternative financing startup Pipe are stepping down from their roles as executives of the company in one of the most dramatic management shake-ups seen in the fintech startup world in some time. Since its founding, the startup says that 22,000 companies have signed up for Pipe and $7 billion of ARR (annual recurring revenue) has been connected to the platform.

NFT marketplace Magic Eden is integrating with the Ethereum scaling layer-2 blockchain Polygon to dive deeper into the blockchain gaming and NFT ecosystems, the companies announced on Tuesday. In Magic Eden’s case, its NFT marketplace launchpad is a cross-chain on Solana, Ethereum, or both and is responsible for 90% of all Solana-based NFT volume, according to its website. Long term, the partnership between Magic Eden and Polygon aims to bring more gaming developers and NFT games to market, Yin said. However, in the past 30 days, Ethereum NFT sales volume increased about 26%, while Solana NFT sales volume fell almost 20%, the data showed.

The DID system is compatible with more than 20 Layer 1 networks including Ethereum and Solana, which Yu says will allow Carv to cover 95% of the blockchain games on the market. Blockchain-based identity systems, they argue, are the portal to user-facing applications in the decentralized land, whether the piece of identity is used to send tokens or showcase a gamer achievement. On the enterprise front, Carv provides white-label data service to game operators which can then query cross-platform data about new users, such as their reputation and achievements on established ecosystems like Steam. Carv starts with games because it’s where much of the consumer-facing development in web3 is happening, Yu reckons, but the startup eventually wants to expand to other user scenarios when they are more mature.

Users can also leverage Taktile to experiment with off-the-shelf data integrations and monitor the performance of predictive models in their decision flows, Wehmeyer said, performing A/B tests to evaluate those flows. To allay the fears of privacy advocates, customers and regulators, Wehmeyer says that Taktile built technology that enables its clients to host decision flows in their country of choice and process data locally — a requirement for many regulatory agencies. As a piece in The New York Times recently detailed, some lenders are increasingly drawing on outside-the-box data sources to evaluate creditworthiness, presenting opportunities to consumers historically barred from certain financial products but at the same time amplifying the risk of perpetuating biases or making inaccurate predictions. Taktile puts the onus on its fintech customers to communicate the types of data and models they’re hosting and deploying via the platform.

This April, FTX announced a partnership with AZA Finance to roll out African and digital currency pairs and expand trading in nonfungible tokens (they managed to launch the fiat rails for Ghana and Senegal prior to FTX’s collapse). FTX offered to invest in Bitnob via stablecoins, to be held in custody on the defunct exchange, but the Nigerian crypto platform declined, according to two people familiar with the matter. There has been speculation that FTX and Alameda may have required their portfolio companies to hold their assets on the FTX exchange as part of their investment terms. In one case, FTX erroneously included BTC Africa, the parent company of Kenya-based payment automation and settlement platform AZA Finance, and its subsidiaries as entities under its Chapter 11 bankruptcy filings.

We obtained a letter that Drive sent out to its limited partners tonight that reads: Dear Limited Partner, This week an article was published indicating that our Partner Emeritus Mark Kvamme is launching a new investment fund. Columbus Business First reported that Kvamme, who races cars, is not zipping off to semi-retirement but instead talking with potential backers about a new fund, the Ohio Fund, which will apparently invest in multiple asset classes, including other funds, public stocks, private companies in Ohio, and infrastructure. In fact, in June, the firm — cofounded by veteran VCs Mark Kvamme and Chris Olsen — seemed to be riding high, with a couple of apparent wins and news funds that brought Drive’s assets under management to more than $2 billion. According to our sources, part of the split traces to a relationship between Olsen and Yasmine Lacaillade, who was Drive’s COO for nearly seven years before leaving the firm in April to launch her own investment outfit.

Jack Selby, a former PayPal exec the longtime managing director of Thiel Capital said: "I will never voluntarily leave the orbit of Peter Thiel. It’s a pretty amazing seat to have."

The CEO also cited gaming as a market opportunity for NFTs to spark more consumer enthusiasm (OpenSea is working on assisting games and gaming companies mint NFTs). If consumers are willing to engage with crypto products outside of a crypto-native experience, it is easier to see how gaming and crypto could eventually find common ground. Today at journalist crypto-focused event in Miami, OpenSea CEO Devin Finzer discussed his business, and the future market for non-fungible tokens. NFTs became synonymous with neo-wealth bubbling up from the blockchain economy, as a number of image collections that employed the digital asset format reached pop-culture status and eye-watering prices.

In an interview with journalist, Anderson explained that while Plaid will be personally facilitating payments through its Transfer offering, it will also continue working with its dozens of payments partners, which include the likes of Square, Stripe, Marqeta, Gusto and Silicon Valley Bank. In its own way, Anderson pointed out, Plaid has been involved in digital payments for years, by enabling nearly a billion ACH transactions for things like account funding and account-to-account transfers. In working with its payment partners over the years, Anderson said that Plaid saw a consistent challenge — that it usually took several days for an ACH transfer to complete. Specifically, Stripe’s Financial Connections was designed to give that company’s customers a way to connect directly to their customers’ bank accounts, to access financial data to speed up or run certain kinds of transactions — exactly what Plaid has done historically.

It also said that its due diligence process for FTX took about 8 months, from February to October 2021, and involved a review of FTX’s audited financial statement, which it said showed the exchange to be profitable. Temasek’s announcement comes a few days after SoftBank said it was writing down its $100 million investment in FTX, which was once valued at $32 billion. Temasek made a point of noting that its investment in FTX was not an investment in cryptocurrencies. Temasek invested $210 million USD in FTX international, giving it a minority stake of about 1%.

Investors into the new fund include Invesco Private Capital, which anchored the fund, DAHG Capital Partners, Joint Effects LLC, Full Spectrum Capital, Temerity Capital Partners, Now Investments, Mountaineer Capital, Permit Ventures and a group of fintech founders, including Bestow’s Jonathan Abelmann, Chime’s Kyle Daley and Mulberry’s Chinedu Eleanya. Fiat Ventures general partners Drew Glover and Alex Harris, along with managing partner Marcos Fernandez, are out to find and invest in fintech next generation of startups, and are leveraging their unconventional backgrounds to find equally unconventional founders. Some notable investments among the 22 companies in Fiat’s portfolio so far include teen-focused banking app Copper, which raised $29 million in April; insurance company Breeze, which grabbed $10 million last year; and Sleek, a one-click checkout company that bagged $1.7 million earlier this year. The early-stage VC firm started in 2021 is now armed with $25 million in capital commitments to close its first fund; the partners are targeting financial services and financial technology startups building for the 90% of Americans who don’t already have enough savings or don’t know how to start managing what they do have.

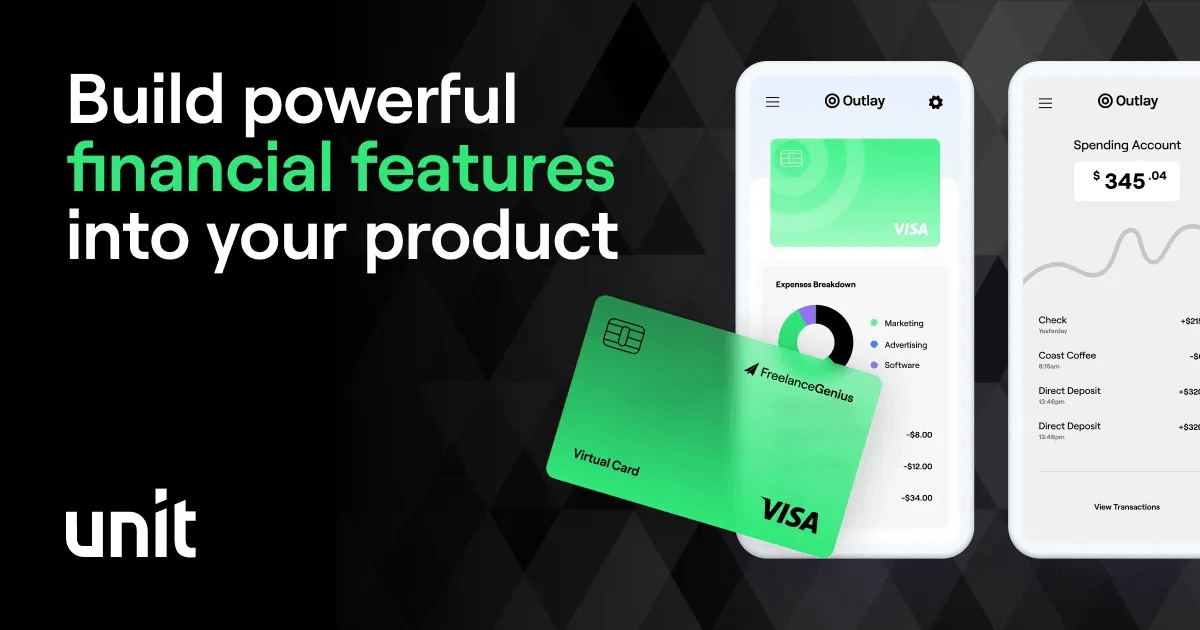

Customers can offer their customers a charge card, credit card, revolving loan or any other credit products that Unit’s bank partners offer. Charge cards, which are more popular than credit cards for small businesses, give Unit a way to enable customers to build and offer lending products, even though the startup is not a lender itself. Unit claims that a card swipe transaction will yield 0.5% more interchange revenue when done with a credit card compared to a debit card. The company gives companies a way to embed financial services into their product — and after already launching debit cards, Unit is officially breaking into the charge card game.

One of the most common attacks Yakoa sees is people making copies of NFTs and claiming them as their own work, Andrew Dworschak, co-founder of the startup, said. The funding round was led by Collab+Currency, Volt Capital, and Brevan Howard Digital with participation from Data Community Fund, Alliance DAO, Uniswap Labs Ventures, Orange DAO, Time Zero Capital, gmjp, Sunset Ventures and FAST by GETTYLAB, as well as angel investors. Yakoa provides tools and an indexer that detects copies or infringement probabilities on original NFTs, ranging from direct forgery to partial or stylistic forgery, which will then notify platforms, brands or creators of these fraudulent activities. Yakoa, an NFT fraud detection startup, has raised $4.8 million to build tools to fight intellectual property fraud in web3, the company exclusively told journalist.

New York-based venture platform Modus has launched Modus Africa, a venture capital fund for AI and blockchain startups across sub-Saharan Africa, journalist has learned. The firm is currently closing three investments in startups using AI and blockchain across insurtech, fintech and health tech, said the general partners who control the fund’s thesis, direction and investment strategy while leveraging Modus’s 50+ team to carry out due diligence and portfolio management. Though it has household names such as Tunisia’s InstaDeep, Kenya’s Sama, and South Africa’s DataProphet — and several web3 startups claiming to build on the blockchain — Africa’s AI and blockchain sectors are still relatively nascent. The thinking behind adopting this strategy can be traced to Vianney Mathonnet and Andre Jr. Ayotte, the general partners of Modus’s Africa-focused fund.

Notably, former SoftBank COO Marcelo Claure, who stepped down in late January after a reported battle over pay, had this to say about the FTX fiasco: journalist has reached out to SoftBank for comment on its investment in FTX. Also among FTX’s long roster of investors are: NEA, IVP, Iconiq Capital, Third Point Ventures, Tiger Global, Altimeter Capital Management, Lux Capital, Mayfield, Insight Partners, Lightspeed Venture Partners, Ribbit Capital, Temasek Holdings, BlackRock and Thoma Bravo. The notorious Japanese investment conglomerate SoftBank, for example, is just one of many such firms that backed FTX after the startup raised a $400 million funding round in January, valuing the company at a staggering $32 billion. FTX files for bankruptcy, CEO Sam Bankman-Fried steps down

Joepegs, an NFT marketplace on the Avalanche blockchain, raised $5 million in a seed round led by now-defunct FTX Ventures and the Avalanche Foundation, its co-founders who go by the pseudonyms Cryptofish and 0xMurloc, exclusively told journalist. The marketplace launched in May and has grown rapidly to the largest NFT marketplace on Avalanche with over $3.4 million in secondary NFT sales and 12,000 users. Earlier this year, Avalanche dove further into the NFT space after partnering with the largest NFT marketplace, OpenSea, which now operates on the blockchain alongside other platforms like Joepegs and Kalao. It also has an in-house production unit, Joe Studios, as well as an NFT Launchpad, which has on boarded over 50 projects to the Avalanche ecosystem, the company said.

Since Sam Bankman-Fried’s crypto empire, made up of FTX, Alameda Research, and FTX Ventures, collapsed last week, there have been various reports of companies whose money are stuck on FTX, its crypto exchange platform. FTX, for instance, led the $150 million Series C extension round in Chipper Cash, an African payments company; Alameda Research, on the other hand, has backed Nestcoin, Nigeria- and Kenya-based web3 company Mara, Congolese web3 startup Jambo. Some of them include Galois Capital, a hedge fund with half of its assets stuck on FTX; Genesis Trading, which had about $175 million locked on the crypto exchange; Multicoin, the famed web3 venture capital firm that had nearly 10% of its assets under management trapped. According to several reports, companies with money stuck on FTX might get their money back depending on how much FTX’s assets are ultimately worth.

Another focus will be on businesses that embrace the UN Sustainable Development Goals (SDGs), in particular Good Health and Wellbeing, Quality Education, Gender Equality, Decent Work and Economic Growth, Reduced Inequalities, Responsible Consumption and Production, Climate Action, Peace, Justice and Strong Institutions and Partnerships for the Goals. Prediction Capital is a new VC sprung out of the Swiss Family Office infinitas Capital, the investment firm of former entrepreneur and investor Robin Lauber, and formed together with Christopher Chuffart and Kilian Graulich. Chuffart was most recently at Mountain Partners, a Zurich based VC before moving to i2i Logic (Australian corporate finance FinTech) to open their European HQ. The fund, which has hit its first close of €30M, will focus on startups covering ConsumerTech and FinTech mainly in the German-speaking DACH region.

You can tease these out for yourselves, though: payments providers, those providing commerce supply-chain management, and those building ‘headless’ systems for retailers and brands to build their own commerce experiences are all the kinds of platform players I imagine might want to own both the kind of technology that Ordergroove is building, and its substantial client list. Ordergroove currently has close to 500 customers, Alvo said, a list that includes some of the largest brands and retailers in the world — they include Walmart, Nestle, L’Oréal, Bonafide, The Honest Company, La Colombe, and PetSmart — as well as emerging names and smaller businesses. The company is built around the tech stack to create, run and measure subscriptions — which includes integrations with the likes of Salesforce, Magento, Shopify, payments systems and whatever else that merchants and brands are using to build their own commerce technology stacks. Subscriptions are the core of what Ordergroove does right now, so the plan is to build out more services that enhance that, said Greg Alvo, the company founder and CEO, in an interview.

Because it is using its retail customers’ savings deposits to fund these loans at a 3.85% to 4.5% yield, Tellus makes its money on the spread of what it’s paying out in interest versus what it’s charging its borrowers. The six-year-old fintech startup claims it can offer people yields of 3.85% to 4.5% on their savings balances by using the money to fund certain U.S. single-family-home loans. Tellus says it promotes financial literacy by quizzing users on financial terms, for example, and then rewarding them with higher interest rates. With mortgage interest rates having more than doubled since a year ago, one might think that this is not the best time to be a digital mortgage lender.

Elon Musk detailed his vision for Twitter plan to enter the payments market during a live-streamed meeting with Twitter advertisers, hosted on Twitter Spaces on Wednesday. The new Twitter owner suggested that, in the future, users would be able to send money to others on the platform, extract their funds to authenticated bank accounts, and later, perhaps, be offered a high-yield money market account to encourage them to move their cash to Twitter. In today’s meeting, Musk explained how paid verification, which Twitter is rolling out now with its revamped Twitter Blue subscription, as well as support for a creator ecosystem could pave the way for a payments system on its platform. Musk then explained how this payments system could scale saying that, once users gained a cash balance, Twitter could prompt them to move that money on its platform.

Decentralized finance (DeFi) is often associated with trusting blockchain technology to execute services through smart contracts, while centralized finance (CeFi) usually refers to more traditional business models and involves having people manage funds and manually execute services. As the crypto market digests the past few days of chaos, venture capitalists see the moment as a warning, but also an opportunity for the growth of decentralization and maturation of the larger blockchain space. When there are massive crashes and burns, it speaks to what we’ve been seeing over the past decade: It the Wild West out there, Samantha Lewis, principal at Mercury, said to journalist.

Mentors include Colleen Sullivan, co-head of ventures at Brevan Howard Digital; Mike Dudas, founder of LinksDAO, The Block and an investor for 6th Man Ventures; Anatoly Yakovenko, co-founder of Solana; Ryan Selkis, founder and CEO of Messari; Mounir Benchemled, founder of ParaSwap; Amir Bandeali, co-CEO of 0x Labs; and Ryan Wyatt, CEO of Polygon Studios. The pitch: Slide is a web3 digital advertising-focused platform that aims to analyze on-chain activity to provide tailored ads across the web3 ecosystem. Many of the teams are looking at improving crypto themes like proof-of-physical-work, wallet experience for everyday users, product-driven protocols, crypto B2B products, on-chain data and verticalization, Wang said. The current marketing technology doesn’t cater to web3 tools or on-chain and off-chain data, so it needs to be revamped to consider new technologies, co-founder Nathan Snell said.

Alameda Research, a crypto trading firm run by FTX chief Sam Bankman-Fried, was caught in the eye of the storm this week when its leaked balance sheet financials revealed unusually close ties with FTX through the exchange’s native FTT token. In addition to the liquidity crisis itself, the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are investigating FTX’s relationship with its sister entity Alameda Research as well as with FTX US. Crypto trading behemoth FTX fell from grace this week after the exchange experienced a liquidity crunch and agreed to give its rival, Binance, the option to purchase the company non-U.S. operations in what appears to be a bailout. Binance and FTX both revealed yesterday that the former had signed a non-binding letter of intent that gives it the option to purchase FTX pending due diligence.

Its differentiator is Notifi’s product is designed to allow for highly customizable experiences that dApps can implement and manage, Kim said, adding that the user experience developers can offer messaging and notification functionality within their native UI with a user experience that feels native to their app or platform. Notify will soon launch Notifi Hub, the Web3 inbox to aggregate cross-chain notifications and messaging into one single hub, which is currently in beta, to provide users with a centralized location to track and manage all of their messages and alerts across different blockchains, wallets and dApps. Notifi, a communication infrastructure platform for Web3, said Tuesday it has raised $10 million in an oversubscribed seed funding co-led by previous backers Hashed and Race Capital. Notifi, which launched its SDKs in April this year, has more than 25 customers, including Orca, one of Solana biggest DEXs; Zebec, treasury management for DAOs; SynFutures, Polygon’s largest derivatives protocol; Hyperspace, an NFT marketplace; Realms, Solana’s DAO governance platform, and more, Kim said.

He led the building of the company on the rails of Latamex, Latin America’s largest fiat-to-crypto gateway that provides what he told journalist is a safe option for users to buy and sell crypto from exchanges like Binance. The company is now also working off of $15 million in seed funding from a group of investors, including Y Combinator, Race Capital, BlockTower, Danhua Capital, Signum Capital and Goat Capital. Ping users create a free account in U.S. dollars to receive bank transfers in either their local currency or crypto, including Bitcoin, Ethereum and Litecoin. The company was started in 2021 to solve payment challenges in Latin America, where about 70% of the population does not have a traditional bank account.

Withdrawal transactions for customers using FTX, the third largest crypto exchange by volume, have seemingly been limited to a nominal amount or none at all, according to multiple on-chain data sources. On Monday, Bankman-Fried tried to calm the waters in regard to FTX’s liquidity via a series of tweets indirectly responding to Zhao and Binance’s liquidations. Stablecoin withdrawals from FTX dropped to zero around 6 a.m. ET on Tuesday, according to data on CryptoQuant. FTX’s stablecoin reserve also decreased 93% over the past two weeks, and it has injected USDC liquidity from Alameda Research wallets, Ju said.

Brand Engel, who leads Quona’s investments in Africa and the Middle East regions, said the fund’s investors include a majority of existing investors from sectors like global asset managers, insurance companies, investment and commercial banks, university endowments, foundations, family offices and development finance institutions. Though finance technology startups are having a moment when it comes to decreased venture capital deals and layoffs, Quona Capital, a venture capital firm that invests in emerging markets that accelerate financial inclusion, has found the appetite is still there for fintechs. Some of the first six investments from the new funding have gone into companies including Egyptian financial super app Khazna, MoHash, a decentralized finance protocol, Pillow, which wants to make cryptocurrency saving and investing easier, and nocnoc, helping global sellers connect with marketplaces in Latin America. The commitments for Fund III exceed the $250 million target Quona was initially shooting for and brings the firm aggregate committed capital to over $745 million, co-founding managing partner Monica Brand Engel told journalist.

Japanese messaging app Line non-fungible token (NFT) unit LineNext said Tuesday that it has launched a consumer-to-consumer (C2C) marketplace on the NFT platform DOSI. The company claims that DOSI has amassed scores of users from 149 countries and issued more than 100,000 DOSI Wallets with 170,000 membership NFTs since its beta service launch in September. DOSI’s citizen membership service helps users acquire membership points, called DON, by participating in the NFT community activities or purchasing their NFTs. The announcement comes nearly a year after Line said it plans to launch an NFT service in 2022 to provide a marketplace for companies and individuals to trade NFTs.

When you include a wider variety of people in investing, it can impact the entire system from the cap table to the boardroom to founders, executive teams, and workforces, and it can lead to more diverse wealth creation over time because some percentage of the startup investments pay out. The couple has been involved in investing on their own, including investments in SpaceX and Robinhood, but they want to create a network to bring in people they know, who have not been asked to be involved in startup investments. Shruti Challa and her husband, Patrick Ekeruo, launched Community Growth Capital this year to give people like this access to later-stage deals with the goal of democratizing growth-stage cap tables. General partner Lorenzo Thione said that the group of people involved in venture investing in the past has been very narrow, and he sees that as a missed opportunity by the venture community.

Law enforcement also recovered $661,900 in cash, 25 Casascius coins of bitcoin (valued at about 174 bitcoin), an additional 11.116 bitcoin, and a handful of silver- and gold-colored bars. The whereabouts of this massive amount of bitcoin was a mystery for almost 10 years, U.S. Attorney Damian WIlliams said in the release. The plea came almost a year after law enforcement seized 50,676.17851897 bitcoin, then valued at over $3.36 billion, from Zhong home, the statement said. Officials found the bitcoin in an underground floor safe and on a single-board computer that was hidden under blankets in a popcorn tin placed in a bathroom closet.

So the pair spent nights and weekends building a prototype for Loop, a startup that sits at the intersection of logistics and payments, before leaving Uber in May of 2021 to focus full time on the business. And, McKinney claims, it can bring payments down Loop makes money by taking a percentage of total payments volume. Matt McKinney was a data science manager at Uber, helping launch Uber Freight, along with software engineer Shaosu Liu. One of the tailwinds that helped Loop, believes McKinney, is the COVID pandemic-driven secular shift of paper to electronic methods of payments.

Top crypto firms including Coinbase and Polygon are among the firms that have formed an industry body in India to promote dialogue between key stakeholders and drive awareness about web3, months after the largest local crypto advocacy group was disbanded. In the wake of the uncertainty, the local ecosystem has seen some talent move outside of the country and a growing number of local entrepreneurs build for the foreign markets and avoid serving customers in India, the world’s second-largest internet market. The Indian central bank continues to force the hand of banks from engaging with crypto platforms in India, a move that has made on-ramp a nightmare for the firms involved, people familiar with the matter said. Members of the new industry body, named Bharat Web3 Association (BWA), include top local crypto exchanges including CoinDCX, CoinSwitch Kuber and WazirX.

The study also showed that startups founded and co-founded by women received less than half the average investments made into companies led by men, even though the female led startups generated 10% more revenue over time. Privilège Ventures’ LPs are mainly high net-worth individuals and family offices, the firm says, and the fund aims to write 15-20 early-stage checks, with initial investments in the $250,000 range. The firm says that its investment thesis is based on the statistical evidence that women perform better than men in leadership roles. The CHF 20 million (just over $20 million) fund is earmarked for women-led early-stage startups across Europe.

The new offering is a sign of competition between web3 infrastructure providers heating up, as it puts the startup in direct competition with ConsenSys, the company that owns popular node-as-a-service provider Infura, and Alchemy, another widely-used node provider in the industry. Yasmin Razavi, a growth investor at Spark Capital who helped lead the firm’s investment in Tenderly, told journalist that the startup’s new offering came as a result of its developers finding they could not rely on existing node providers for their purposes and deciding to instead build out that capability themselves. The financing came just months after the startup’s Series A round and it was announced in the same month as Alchemy’s $200 million Series C extension, which valued the latter company at $10.2 billion. Blockchain infra startup Tenderly raises $40M after seeing 500% YoY revenue growth One aspect of Tenderly’s offering that differentiates it from other node providers is its transaction simulation platform, which Benčić said is already serving 50 million simulations per month to web3 apps such as Instadapp, Yearn, Safe and Yield.

In the memo, Britt said that he and co-founder Ryan King are re-calibrating marketing spend, decreasing the number of contractors, adjusting workspace needs and renegotiating vendor contractors. The company memo, along with the fact that Chime has paused its public debut plans, suggests that growth trends may have changed. Chime was notoriously one of the first neobanks to hit EBITDA profitability, a milestone it shared when it hit $14.5 billion two years ago. Digital bank Chime confirmed today that it is laying off 12% of its workforce, or about 160 people.

It fitting, then, that Kala was able to raise her first fund as a solo GP focused on early-stage consumer startups in the web3 space in just four months despite a broader downturn in the crypto market. Double Down’s backers include crypto and venture heavyweights such as Chris Dixon and Marc Andreessen of a16z, Paradigm co-funders Matt Huang and Fred Ehrsam, Alexis Ohanian’s VC firm Seven Seven Six, and consumer-focused LPs such as Paris Hilton and Sara Blakeley. Kala’s fundraise is no small feat, especially considering that women are deeply underrepresented in venture capital, not to mention the added challenges that come with raising capital as a first-time fund manager in today’s depressed venture market. Kala says she plans to collaborate with some of the crypto-focused investors who are LPs of her fund on individual deals.

Microsoft has backed Wemade, a popular video game developer that has made aggressive bets on blockchain in recent years, the latest sign of tech giants’ showing growing interest in web3. South Korea Wemade said in a press release that it has raised $46 million in a funding round from Microsoft, Shinhan Asset Management and Kiwoom Securities. Microsoft is also an investor in ConsenSys, the firm behind MetaMask wallet and enterprise solutions such as Infura, as well as decentralized data warehouse Space and Time and NFT studio Palm, according to Web3 Signals. Scores of tech giants including Microsoft and Google and storied banks have made a series of investments in the web3 space in recent years.