🗓 All FinTech news in July 2022

The runaway success of Axie Infinity and StepN has convinced a flurry of entrepreneurs that web3 gaming, where the ownership of in-game assets is in the hands of users via blockchain adoption rather than a centralized platform, is the future.

A day after Central Bank of Kenya (CBK), Kenya monetary authority, said that Chipper Cash and Flutterwave were not licensed to operate in the East African country, the regulator has directed all financial institutions to cease doing business with the two fintechs. The CBK’s bank supervision deputy director, Matu Mugo, in a letter, directed all regulated banks, microfinance and mortgage finance institutions to stop their partnerships with the two startups with immediate effect — dealing a blow to Flutterwave and Chipper Cash, some of Africa’s highest valued startups. Flutterwave, which is also facing money laundering allegations in Kenya, in a statement said it has been operating in the country through partnerships with regulated banks and telecoms, as it waits for a payments service provider license it applied for in 2019. The letter to the bank CEOs followed remarks by CBK’s governor, Patrick Njoroge, that the two startups are not licensed remittance or payment service providers in Kenya — one of the biggest fintech hubs in Africa.

Publicly traded Lemonade has laid off about 60 employees of Metromile, the auto insurtech company it recently acquired – adding to the volatility the technology sector has seen over the past 18 months.

After assessing the current market conditions and uncertainty we’re seeing across the e-commerce sector, this was the most prudent action to take and was necessary to.

Kompliant’s platform allows customers — mostly acquirer processors, banks and sales organizations — to build credit risk programs by leveraging services such as auditing, application processing and verification, and business monitoring.

Umba, a US-based digital bank with a focus on emerging markets, has acquired a majority shareholding of Daraja, a Kenyan deposit-taking microfinance bank, for an undisclosed amount.

China billionaire tech boss Jack Ma plans to cede control of Ant Group, the fintech powerhouse closely affiliated with Alibaba, the e-commerce giant he founded, The Wall Street Journal reported on Thursday. Ant informed regulators of Ma’s intention to relinquish control as the company prepared to transition into a financial holding company, The Wall Street Journal reported. The pair has been symbiotic, with Ant’s Alipay app deeply integrated into Alibaba’s suite of retail services and its financial services touted to business owners on Alibaba’s marketplaces. Ant started out as a payments processor of Alibaba, which Ma, at the time the e-commerce firm’s CEO, spun out in 2011.

The idea of corporate gifting to maintain client relationships isn’t a novel concept. In fact, there’s a cottage industry of “gifting-as-a-service” startups that promise to streamline the task, ranging from companies such as Reachdesk and &Open to Sendoso and Goody. Vendors claim their industry is a profitable one (worth an estimated $258 billion) because the \[…\]

When Leapfin founder and CEO Ray Lau was managing financial operations at the game company Zynga a decade ago, he saw just how hard it was for his team to get answers about the financial health of the company quickly.

Pantera Capital led the four year-old startup new financing round with participation from Mayfield, Gaingels, Alchemy Ventures, Redbeard Ventures, Spartan Group, OKG Investments, Polygon, CoinDCX, CoinGecko, We3 syndicate, Rainfall Capital, Broadhaven, EI Ventures, Hardyaka, Alt Tab Capital, Boost VC and Draper Associates. Unstoppable Domains, a popular blockchain naming system provider and identity platform, is the latest crypto startup to become a unicorn. Unstoppable Domains allows people to create their username for crypto and build decentralized digital identities. The platform, which includes members who worked at companies such as Amazon’s AWS, Uber and Slack, mints each decentralized domain name as an NFT on the Ethereum blockchain to give the owner broader control and ownership.

Islamabad-headquartered startup Dbank said on Thursday it has raised $17.6 million in a seed round, the largest in Pakistan, co-led by Sequoia Capital Southeast Asia, the recently unveiled $1 billion fund, and Kleiner Perkins.

A new web3-focused production hub, Trustless Media, has launched out of stealth mode as it aims to build an NFT community-owned media company. Trustless Media plans to grow its community beyond the initial 1,000 NFT community members by expanding the network.

Although it’s currently not making any money in its Russian operation, Viber, which is end-to-end encrypted, has kept the service live where it hasn’t been blocked by Russian authorities, since a lot of communication happens between Ukrainians and Russians (there remain a lot of links between the people, despite the actions and rhetoric of the Russian government), and it’s continuing to operate its service in Ukraine where it can — the occupied territories where Russia has taken control of communications being the exception. The company is not quick to disclose exact monthly active user figures, but in 2016, Viber was widely reported to have 823 million users (note: not active users — one citation of this number from its PR firm here); in that same year, an exec told journalist that it had 266 million monthly active users. Now it is making a move to double down on that strategy: it launching Payments on Viber — a new service that will let users set up digital wallets tied to their Viber accounts. Viber, the messaging app owned by Japanese e-commerce giant Rakuten, has long been dancing around the area of fintech, launching services like money transfer and chatbot payments in various countries over the years.

Founded last year by Kelly Ifill, the company aims to narrow the racial wealth gap by providing financial services to Black small businesses and creators. As a result, Ifill hopes Guava will help Black entrepreneurs receive access to the financial support needed to weather every kind of financial storm, especially as another recession looms. And yet, Black founders receive less than 2% of all venture capital funding, and only 3% of Black women run mature businesses. At the same time, Bloomberg reported that Black founders — Black women specifically — were the fastest growing cohort of entrepreneurs.

Joining in on the new round are Salesforce Ventures, HubSpot Ventures, Lyra Ventures, Gramercy Ventures and a group of B2B e-commerce leaders as angel investors, including former Shopify CMO Jeff Wisener and Faire co-founder and CTO Marcelo Cortes.

Interplay current offerings include a venture capital arm that houses two early-stage funds, a foundry that helps build companies from scratch, an incubator to support existing companies and a family office.

His community building had accidentally led him into the world of venture, as Salisbury ultimately became a founding member of a16z’s fintech practice alongside general partners Anish Acharya and Angela Strong before becoming a partner in 2019.

Right now, the company gets largely paid through affiliate fees and exchange of data. opts in for a suggested insurance plan Clicks into a location-based offer Answers market research or campaign measurement questions Or scans Pogo card for a discount when buying a prescription In the next iteration, Wong says, Pogo will suggest users to turn to fee-free banking alternatives, and then Pogo can make money through affiliate fees.

Given two of the primary hardware wallets, Ledger and Trezor, have roughly 5 million users, there would appear to be plenty of room for growth, since that there are at least 295 million crypto holders who may decide to add hardware wallets to their portfolio.

Blockchain ecosystem Topl has raised $15 million in a Series A funding round to help companies track and monetize social impact initiatives.

DSCVR, a blockchain-based social network built on Dfinity’s Internet Computer protocol, has entered the race to build a scalable DeSo platform with $9 million in seed funding led by Polychain Capital. Porter said he made that decision after meeting Dfinity’s president and chief scientist, Dominic Williams, while Porter was working on a blockchain-based smart contract project as a consultant at BCG. His first project was to build a message board on the protocol, which he said exposed him to the need for web3 communities and inspired his decision to build a social network. The communities help NFT projects build hype by airdropping digital assets to DSCVR users, co-founder and CEO Rick Porter told journalist in an interview.

With this expansion, grocers of all sizes can use Carrot Payments, an Instacart Platform solution, to accept EBT SNAP payments online across 49 states and Washington, D.C. Instacart offers EBT SNAP acceptance through the Instacart Platform, a suite of enterprise-grade solutions that help enhance and digitize retail experiences. EBT SNAP participants can shop for pickup or delivery via the Instacart App and grocers’ Instacart Platform-powered websites and apps. Instacart announced today that Electronic Benefits Transfer and Supplemental Nutrition Assistance Program (EBT SNAP) can now be used to buy groceries online in 10 additional states through its app.

The latest close marks the first time that BAI Capital has brought in external limited partners, including sovereign wealth funds, large insurance companies, internet giants, funds of funds, on top of capital from its parent Bertelsmann.

There are any number of enterprise software companies in the market today that are addressing the challenges in HR, enterprise training and education, and performance management, but what makes 15Five unique among them is how it is integrating all of these, and how it’s doing it first and foremost from the perspective of performance management, which is a subtle but important distinction as it informs how, say, educational and training tools are built and incorporated, and to what end. Now in use at some 3,400 companies — customers include Credit Karma, Spotify and Pendo, with its sweet spot specifically on businesses with between 100 and 2,500 employees — the startup will double down on what David Hassell, the CEO and founder of 15Five, describes as not just as providing insights, but also outcomes, ushering in a wider move into areas like coaching and education to expand a platform that today is used to help track and set goals for teams and individuals in them. 15Five — an early mover in the world of building technology to help motivate teams, and to improve performance management for execs overseeing those teams — has raised $52 million in a round of growth funding that it will be using to expand its own performance. Tools like 15Five found themselves in an interesting position: whereas previously some might have considered tech to help shape and work towards goals as potentially nice to have, in the absence of being able to see and work with teams in person, those tools suddenly tool on an essential role.

After living and working in the United States for almost 25 years, he moved back to Bangladesh in 2018 to digitize micro-credit, with the goal of creating a digital credit platform for micro-merchants that did not require a smartphone or digital literacy.

Specifically, the SEC framed the following assets as securities: Power Ledger’s POWR token, Flexa’s AMP token, Rally’s RLY token, DerivaDEX’s DDX token, XY Labs’ XYO token, Rari Capital’s RGT token, Liechtenstein Cryptoassets Exchange’s LCX token, DFX Finance’s DFX token and Kromatika Finance’s KROM token.

A January filing indicates that Menlo once sought to raise $750 million for its third special opportunities fund; it wound up raising about $11 million more, from 29 undisclosed investors, per the firm’s latest filing.

When Kristy Kim started TomoCredit in early 2019, she was on a mission to help international students more easily obtain credit.

Founded out of Dublin, Ireland, in 2019, Fonoa targets digital services companies that operate globally, automating many of the processes involved in managing sales tax, VAT, and goods and service tax (GST) wherever the company sells its wares.

It’s almost formulaic: 409A assessors will tell a startup what public market companies they look like, and the more mature the startup is, the higher the impact public stock prices can have on the startup’s valuation. That’s because a low 409A valuation allows companies to grant their employees stock options at a lower price.

Arrenda, a Mexico City-based fintech company, is offering digital financial services to the real estate market of Latin America and closed on $26.5 million in a pre-seed round of equity and debt.

Crypto infrastructure provider Blockdaemon has acquired Danish company Sepior, a digital asset security company providing key management services for institutional clients, for an undisclosed price.

The full scope of the Yuga’s monetization plans for their network are still in development and the founders have yet to nail down timing for a wide public launch, but while multi-million dollar avatars and massive NFT land sales may be unique among today’s games, Yuga is positioning itself to compete with today’s big platforms including players like Epic Games, Roblox and Meta.

While Glyman did not reveal hard revenue figures, he did point out that the company had crossed $100 million in annualized revenue before its third birthday in March.

In addition to the patent for the ENIAC, Arkive has also acquired Seduction (1985), a vintage print by Lynn Hershman Leeson, which, like the ENIAC patent, will be a part of Arkive’s traveling exhibition in late 2022.

The fund is strategic for Valkyrie in that it is focused on nascent infrastructure the firm might use in its digital asset management operations, including: security, authentication, compliance, data management, storage, networking, communication, governance, payments and transactions companies.

As capital continues to enter the crypto space, Tribe Capital has raised $25 million from outside investors and has launched its incubator program, Tribe Crypto Labs, its CEO Arjun Sethi.

Casavo’s rise has largely come out of three main areas: the pandemic, the gaps in the property market in Europe as it exists today, and Casavo’s particular approach to tackling that.

Internet insurance and the web3 world might seem to have little overlap, but Lau’s involvement in art — sitting on the board of Asia-based projects for Tate and Guggenheim Museum — could serve Animoca well as the art industry has been keen to embrace the metaverse and NFTs.

Cathay AfricInvest Innovation Fund (CAIF), a Pan-African fund launched via a partnership between AfricInvest, a multi-asset investment platform in Africa and Cathay Innovation, a European-born but global-focused venture capital firm, has achieved a final close of €110 million.

Bloom’s seed round is the largest in Sudan, a country whose tech ecosystem can be termed passive and only recently welcomed foreign investment when Fawry backed fintech and e-commerce player Alsoug after 30 years of international sanctions on the country.

But in May, Union54 began experiencing some operational issues with its product, resulting in the temporary suspension of its Bank Identification Number (BIN), the first four to six numbers on a payment card that identifies a card issuer. They attributed the virtual dollar card service disruption to an update from a card partner — which happens to be Union54 — without citing a definite recommencement time. This April, when we covered Union54, whose API allows companies to issue debit cards to their customers and employees without needing a bank or a third-party processor, it had just raised a seed extension, bringing its total seed round to $15 million (Tiger Global led both rounds). Many have begun searching for alternative options, which include Sudo Africa, another card-issuing platform and other fintechs, which claim to be unaffected by Union54’s downtime (as a result of using another provider), such as Chipper Cash, Mono and Bitmama.

A source close to the company noted that there was a reduction of 7%, or 68 members, in Gemini’s company-wide Slack channel Monday morning. The company had not widely communicated the extent of Monday layoffs internally, leaving employees to speculate on the exact number of co-workers laid off in this most recent downsizing.

X1 Card is taking a different tack by underwriting customers based on their income rather than their credit scores, which the company says enables it to set credit limits up to 5x higher than traditional card providers.

Solomon co-founded Sunscreen last year alongside threshold cryptography veteran MacLane Wilkison of Y Combinator-backed NuCypher.

Fundrise manages over $2.8 billion worth of real estate equity on behalf of the 300,000 active investors on its platform today, and Miller says the company is growing fast enough that he expects it to climb to a top-ten spot by size in private real estate within the next two years.

On a high level, it’s no surprise that funding flowing into fintech startups was down both globally and in the U.S. in the second quarter of 2022. And it wasn’t only funding. Everything was down. New unicorn births, M&As, IPOs.

BAI Capital, GIC and GGV Capital co-led the equity portion of the deal, which also included participation from other existing and new investors.

Smolin references the great lengths users go to at the end of the year to reach the next level of airline status as a way to signify how they price the value of the service; he wonders whether more services could build this relationship and create better membership programs for users.

Today, 70% of trading volume on Binance.US, the American offshoot of the global exchange, comes from institutional customers, its CEO Brian Shroder told us in an interview.

Former OpenSea exec arrested and charged with insider trading of NFTs Crypto’s top venture capitalists have said that the talent entering the crypto space is one of the biggest reasons they’re bullish on the space, but as crypto giants continue to make huge layoffs, it’s unclear how much of that talent is being held onto.

Unlike Stripe, Klarna’s valuation was cut by its investors – which include Sequoia, Silver Lake, Commonwealth Bank of Australia, the UAE’s sovereign fund Mubadala Investment Company and Canada Pension Plan Investment Board (CPP Investments). The Journal reports that the valuation cut comes from a 409a price change, which means that Stripe hasn’t decreased the value of preferred shares sold in the last round.

To power the expansion, which will see Lightyear land in 19 new markets including the Baltics and much of Western Europe, London-based Lightyear has also raised $25 million in a series A round of funding led by U.S. venture capital firm Lightspeed, with participation from other notable backers including Virgin Group,

Pow, who worked at Ox Labs, a decentralized exchange protocol builder, and his co-founder Hongzi Mao, a computer science Ph.D. from MIT, have created a desktop tool that uses machine learning algorithms to turn still avatars into motion-tracked ones. Available as a Chrome extension, Hologram swaps out Pow’s real video feed with the cat avatar.

UnCaged Studios, a web3-focused gaming studio, has raised $24 million in a Series A equity funding round to continue growing the crypto gaming industry.

Plaid, the company building data transfer technologies to power fintech and digital finance products like smartphone-based wallets, today announced that it adding support for thousands of crypto exchanges to its data network.

Celsius Network, one of the world’s largest cryptocurrency lenders, has filed for bankruptcy protection, a month after freezing customer assets in the wake of sharp turbulence in the crypto market that has toppled business models of several firms. The New Jersey-headquartered startup, which was valued at $3.25 billion when it extended its “oversubscribed” Series B \[…\]

With the company announcing its quarterly financial results on July 21, one thing to listen for is whether it elaborates any further on either of these fronts, which, conveniently, would help Snap bolster the message to investors that it’s working on more ideas to generate revenue, to complement, or offset, whatever ups and downs it might face in the advertising market. The leak of the NFT test seems to be part of a mini product sprint at Snap: It’s coming just days after Snapchat launched its premium subscription Snapchat Plus. FT’s report noted that Snap doesn’t plan to take any money from creators to show off their digital collectibles — just like Twitter, Instagram and Facebook. In the latest development, Snap is exploring ways to let artists show off their digital collectibles as AR filters on Snapchat.

Wave, an African fintech that offers mobile money services in Senegal and Ivory Coast, laid off about 15% of its workforce last month. Thus, the layoffs affected almost 300 employees, most of whom worked in Wave’s new markets: Burkina Faso, Mali and Uganda. The Senegal-based startup likely has enough money in the bank for the next few years, and last week, it secured a €90 million syndicated loan from the International Finance Corporation (IFC), Lendable, Norfund and other lenders in one of the largest debt deals on the continent. journalist first got a whiff of the layoff news on LinkedIn, where Jessica Chervin, a former Andela executive who joined Wave as an expansion lead in March, wrote that she was leaving the company.

In April, China’s top financial industry associations proposed that NFTs must not be used for securitization; nor should they be traded with cryptocurrencies, which have been outlawed in the country.

The program has cohorts three times a year for 10 weeks, Qiao Wang, a core contributor at Alliance DAO, said during the event. “Startups from all stages have joined our cohort, from those with just an idea to billion-dollar companies.”

FPL Technologies, an Indian startup that operates credit cards called OneCard, is the latest in the South Asian market to join the unicorn club following a new round of funding.

Pulley is also helping companies weather this economic downturn, and though most of the companies Pulley works with are at an earlier stage and aren’t seeing the kinds of layoffs occurring in later stages, I asked Wu what kinds of questions Pulley was getting from customers.

The Japanese fintech startup said today it has raised a $20 million (2 billion JPY) Series A funding round led by Globis Capital Partners with participation from Z Venture Capital, Mitsui Sumitomo Insurance Venture Capital, and DBJ Capital.

The firm was founded by Colton Sakamoto and long-time crypto entrepreneur and investor Anthony Pompliano in an effort to help connect crypto companies looking for talent with people who wanted to enter the space.

To help users search these various money transfer options in their region and compare rates and fees, Zazuu initially launched as a chatbot in 2020, informing users of the daily remittance rates of various platforms via Facebook and Telegram groups.

Lightspeed began investing in India over 10 years ago and has amassed an impressive portfolio of several fast-growing startups including Byju’s, India’s most valuable startup, SaaS firm Innovaccer, e-commerce giant Udaan, social media giant ShareChat and payments giant Razorpay. The firm, which has a team of nine partners in India and Southeast Asia, is nearly doubling the size of its fund because it’s seeing more opportunities in the regions as a young crop of startups attempt to solve deeper and newer problems, said Rahul Taneja, a partner at Lightspeed, in an interview with journalist. The fund, fourth for Lightspeed India, was hard-capped at $500 million, meaning it didn’t want to raise additional capital, said the firm, which unveiled its $275 million third India fund in 2020. The Tuesday announcement confirms journalist April report, which said Lightspeed had kick started fundraising deliberations for the new India and Southeast Asia fund and was aiming to raise about $500 million.

Bloomberg Beta announced its fourth $75 million fund and also a new $75 million opportunity fund for later-stage checks into startups the firm has already backed. Over at Golden Section, a Houston-based founder studio and venture capital firm, the firm completed the first closing of its second fund in May, but did not disclose the amount. Haris Khurshid, general partner at Chalo Ventures, launched a $50 million second fund focused on investing in Pakistani startups and a smaller percentage in Latin American startups. He did say that LPs wanted to know how the firm would navigate investment in that market, which required the firm to do a bit of educating on why Pakistan needed a focused fund.

The new fund will focus on a handful of areas in the crypto ecosystem, including web3 infrastructure, decentralized finance (DeFi), decentralized autonomous organization (DAOs) tooling, and new business models to collaborate on intellectual property, to name a few.

Founded out of Berlin in 2015, Wefox sells various insurance products through a combination of in-house and external brokers, bypassing the direct-to-consumer model of insurtech competitors which include rival German startup Getsafe. European insurance tech startup Wefox has raised $400 million in a series D round of funding, giving the German company a post-money valuation of $4.5 billion. This way of growing users, by getting third-party brokers to use Wefox to advise their own customers, is how CEO and founder Julian Teicke reckons helped the company double its revenues to $320 million last year. To date, Wefox said it has built a network of around 3,000 independent brokers in its native Germany, while in other markets such as Switzerland, Germany, and Austria, it has trained its own brokers.

On the employee side, Kadmos serves up a mobile app replete with e-wallet that holds workers’ salaries in U.S. dollars or euros, while also allowing them to send money home instantly, with predictable set fees.

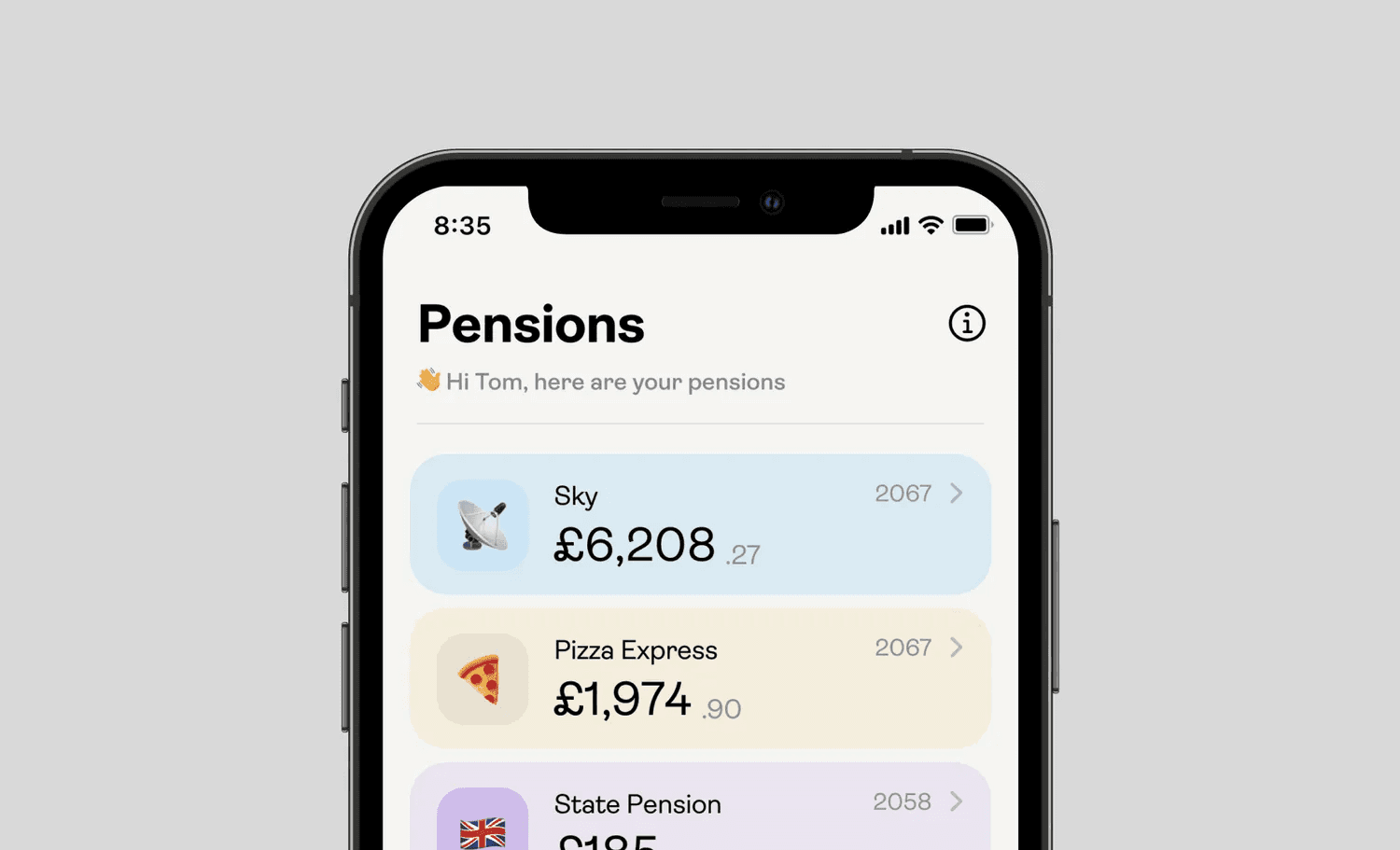

Given that the average worker only remains in the same job for a few years, when they move to a new employer, a new pension fund automatically begins — quite probably with a completely different provider to their previous one — which creates this giant fragmented pension palaver.

Roughly a year-and-a-half on from its big IPO, Klarna’s rival Affirm has also endured turbulent times, with its shares plummeting over the past year — it too is now valued at roughly the same amount as Klarna, after its market cap peaked last year at around $47 billion.

The company also took in $1.4 million in pre-seed funding from institutional investors like Contrary Capital, Hustle Fund, On Deck and Dash Fund and a big group of individual investors

The donor-advised fund makes the process of launching a giving campaign much simpler for companies and charities because they can just search for a nonprofit from the list to be a beneficiary of their initiative rather than having to coordinate individually with those charities, get their crypto wallet addresses and process those donations manually, according to Nigam.

The company is also building out some bonus adds, like billing and subscription management, so that users can start with off-the-shelf, white-label apps and then transition to more specialized offerings when needed, or when they want to control the full experience without interrupting its back end data or services.

While GoHenry has pretty much had to build itself up from scratch in the U.S., it clear that it’s adopting an entirely different approach for markets closer to home — and there are many advantages to buying an established brand with traction as it has done with Pixpay, perhaps chief among them being that GoHenry doesn’t have to concern itself as much with hiring, localization, and launch campaigns.

So if you include that company’s layoffs — which amounted to some 3,000 in the first quarter of 2022 — the fintech numbers inch up even higher and fintech becomes the category that saw the most layoffs by percentage — 15.4% — in the first half of 2022.

As RUVs have grown, Kohli explained, founders asked AngelList Venture for a better way to look at RUVs within their cap tables; of course, that’s difficult if AngelList doesn’t host cap tables to begin with. Stack Equity Management charges companies based on team members, while Carta charges companies based on stakeholders, aka investors, on the cap table. AngelList claims that stakeholder-based equity management software means that people on your cap table can cost you hundreds of dollars per year, despite their position in your company not changing. When asked about how this product helps AngelList Venture compete with Carta — which acquired its own AngelList-type startup last month — Kohli said that he doesn’t have anything new to add.

As a result of the startup’s recent growth and a recent partnership with international financial services provider Allianz, Coalition tells journalist that for the first time since its founding in 2017, it’s planning to offer its cyber insurance policies in the U.K. However, Motta wouldn’t be pressed on whether this will be the company’s last raise before Coalition plots its exit, despite telling journalist back in September that its Series E raise could be its final funding round before the startup prepares to go public. Coalition, a San Francisco-based startup that combines cyber insurance and proactive cybersecurity tools, is preparing to expand outside of the U.S. for the first time following a mega $250 million Series F investment that takes its valuation to $5 billion. The investment, backed by Allianz X, Valor Equity Partners and Kinetic Partners, comes less than a year after the company $205 million Series E raise in September, which valued the company at $3.5 billion.

It’s a bold move, and one of the reasons why we’re excited to announce that Solana’s co-founder, Anatoly Yakovenko, will join for a fireside conversation on stage on October 18-20 in San Francisco.

Co-founders Roberto Enrique Kafati Santos and Jose Maria Serrano started the company after a career at McKinsey leading digital payments for Kafati Santos and at delivery company JOKR for Serrano.

Ranger will launch in the fall, and offer home insurance, auto insurance and a home warranty policy that it is underwriting itself as an MGA — in other words, the startup won’t be carrying the risk itself, but partnering with a carrier for its own policies. Ranger is today announcing the close of a $5.25 million seed round led by Lerer Hippeau Ventures, with participation from Alex Rodriguez, Firstminute Capital, Slow Ventures, Global Founders Capital, Raven1 Ventures and, of course, Montauk Ventures. Garrison spent 15 years in the insurance business (at AIG) and saw how neglected agents are at legacy insurance companies. Rather than spend a ton on marketing, Ranger is focused on giving agents (who are boots on the ground in the communities they serve) tools to respond more quickly to customers, generate better leads, maximize cross-sell to other products and personalize client services.

Reddit is launching a new NFT-based avatar marketplace today that allows you to purchase blockchain-based profile pictures for a fixed rate. Reddit noted artists also receive royalties — with a 50/50 profile split with Reddit — from secondary sales of these NFTs on marketplaces like OpenSea and Rarible. You can use Reddit’s own blockchain wallet called Vault — which is available on the firm’s native app — to store and manage these NFTs. Reddit says that while NFT profile pictures is an early-stage blockchain project, it wants to explore more features with the tech.

Elivalat Fintech Ltd., Hupesi Solutions, Cruz Ride Auto Ltd and its director Simon Karanja Ngige, Boxtrip Travels and Tours, Bagtrip Travels Ltd. accounts, and Adguru are the entities said to have received the funds from Flutterwave, and whose accounts were also frozen.

Co-founder and CTO Henry Bradlow had previously written algorithms to power rocket ships at SpaceX, so the trio —Calvano, Francisco Enriquez and Bradlow — was determined to find a way for artificial intelligence to streamline the construction back office.

Shroder, who was promoted from president to CEO at Binance.US last October, has been focused on gearing up to take the company public since he took the top role. Jasmine Lee is coming on board at the company after serving as CFO and chief operating officer (COO) in a dual role at fintech app Acorns for nearly three years.

With a fresh $42 million in its coffer, the firm plans to invest in the “social ecosystem” of web3, a version of the internet built largely on blockchain that promises to be more decentralized.

Apparently when ABG became a Bolt customer in October 2020, reported Insider, Bolt entered a deal to award the group stock warrants, which give the holder the right to buy shares at a specified price before a specified date — under certain conditions.

The company just closed a $6.6 million seed round and plans to launch its first web3 gaming world, Project Nightshade, in the fall, Mark Warrick, founder and CEO of the company, exclusively told journalist.

After building mobile technology for fintechs and payment companies for the past 20 years, Lori Shao, CEO of Finli, started the mobile-first payment management company nearly 3 years ago when she noticed that she was around technology all day but still using a checkbook to manage household services, like landscaping and after-school programs.

In product terms, Peakflo is a collection of services, per Chauhan, including accounts receivable (money in), accounts payable (money out), a payment layer and an integration layer, linking the service to accounting software and some enterprise resource planning.

In April 2022, American Express and Pymnts.com published a survey that found that about two-thirds of firms that have automated accounts receivable processes report benefiting from improved days sales outstanding (a measure of the average number of days that it takes for a company to collect payment after a sale has been made), while about half said that they achieved lower delinquency rates.

In recent months, the company has also been testing support for digital collectables (aka NFTs) — so having its own digital wallet infrastructure could support a wider push into non-fungible token trading if Meta decides there’s enough money to be made (but, again, NFT trading volumes are steeply down vs last year as digital collectables catch crypto’s chill).

We spoke to a dozen Chinese founders and investors to find out how this group is trying to build global web3 businesses while still keeping their roots in China and taking advantage of the home country’s abundant tech talent

Cash App last week launched Round Ups, allowing customers to invest their spare change into a stock of their choice or bitcoin every time they use their Cash Card. Even that new figure represented both a dramatic decline from Klarna’s mid-2021 valuation of more than $45 billion and the $30 billion figure it was reported to be targeting earlier this year, as our own Alex Wilhelm noted here.

Starting at $8 a month, creators can sign up for Notch’s Instagram account insurance, which means that if they get hacked and lose access to their account, the startup will pay them a stipend and help them regain control of their page. journalist reviewed a sample insurance policy, which quoted a $459 annual fee (or about $38 a month) for insurance that pays out $244 for each day that a creator can’t get into their account after a hack. When creators get hacked, it can mean that they aren’t able to post sponsored content, earn payments from badges or operate their Instagram shops — it’s debilitating, like if a chef broke their arm and had to cook with one hand. With that information, Notch can estimate how much sponsored content a creator posts a month, and how much money someone of their caliber would make off of each post.

The publication reported that Menlo Park-based Sequoia is looking at $1.5 billion for a U.S. growth fund focused on later-stage companies and a $750 million fund targeting earlier-stage startups. The storied venture capital firm announced that it was breaking with tradition, abandoning the traditional fund structure and their artificial timelines for returning LP capital.

Swedish buy now, pay later giant Klarna is reportedly close to inking a new round of funding that would slash its valuation to $6.5 billion – about 7x of what the company was valued in June of 2021.