🗓 All FinTech news in March 2022

Like Tink, Klarna offers an open banking application programming interface (API) with Klarna Kosma. Klarna now wants to compete directly with Tink with a new business unit that has its own brand — Klarna Kosma.

Khazna plans to launch additional products before the end of the year; this product expansion and user growth is what Saleh points out when asked how Khazna stays ahead of the competition. The company, founded by Omar Saleh, Ahmed Wagueeh, Fatma El Shenawy, and Omar Salah in 2019, provides basic banking and various financial services focusing on middle and lower-income earners. In a country where 50% of its 100 million people are active smartphone users, two out of every three individuals have little or no access to formal financial services in Egypt.

Datanomik’s goal is to connect financial institutions across LatAm through its B2B open finance API, which gathers a company’s banking information on one platform, Strauss told journalist. Now, dLocal and AstroPay co-founder Sergio Fogel has teamed up with AstroPay’s former head of product, Gonzalo Strauss, to launch another fintech out of Montevideo, Uruguay, called Datanomik.

The latest to receive funding to continue developing its financial infrastructure for the freelance economy is Archie, which raised $4.5 million in funding from B Capital Group and others. As more people moved to remote work over the past few years, there was also an uptick in people choosing freelance or contract work, leaving companies to figure out how to manage that worker segment.

Another relatively new company delivering data analytics to retailers is Black Crow AI, which today announced that it raised $25 million in a Series A round led by Imaginary Ventures.

The one-year immersion program, the Visa Creator Program, will bring together a global cohort of creators including artists, musicians, fashion designers and filmmakers the ability to build their businesses with NFTs It previously made headlines for buying a popular CryptoPunk NFT in August 2021.

Despite the similarities in branding, Zhang told journalist gumi Cryptos Capital (gCC) is not a subsidiary or corporate venture capital arm of gumi, though Zhang notably still holds a position as a vice president at gumi in addition to his role as a managing partner at gCC. San Francisco- and Tokyo-headquartered gumi Cryptos Capital (gCC), a venture capital firm that focuses on blockchain startups, said it has launched a new $110 million early-stage fund.

Bengaluru-headquartered Slice, which became a unicorn late last year, plans to introduce UPI payments for its users within weeks, according to a source familiar with the matter. National Payments Corporation of India, the governing body that oversees UPI ecosystem, is also working to push new changes that are positioned to create a level-field among UPI players.

Bijan Moallemi, Joe Garafalo and Brian Campbell started San Diego-based Mosaic in 2019 after meeting at Palantir Technologies, where they worked on building out that company finance organization as the company grew to 2,500 people and over $750 million in revenue. Mosaic, which aims to change the way CFOs of high-growth companies operate, has raised $25 million in a Series B round of funding led by Founders Fund.

Dapio’s launch is a sign of where the U.K. payments scene is currently — where contactless payments aided by NFC technology have exploded, making up a quarter of all payments in the country.

The latest round marks the third time that a16z has put money in Cross River Bank, with the first time being in the company’s first institutional round that closed in October of 2016 — a $28 million financing which ended up closing at $30 million as others added to it.

It was helping mid-size startups keep track of equity as they grew, but last summer, as the price of Bitcoin shot to a historic high, the company began getting requests from its clients to help manage employee tokens. The company declined to mention how many customers it’s servicing but said Hong Kong-based microinsurance firm YAS Digital and crypto gaming company Animoca Brands are among its early users. Sprout created Folium in light of this customer demand to help companies trace digital coins and non-fungible tokens across various blockchain platforms.

Put even more simply, January strives to be a tech-enabled collections agency service that collects the debt on behalf of creditors in a civilized way. Their other alternatives are to outsource collections to third-party agencies or sell their accounts to entities known as debt buyers, who then place the accounts with agencies and attorneys. Brewer Lane Ventures led the company’s latest financing, which brings January’s total raised to $16 million.

Quick thoughts: This is another area that YC clearly sees as beginning to show promise, with past YC companies that include CrowdForce (which raised $3.6 million in funding last month) and Kudi (it raised $55 million last summer at a $500 million valuation). Blocknom Website: https://blocknom.com Founded: 2021 Location: Jakarta, Indonesia Team size: 6 Promises include: Providing an alternative payment infrastructure without the need for a payment card or consumer app so that customers can pay businesses from their phones without internet access. Among them is Mina Shahid, co-founder and CEO, who says he is a two-time founder and previously worked with co-founder Ben Best at another lending company in Ghana that failed.

Of course, Robinhood also warned of risks in extended-hours trading, but noted the additional hours would give customers the ability to trade based on quarterly earnings announcements made after the market closes, as well as based on activity taking place in foreign markets.

The ether and USDC deposits on Ronin were drained from the bridge contract, but the network is working with stakeholders from Axie Infinity and its parent company Sky Mavis to determine the best move forward so no user funds are permanently lost, it said.

Embedded finance product for SMEs Churpy is also set to roll out a working capital financing product targeting small to medium enterprises supplying to the enterprise customers signed up to the startup’s SaaS product. The startup is connected with some of the largest banks in the region — including Citibank, Sidian, Stanbic and NCBA — through its API.

The credit card is one of two options — the second via the mobile app — consumers can use to access CredPal’s BNPL services when they visit a partner store to shop for items ranging from electronics, particularly smartphones, to furniture and groceries. To that effect, CredPal, one of the earliest pioneers of buy now, pay later in Nigeria, has closed a bridge round of $15 million in equity and debt — the latter constituting a very large chunk of the financing — to expand its consumer credit offerings across Africa.

Vinik’s experience in the hedge fund world has informed Equi’s data-driven approach to investment management and risk assessment; the portfolio team leverages Equi’s in-house technology to help them identify and structure deals with fund managers, Reiss said.

The company decided to develop secured loans for products that enable borrowers to improve their income — like motorcycles, cars and trucks — and unlike their competitors providing used vehicles, Canals said Migrante offers new vehicles.

First, it will help it expand the company expand its geographic footprint: Azimo currently has payment licenses in the U.K., the Netherlands, Canada, Australia and Hong Kong, and it operates a payment network in more than 160 countries, while Papaya Global (not to be confused with the other fintech called Papaya) operated services in 150 countries just prior to this deal, Eynat Guez, Papaya Global CEO and co-founder.

Andreessen Horowitz (a16z) and NFX co-led Latitud’s $11.5 million seed funding round, which also included participation from Endeavor, Canary, FJ Labs, Ganas Ventures and unicorn founders.

Zepto, an Australian real-time account-to-account (A2A) merchant payments platform, said Monday it raised a $25 million AUD Series A (about $18.8 million USD) co-led by AirTree Ventures and Decade Partners. More than 100 Australian organizations, including banks, fintech companies and credit unions, use NPP (new payments platform), Australia’s open-access infrastructure for fast payment, according to the NPP website.

Ola said on Thursday evening it has reached an agreement to acquire Avail Finance, a financial services startup that serves the blue-collar workforce, as the ride-hailing giant looks to expand its financial services offerings.

Digits itself is not a data ingestion tool: Chang notes that it essentially sits on top of Intuit’s Quickbooks (note: that choice was deliberate because Quickbooks accounts for about 80% of the small business accounting software market in the U.S. today, although over time Digits will work with other sources as demand dictates it).

The company operates with an asset light model, Rubin said, in that it doesn’t need cash to buy homes and rather uses money from when people are rolling in their equity from their homes. He was drawn to Flock’s ability to allow any landlord to roll their properties into the portfolio it has created, while still providing the former landlord with the same income stream with no immediate tax consequences A startup called Flock Homes wants to give landlords a similar ability to own shares of a portfolio that is made up of multiple properties and it just raised a $26 million Series A funding round toward that effort.

Kwik, a Nigeria and French-based startup that provides logistics services to B2B merchants, from social vendors to e-commerce platforms, has raised $2 million in Series A funding. Since launching in Lagos in 2019 and extending its presence to Abuja, the company has onboarded more than 100,000 merchants who use Kwik’s site and mobile apps to run the logistical, commercial and financial needs of their businesses.

Simetrik recently began offering a payment methods orchestrator, which it says allows payment services companies to be able to connect directly to different payment methods. In other words, says co-founder and COO Santiago Gomez, the company’s software automates reconciliation for financial teams that have a high number of transactions and reports.

The fintech company, founded in May 2021, came out of stealth mode Thursday with a lending tool aimed at bridging the gap between those policyholders, insurance companies and contractors so that a homeowner can choose a contractor and have repairs completed within 30 days versus 180 days.

The new regulations published Monday by the country financial regulator, the Central Bank of Kenya (CBK), also require digital lenders to get a license from the country’s monetary authority or wind down their operations by September 2022.

Since that 2015 tweet, compensation for open source developers has remained a hot-button issue, and popular developer platform GitHub launched a feature in 2019 that allows users to send tips to their favorite open source coders.

New Era raised $60 million for its first fund, where the limited partner makeup was mostly high-net-worth individuals, family offices and founders of large private equity and hedge funds in the U.S. and large U.S. corporations interested in investing in the Israeli ecosystem. The firm raised $140 million for its second fund, and half of the LPs are U.S. and Israeli institutions.

Island, a Dallas-based startup that built a secure browser for the enterprise, has raised $115 million in a Series B round, valuing the company at $1.3 billion just weeks after emerging from stealth with $100 million in initial funding.

The Miami-based NFT firm behind Bored Apes Yacht Club has not previously raised funding, though the startup has long been courting attention from VCs eager to back a major player in the NFT craze. Yuga Labs, maker of the multimillion dollar monkey JPEGs that plenty of NFT skeptics love to hate, just raised a $450 million round from Andreessen Horowitz.

The $1.5 billion in capital puts Haun Ventures in the company of other crypto native funds like Paradigm and Electric Capital, which have debuted large funds in recent months.

The startup is in talks with a number of new and existing investors including Draper Associates, Coinbase Ventures, Protocol Labs and Naval Ravikant to raise about $60 million in a new financing round, the sources said, requesting anonymity as the deliberations are ongoing and private.

Capital markets focus on giant sums of money handled through foreign exchange, equity swaps and other major capital transactions typical of big banks, but at the end of the day, a lot of the systems in place that big banks use to make these transactions are based on old infrastructure, with money moving through many transaction points that can create delays and, therefore, costs. Canapi Ventures, 9Yards Capital, and SVB Capital led the round.

Less than seven months after closing on a $57 million Series B, fast-growing fintech Jeeves has raised $180 million in a Series C round that values the company at $2.1 billion. For example, Jeeves says that since its Series B was announced in September, it has seen its revenue climb by 900% and doubled its client base to more than 3,000 companies.

Rafael Loureiro, co-founder and CEO of Wealth, which emerged from stealth today, believes his company is taking a more unique approach by appealing to employers that want to offer more value-added benefits. Estate planning startup Wealth is going after a $180 billion U.S. market.

Nikhilesh Goel, co-founder and Group CEO of Validus, told journalist that Validus expects to create synergies with the loan portfolio of CitiBusiness, Citi Singapore small banking unit. Validus, a Singapore-based lending platform for small and medium-sized enterprises, is acquiring CitiBusiness’ loan portfolio for an undisclosed amount to bolster its top-line revenue and customer base and expand its growing loan book.

After hearing from clients that they want to tap into the capital markets, but find it challenging to rely on banks and credit cards, Rodriguez says the second step of Finally is to unlock a credit opportunity. In 2018, after a career as a network engineer, Rodriguez and his wife, Glennys Rodriguez, began helping small and mid-sized businesses manage their finances, and after joining with Edwin Mejia, founded Finally.

Earlier this month, Ramp also announced a partnership with Amazon for Business, in which customers can connect their Amazon Business account to Ramp and then anytime an employee uses one of its cards to make a purchase, Ramp automatically pulls the receipt. Notably, Ramp is college friends Glyman and Atiyeh’s second venture in the spend management industry following the sale of online price tracker Paribus to Capital One in 2016.

Another crypto nonprofit platform, The Giving Block, has also already taken in $1.5 million in crypto donations and announced a campaign yesterday to raise $20 million in cryptocurrency for its Ukraine Emergency Response Fund supporting a variety of accredited nonprofit groups, including United Way Worldwide and Save the Children, according to a webpage for the campaign.

Originally founded by Nick Ogden, who was also the founder of WorldPay (which Fidelity acquired for $43 billion, which was at the time the biggest deal ever made in international payments sector), ClearBank currently has 200 customers — large financial institutions and fintechs using its infrastructure to enable faster transactions — with the list including UK businesses like Tide and Oaknorth, but also international companies like Coinbase, which uses ClearBank for clearing and payments services for its UK customers.

Toronto-based Sleek, which was part of Y Combinator summer 2021 batch, is developing a browser extension enabling one-click checkout and cash-back savings.

This has pushed some founders to build competing blockchains on entirely unique infrastructure, while others in the developer community are focusing their resources on building modular blockchain solutions that sit on top of Ethereum, bundling transactions faster and cheaper while keeping a record of the movements on the central chain.

Delivery Hero worked within what you might think of as the hat trick of the e-commerce world — its three-sided marketplace comprised independent and larger restaurants, delivery people and millions of consumers ordering food; and, as an added layer of difficulty, all of them were making calls into and out of a payment system in real time, 24 hours a day, across dozens of markets, currencies, preferred payment methods and so on. By that, he means that it isn’t necessarily initially positioning itself as a point-of-sale provider or payment facilitator; it’s built a platform that will make it easier to integrate and work with any of these by way of APIs, to work more easily with a wider variety of third-party businesses (paying money in and taking it out), freelancers (payouts) and consumers (paying in), and with a wider variety of payment methods depending on the locale in question.

When asked about its B2B business, Kyash carved out its white-labeled card issuing platform to infcurion last year and is focused purely on direct channel business, Takatori said in an interview with journalist. Founded by Takatori, who previously worked in the banking and consulting industry, Kyash offers a mobile banking app that enables consumers to make online and offline payments, remittances, and ATM withdrawal services. Takatori said Kyash currently focuses on the Japanese retail market.

Multimillion dollar monkey pictures and monkey money are likely not the future you were expecting to capture the undivided attention of Silicon Valley VCs, but Yuga Labs hopes that the new game and token will inspire a mainstream crypto economy built around their their IP, which further expanded last week to include the highly valued CryptoPunks and Meebits NFT collections after Yuga acquired the assets from Larva Labs.

With these funds focusing solely on crypto and its surrounding ecosystem and investing more in these startups than traditional fintechs at the moment, why is Luno Expeditions choosing a dual focus on crypto and fintech instead of going head-on with crypto?

The round of funding is good news for both employees and early backers who took a bet on Wasoko years ago as new investors Tiger Global and Avenir Growth Capital lead its Series B round (the pair also co-led Flutterwave’s Series C investment last March).

The product is for early-stage startups only, with Mercury offering between 25% to 50% of a startup’s equity round in debt.

Peirce will be joined by Kristin Smith (The Blockchain Association), Miller Whitehouse-Levine (DeFi Education Fund) and Zaki Manian (Sommelier Finance) for a session called: DeFi and Regulations: Regulation of DeFi is here (ish).

Fintechs in Africa continue to overshadow all other startups in funding gained Hennessy-Barrett launched 4G Capital in 2013 after a short stint as a loans manager based in Kenya for a lending corporation, an opportunity that saw him travel across Africa and gain insights on the continent lending space. Hennessy-Barrett said that 4G Capital has extended credit valued at $230 million since launch and loaned to over 1.75 million micro-businesses over the same period, recording a 90% year-on-year growth.

But Jack Kudale, the founder and CEO, tells me that it’s projecting its policy holder base to grow three-fold in the next 12 months, to 35,000-40,000 customers (which would imply something around 17,000-20,000 businesses currently), and that its premium run rate (the insurance industry’s revenue run rate equivalent) has grown 40x this year, to $200 million, in what is still a very nascent market, with less than 10% of small businesses in the country currently taking out cyber insurance policies.

It settled on its current structure in 2020 through a transaction that sold certain assets from ConsenSys Mesh, the company’s venture arm, to ConsenSys Software Incorporated (CSI), a newly formed company that, post-transaction, now functions as the parent entity to some of the company’s key products, including MetaMask and developer platform Infura. The funding round comes amid allegations by a group of ConsenSys shareholders that the company’s founder, Joseph Lubin, illegally shifted assets from ConsenSys Mesh into CSI as part of this transaction.

They started off building a universal e-commerce API for reading and writing data so that tech customers can integrate with commerce platforms and access financial data points to offer loans, launch in new marketplaces and streamline inventory syncing for brand management.

Bloomberg reported this afternoon that Paytm digital bank was barred from adding new customers because it violated India’s rules by allowing data to be shared with China-based entities that indirectly owned a stake in Paytm Payments Bank.

Piecing together many of its services makes sense for a startup like Bazaar in Pakistan because it enables the startup to offer a more comprehensive set of values to a merchant, and Easy Khata is helping the firm win customers, Saad Jangda, co-founder of Bazaar, said in an interview with journalist. Dragoneer Investment Group and Tiger Global are backing Bazaar, a startup that is attempting to digitize Pakistan retail with e-commerce, fintech and last-mile supply chain solutions, they said today, joining a growing list of high-profile investors making large bets in the South Asian market.

Moove, an African mobility fintech that provides vehicle financing to drivers of ride-hailing platforms like Uber and other gig networks, has raised $105 million in new Series A2 financing.

The Larva Labs founders have almost fully divested from the project at this point, with Yuga Labs detailing in a blog post that they had also acquired 423 CryptoPunks and 1,711 Meebits from the company, leaving the founders with just a few of each in addition to their generative art project Autoglyphs which was not part of the deal.

With regard to continued funding into the autonomous retail space, it still seems to be flowing, as evidenced by AiFi and some additional companies, including French convenience store startup Boxy, which announced $28 million in funding a few weeks ago, and Focal Systems, which works with retailers like Walmart.

While 73% of financial articles targeting men focused on investing, 90% of the financial articles targeting women focused on spending less. This leads to a disconnect between women’s financial priorities (which may be more focused on longer-term stability as opposed to short, risky financial gains) and what the financial services industry typically emphasizes.

Payments giant Stripe already powers a pretty major swath of the web financial infrastructure, now it’s launching crypto payments support to give customers an easier path to onboard web3 users and interact with cryptocurrencies.

The fund is backed by a who’s who of crypto investors, with LPs including a sizable chunk of a16z’s investing team.

But starting today, Stilt said, any fintech or digital bank that wants to offer credit building tools, revolving lines of credit or personal loans to its customers could do so using its API-powered product.

The ability to raise a relatively large seed round so soon after inception speaks to the experience of the company’s founders, which include Juan Pablo Ortega, the co-founder of on-demand delivery unicorn Rappi (which as of last July was valued at $5.25 billion) and Julián Núñez, an early Rappi employee. Yuno wants to bring to Latin American companies an easy online checkout solution that solves the pain point of managing multiple payment methods.

In a study that it conducted, Credit Karma found that many borrowers with outstanding student loan debt have had to sacrifice necessities like groceries and making rent payments in order to maintain their student loan payments.

But while that seems to foreshadow that Lunar definitely has ambitions to move beyond its Nordic shores (with a name and stratospheric association to match that), the startup is actually still focused on building out services that ferret out what the incumbents are still not providing, to build those services into the Lunar platform, not least because he points out that Nordic consumers and businesses are some of the most lucrative not just in Europe but the world in terms of the value-added services they take, the money they transact with and so on.

The press release lays out seven major goals of the executive order with added detail: Protect U.S. Consumers, Investors, and Businesses Protect U.S. and Global Financial Stability and Mitigate Systemic Risk Mitigate the Illicit Finance and National Security Risks Posed by the Illicit Use of Digital Assets Promote U.S. Leadership in Technology and Economic Competitiveness to Reinforce U.S. Leadership in the Global Financial System Promote Equitable Access to Safe and Affordable Financial Services Support Technological Advances and Ensure Responsible Development and Use of Digital Assets Explore a U.S. Central Bank Digital Currency (CBDC) For those in the crypto sector concerned about aggressive government intervention, the order language seems to signal that the Biden White House is uninterested in sweeping near-term reforms and is instead merely focused on ensuring that agencies are on the same page in researching and observing the national security implications of the crypto industry.

The firm, led by former Tinder product chief Jeff Morris Jr., has shifted from a more generalist vertical interest toward web3 obsession over the past several months, as early bets in crypto startups like Dapper and Compound Finance have taken off.

Antler East Africa, the Nairobi office of VC firm and venture builder Antler, has closed a $13.5 million fund to invest in early-stage tech startups in the region. Being a female-led VC team, Antler East Africa is particular about investing more in startups founded and led by women in the region, Kebede said

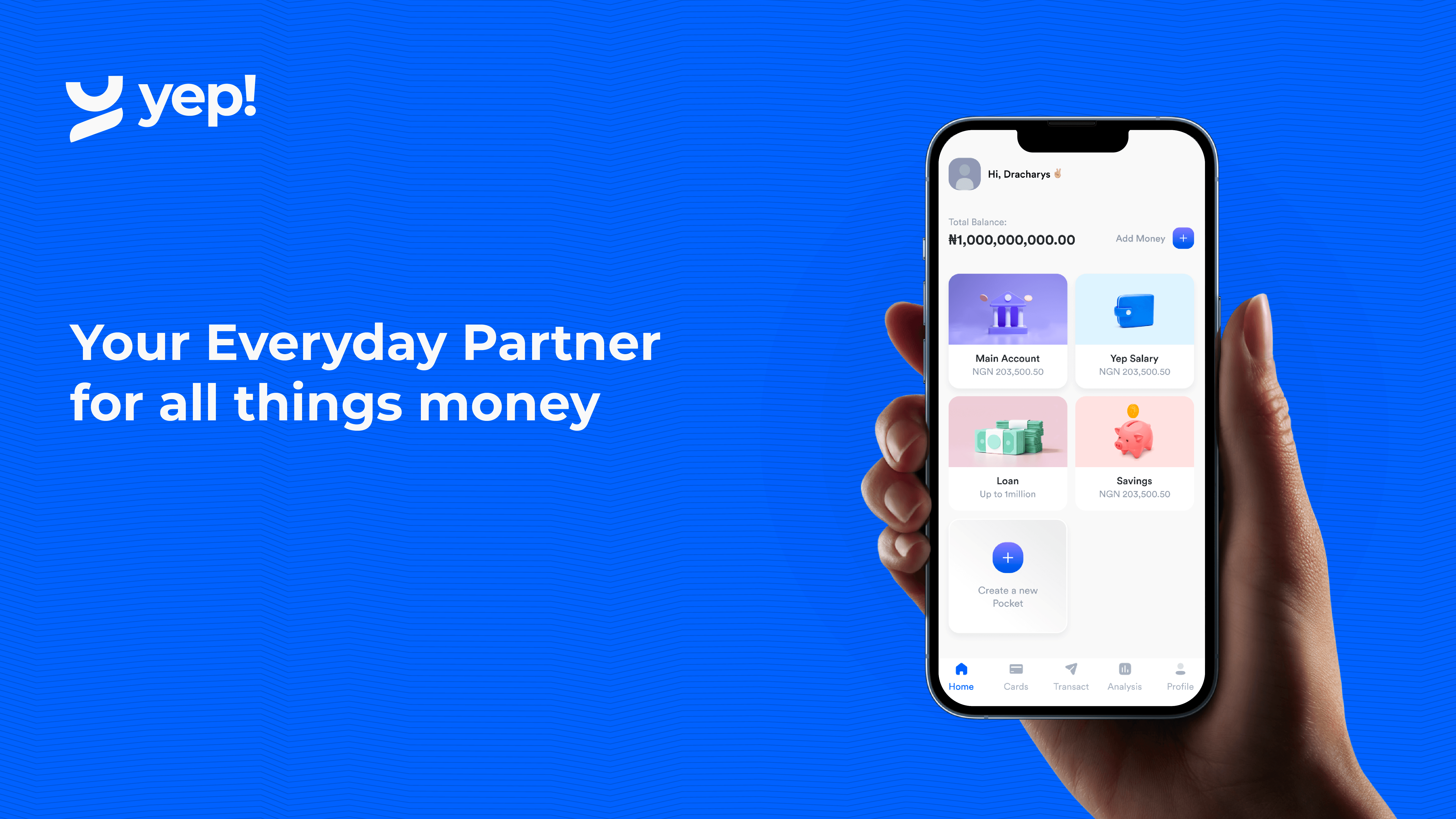

What gives Yep! an edge, according to its founders, is a superior experience in raising debt capital for lending purposes — a practice where agency banking providers supply working capital to their agents who in turn lend to their end consumers.

Why global investors are flocking to back Latin American startups Marcos Toledo, managing partner at venture firm Canary, said that in their previous roles, Mara’s co-founders created, operated and disrupted very complex businesses, in sectors like ride-hailing and food delivery.

Digging into the Alkami Technology IPO Tacora’s fund is backed by prominent venture capitalist Peter Thiel, whose Mithril Capital Management, an investment firm he co-founded with Ajay Royan, left the Bay Area for Austin in 2018.

The famed DreamWorks SKG co-founder and former chairman of The Walt Disney Studios, Jeffrey Katzenberg is a founding partner, with Sujay Jaswa, at WndrCo, a holding company that acquires, operates and develops businesses at the intersection of technology and media. Several of your portfolio companies announced investments from you recently, including Sparrow, which manages employee leaves; Point.me, a reward travel booking company; and HUBUC, which focuses on embedded fintech.

OkHi’s grand mission, the founder says, is to get these people who don’t have a physical address included in the global address system.

Last year, when the company planned to go public via a SPAC, it had projected revenue of $126 million for the year, according to its deck, as analyzed by our own Alex Wilhelm. Savings and investing app Acorns has raised $300 million in a Series F funding round that values the company at nearly $2 billion.

Branch, which aims to power faster payments to contract workers with its technology, has raised $75 million in a Series C funding round that has closed just six months after it announced its last financing round.

The mass layoffs at digital mortgage lender Better.com have reportedly started, according to employees and other sources at the company, and affected workers are finding out by seeing a severance check in their Workday account — the company payroll app.

At that time, New York-based Selfbook was valued at $125 million — so it has essentially seen a 2.4x increase in valuation from the fourth quarter of 2021 to the first quarter of 2022 and a 38x increase after it raised a $2 million seed round in April of 2021. Hotel payment software provider Selfbook has completed a $15 million extension of its Series A financing that values the company at $300 million.

Toyosaki, who also headed up marketing at Bitcoin.com, told journalist in an interview that many of the strategies available to crypto derivatives traders today are fairly risky, a motivating factor behind why she founded Cega, which she says is the first-ever DeFi exotic derivatives protocol. Now, Cega, a new protocol founded by former UBS derivatives trader Arisa Toyosaki, is setting out to create a new category within DeFi — exotic derivatives.

And today the startup is emerging from stealth with $10.8 million in pre-seed and seed financing from Contour Venture Partners, Infinity Ventures (from the team that led PayPal Ventures), B Capital, Portage Ventures, Amex Ventures and other prominent venture funds and fintech angels, it tells journalist exclusively.

Upon carefully studying different models pioneered by digital-first banks such as TymeBank, Kuda and FairMoney, they saw a big gap for building a savings product that helps solve what they think is the biggest problem facing African consumers: inflation and currency devaluation.

Online mortgage lender Better.com is poised to lay off roughly 50% of its staff of about 8,000 this week, sources familiar with internal happenings at the company told journalist on Monday.

This validity proof is then posted to the main Ethereum blockchain, and Layer 2 transactions can’t be altered because they won’t comply with the validity proof. In order to bring transaction fees down, transactions could be handled off the main Ethereum blockchain (the Layer 1).

MD Olly Thornton-Berry said that he and Jack Bidgood first came upon the idea for Thirdfort after a friend of theirs lost £25,000 while buying a flat in London due to a phishing attack: fraudsters had picked up some data about the deal, and created a domain similar to that of the legal firm the friend was using for the purchase, and with that wrote an email impersonating the friend’s lawyer, asking for the sum to be transferred via a link.

Espresso Systems, the company behind the blockchain project, is led by Fisch, chief operating officer Charles Lu and chief scientist Benedikt Bünz, collaborators at Stanford who have each worked on other high-profile web3 projects, including the anonymity-focused Monero blockchain and BitTorrent co-founder Bram Cohen’s Chia.

So, users from different countries — Ghana, Nigeria and Kenya, for now — can connect their bank or mobile money accounts to Dash, pay bills, and send and receive money to other users while the platform handles currency conversions.

Cayena founders Gabriel Sendacz, Pedro Carvalho and Raymond Shayo believe injecting technology into procurement will make the process much simpler for food preparation facilities, like restaurants, bars, bakeries, hotels and dark kitchens, in their home country of Brazil and across the region.

Tabby, the Dubai-based buy now, pay later (BNPL) platform that lets users shop, pay later and earn cash from over 3,000 global brands, including Adidas, IKEA and Bloomingdale, has completed a Series B extension of $54 million.

Debt marketplace CredAvenue, which helps businesses and enterprises secure debt from lenders, has become the fastest Indian fintech startup to join the unicorn club, it said on Sunday. The startup, which counts Sequoia Capital India, Lightspeed Venture Partners, TVS Capital, Lightrock, Vivriti Capital and Indian fintech CRED among its backers, has raised over $227 million to date.

SteadyPay CEO and co-founder John Downie, who had spent most of his career building tech solutions for banks, realized that existing lending solutions did not address the needs of workers with irregular income. Both existing and new investors participated in SteadyPay’s latest fundraise alongside Digital Horizon, including Ascension Ventures (via their impact Fair By Design fund), the U.K. government’s Future Fund.

CEO and co-founder Matias Recchia said this allows the business owners to free up capital to expand their business while staying in the same location. The company said the majority of real estate investment trusts (REITS) focus on deals above $10 million, but properties valued at less than that price account for one-third of the U.S. commercial real estate value.

Shop owners who intend to offer loans to their end consumers get higher credit lines from Chari, which shares the data collated from Karny (on end consumers’ purchasing behaviour) with FMCG companies that pay for the cost of the higher loans.

This time, Valar Ventures is leading the Series A with other existing investors Singular, Global Founders Capital and Red Sea Ventures putting more money in the company. In particular, Shares wants to make stock trading more accessible from a financial point of view and less daunting thanks to social features.

Lido aims to solve both of these issues through its decentralized staking platform that allows users to stake their coins with no minimum investment required. Andreessen Horowitz made the investment in Lido partially using ETH, buying up some of Lido’s governance tokens from other holders, Lomashuk said. Assets staked on Lido are worth over $10 billion USD at today’s prices, and are split across 76,000 individual crypto wallets.

Two years later, after the platform did not make enough revenue from developers, the team chose to go vertical to what it is today, Stax, a universal money app on USSD rails for African users. The company, founded by Ben Lyon, Jess Shorland and David Kutalek, fetches all these codes from multiple accounts together into an app users can access offline, letting them perform transactions without dialling any USSD code.

The Salt Lake City, Utah-based company’s API-delivered product, which focuses on payroll data, powers 70 banks, credit unions and fintech companies such as Coinbase, Dave and Propel. Atomic, a provider of payroll APIs, has raised $40 million in Series B funding just five months after announcing its Series A financing.

In addition to allowing patients to finance their bills, Susu proposes a collective financing solution where family members living locally or in the diaspora can also help patients finance their monthly subscription fees via care bundles. Susu offers care packages or bundles to patients suffering from chronic diseases like diabetes and hypertension and pregnant women who require careful management to ensure their conditions are monitored and get the preventative advice to live the best way with their conditions. While insurtech incumbents and upstarts such as CarePay and Reliance Health try to make insurance readily available for the rest of the market via partnerships with companies or by enabling weekly to monthly subscription charges, users are still required most times to pay out of pocket. Care bundles are basically medical calendars composed of doctor consultations, nurse visits, medical advice sent by SMS and a combination of other medical activities for patients.

Ukraine official Twitter account has been sharing cryptocurrency wallet addresses for the past few days to raise funds during the Russian invasion of Ukraine.

Emtech’s digital regulatory platform includes the innovator’s center, which helps fintechs to prepare and test the requirements for multiple regulators and/or countries and test regulatory reporting APIs for pre-market technical integration, as well as the regulatory sandbox, a fintech launchpad based on regulator limits and the live reporting of data. It is this missing connection that Emtech, a central bank digital infrastructure provider, is looking to fill through its digital regulatory platform, which aims to fast-track the reach of fintech products to market.

In the works is Zeller Financial Services, which will include credit and debit cards and expense management tools, as well as enhanced analytics through Zeller’s dashboard. Zeller’s product roadmap includes new omni-channel commerce capabilities, like the ability to accept online payments through integrations with website and e-commerce platforms.

Existing backers Accel (which led its Series A) and Point Nine Capital (which led its seed round) also participated, along with Abstract Ventures, Coinbase Ventures, Uniswap, Daedalus, Vercel CEO Guillermo Rauch, Optimism co-founder and CEO Jinglan Wang, Eric Ries, founder of Long-Term Stock Exchange and Tihomir Bajic, CEO of LTSE Software.

Say a company uses Sudo Africa to issue cards for employee expense management; what happens is that employees are given cards with a low balance so whenever they need to use the card, an API is called each time to decide whether to approve or deny that transaction in real time.

UK-based TrueCircle, a computer vision startup founded just last year, has nabbed $5.5 million in pre-seed funding in a bid to bring data-driven AI to the recycling industry to improve recovery rates and quality — with the overarching goal of transforming the economics of waste reuse to shrink demand for virgin materials.

This capital raise pushes the Palo Alto-based fund toward the company of larger firms like Andreessen Horowitz, which closed a $2.2 billion crypto fund this past June, and crypto VC Paradigm, which debuted a $2.5 billion fund in November.

While CTC pulls in all the data needed to build a transaction history and performs tax calculations for its users, Brunette still advises advanced crypto users to consult a tax professional to help them interpret regulatory grey areas to determine what they actually need to pay, and what rules apply to their activity.

Beyond the consensus mechanism, Wagstaff says Subspace allows for data to be stored far more cheaply than on other blockchains by incentivizing users to run archival nodes, which store historical data relating to a particular blockchain. Subspace will use the capital to expand its integrations with projects on other blockchains and build a dedicated product team to support its Subspace Meta Services (SMS) segment.

The simple reason is that people need smartphones more than they need solar systems, evident in M-KOPA’s numbers as of July last year — which in 18 months had already sold 500,000 smartphones, half the units solar systems managed in 10 years. M-KOPA is known chiefly for its pay-as-you-go (PAYG) financing model that allows customers to build ownership of appliances over time by paying an initial deposit followed by flexible micro-payments.

Riogrande plans to have about 30 brands under its umbrella.